Legal regulations in the cryptocurrency market are causing increasingly notable developments. According to a European Commission official, FTX’s bankruptcy process in 2022 and Binance‘s $4.3 billion deal with US authorities provided a strong argument for the provisions of the European Union’s Markets in Crypto-Assets (MiCA) legislation.

Binance Decision Draws Attention in the EU

Ivan Keller, policy officer at the European Commission, made statements at the MoneyLIVE conference in Amsterdam. The news of Binance’s agreement with the US Department of Justice (DOJ) emerged the night before Keller’s opening speech and was described as a precedent for MiCA’s full-scale implementation in 2024:

“I think we have received a few unfortunate approvals moving in the direction of this strong regulation. FTX was definitely one of the biggest, and now the recent agreement with Binance is also precedent-setting. Our position is that this rulebook will reduce some risks and, more importantly, give regulators clearer levers and powers to oversee these organizations and thus reduce these risks.”

Keller also provided an update on the process of addressing MiCA within the European Union. The legal regulations set by MiCA, considered one of the first comprehensive cryptocurrency market frameworks globally, will be applicable to all EU member countries.

Final Stages for MiCA

Keller explained that the main purpose of addressing MiCA is to encourage innovations in this field while addressing the risks to consumers, market integrity, financial stability, and monetary sovereignty. The scope of the legal regulations will cover cryptocurrencies and will apply to cryptocurrency service providers, aiming to combat illegal transactions in the market.

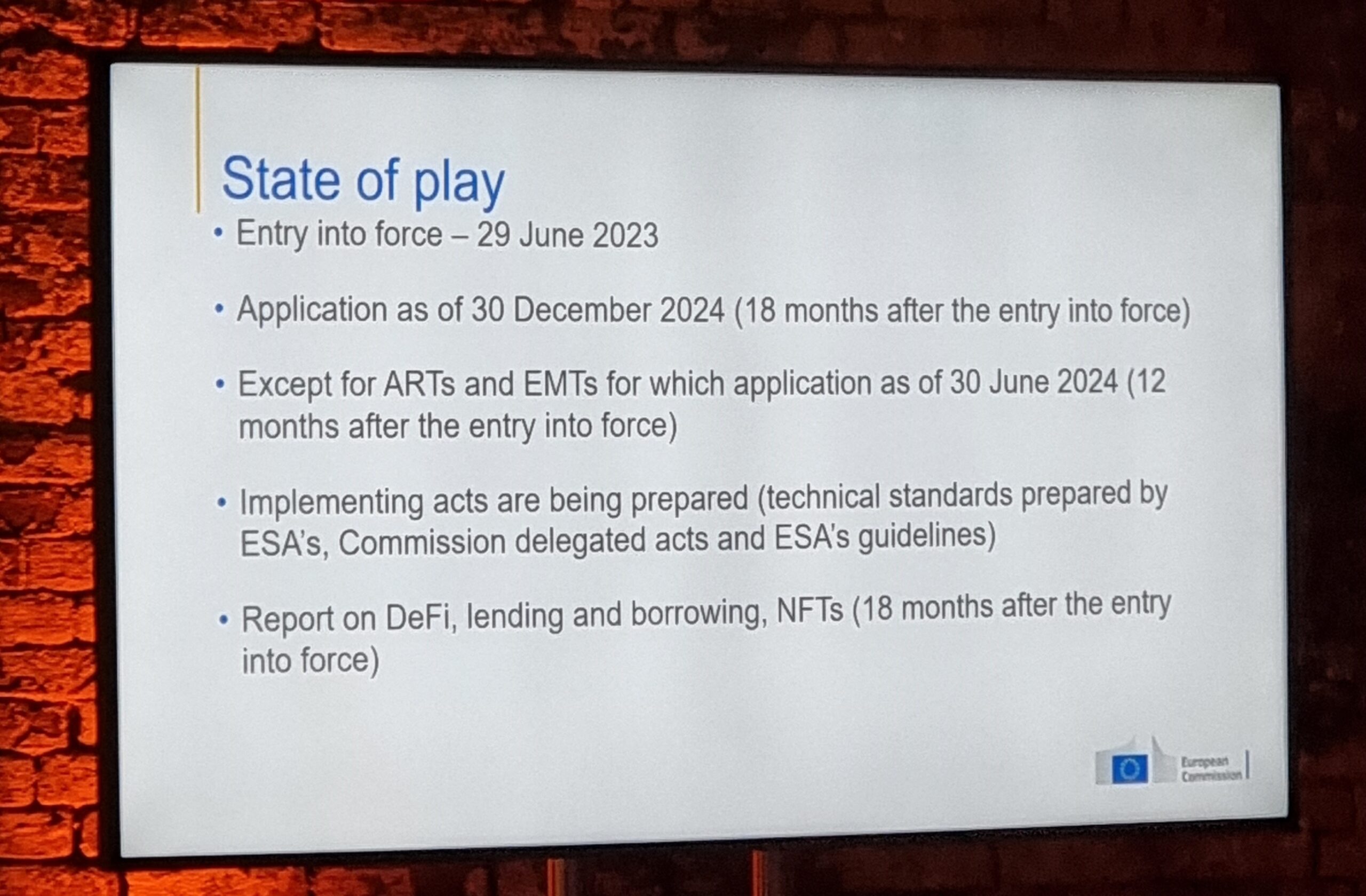

MiCA came into effect in the EU in June 2023, but the implementation of rules concerning asset-referenced tokens and the e-money area, predominantly targeting stablecoin companies, is expected to be addressed in June 2024. After this process, rules for cryptocurrency service providers, including trading platforms, wallet providers, and cryptocurrency exchanges and services, will come into effect in December 2024.

Türkçe

Türkçe Español

Español