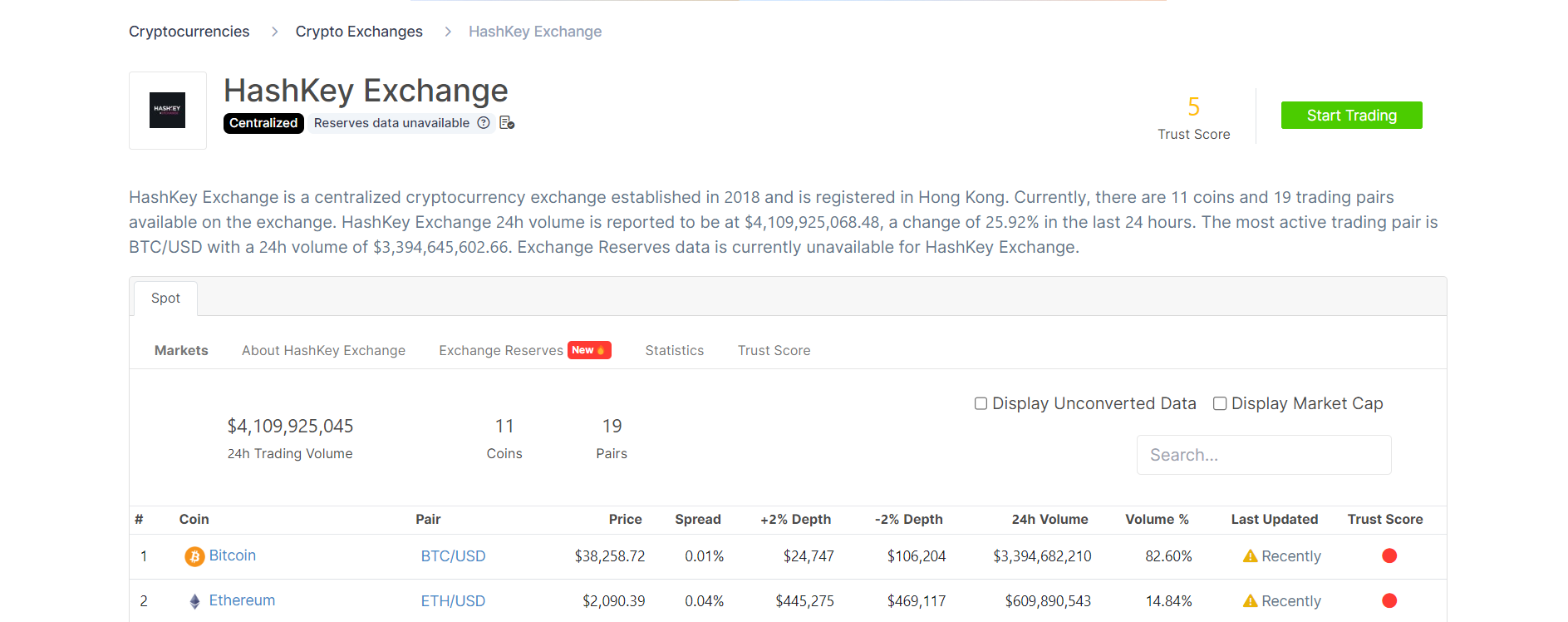

In the world of cryptocurrency, a notable development has been the compliance-focused Hong Kong exchange Hashkey, which experienced an increase in 24-hour BTC/USD trading volume, impressively reaching a volume of $3 billion 480 million. The total trading volume also rose to $4 billion 210 million, entering into close competition with industry giant Binance.

Bitcoin’s Trading Volume Raises Questions

A thorough analysis indicates a potential correlation between washing trade activities, conducted by market makers who aim to accumulate platform coins, and the increase in trading volume. Washing trade is a form of market manipulation where investors create artificial activity in the market by simultaneously selling and buying the same cryptocurrencies.

Allegations of Washing Trade in Hashkey’s Trading Volume

The rise in Hashkey’s trading volume signals a significant uptick in market activity on the platform. With a 24-hour BTC/USD trading volume of $3 billion 480 million, Hashkey has emerged as a formidable player in the cryptocurrency exchange environment. However, such volume also leads to questions about the dynamics behind this increase.

Insightful analysis suggests that the significant rise in trading volume may be connected to washing trade practices used by market makers. In addition to the definition given above, washing trade often involves artificially inflating trading activity to create deceptive appearances, typically with the aim of earning platform coins.

The Outcome of the Artificial Volume Allegations

Market makers employing such strategies might be contributing to Hashkey’s noteworthy trading volumes, potentially increasing speculations and interest in the exchange. As Hashkey continues to navigate the competitive cryptocurrency exchange sector, the consequences of this increase in trading volume are prompting industry participants to closely monitor developments and assess the veracity of the reported figures. The proximity to Binance’s total trading volume highlights Hashkey’s growing importance in the global crypto trading landscape.

While Bitcoin’s trading volume has increased, especially today, we see BTC surpassing the critical resistance level of $38,000. The price is now eyeing its 2023 peak of $38,450. If Bitcoin exceeds this 2023 peak, it seems poised to begin its journey towards $40,000. The next level is then marked at $42,000. Will Bitcoin set a new 2023 record today?