Cryptocurrency exchange Coinbase, based in the United States, has issued a notable warning to the Securities and Exchange Commission (SEC). The company has reiterated its call for SEC officials to respond to the petition to create rules for the crypto market and has addressed the latest sanction action against Kraken to support its claims.

How the Process is Proceeding?

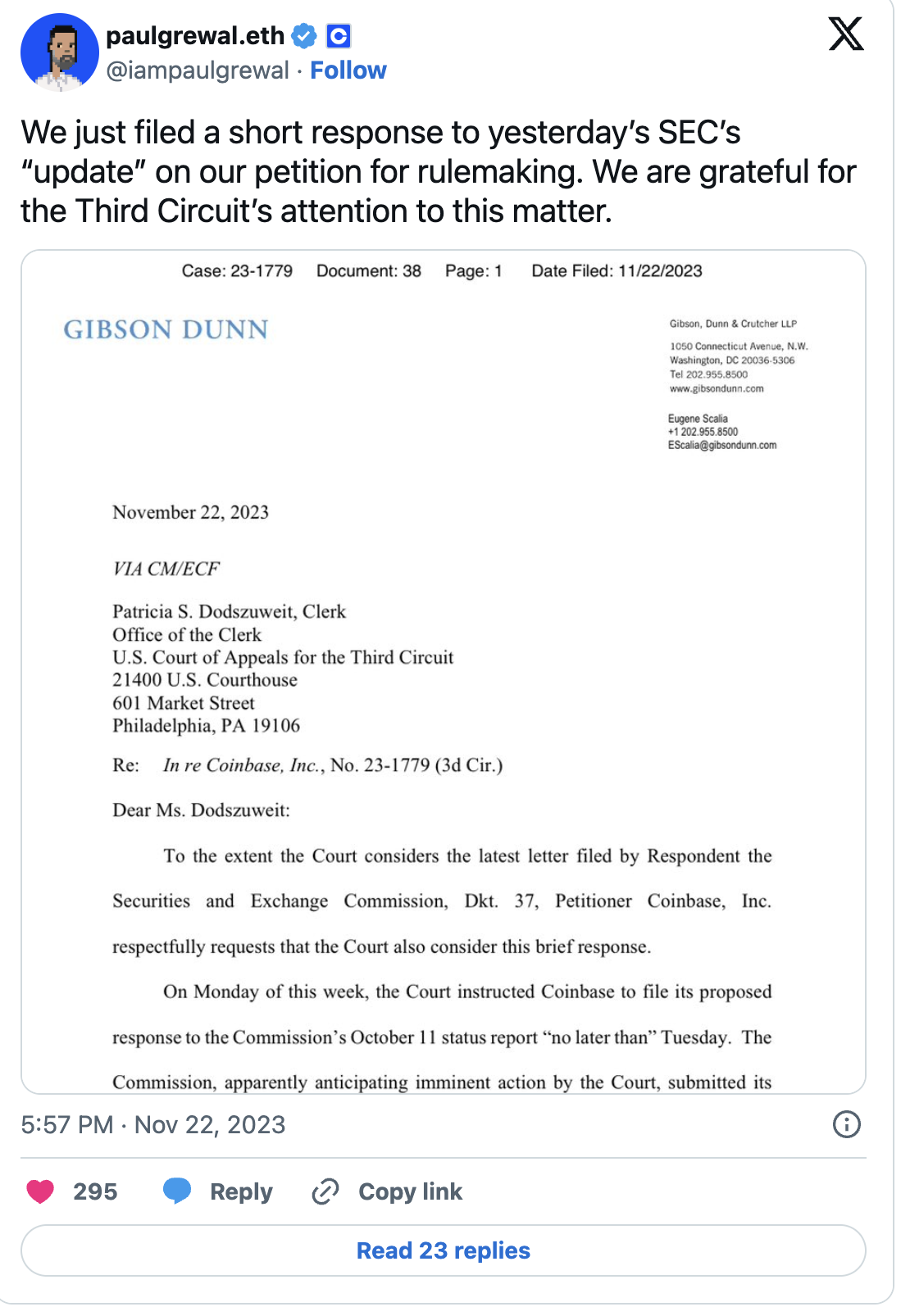

In this process, lawyers representing Coinbase responded to a letter stating that the company plans to submit a status report regarding the petition to establish rules for the crypto market, which was sent by the SEC on November 21 and granted until December 15, to the US Third Circuit Court of Appeals on November 22.

Coinbase submitted a petition to the relevant authorities in July 2022, requesting the SEC to propose and adopt rules to regulate securities offered and invested in through crypto means, and delays occurred in the subsequent process. The letter included the following statements:

“The Commission will only take action if this court issues an order. Although the agency’s fear of a court decision has prompted it to do something, submitting another report will only confirm that the Commission will finally and fully acknowledge that Coinbase’s petition for rulemaking was vetoed a long time ago.”

Kraken Reference from Coinbase Team

Coinbase referred to the enforcement action brought by the SEC against Kraken on November 20, alleging that the commission mixed customer funds of the crypto exchange and did not register as a securities exchange and clearing agency. The letter did not make any reference to the ongoing process regarding the enforcement action against cryptocurrency exchange Binance, which was filed on November 21.

Coinbase’s effort to establish rules for the cryptocurrency market, which the SEC officials may be approaching a decision on a spot Bitcoin exchange-traded fund to be listed on US markets, came along with reports suggesting. An approval from the agency will likely be one of the most significant positive developments towards mainstream adoption of the cryptocurrency market.