The world of cryptocurrency is going through an exciting December. Developments are so rapid that it’s becoming difficult to keep track of what’s happening with each cryptocurrency. At this point, BTC and Ethereum are breaking records for 2023 while the emphasis on resistance and support levels has started to increase. On the other hand, predictions for Bitcoin continue to arrive.

Bitcoin Surpasses $41,500, Setting New Targets

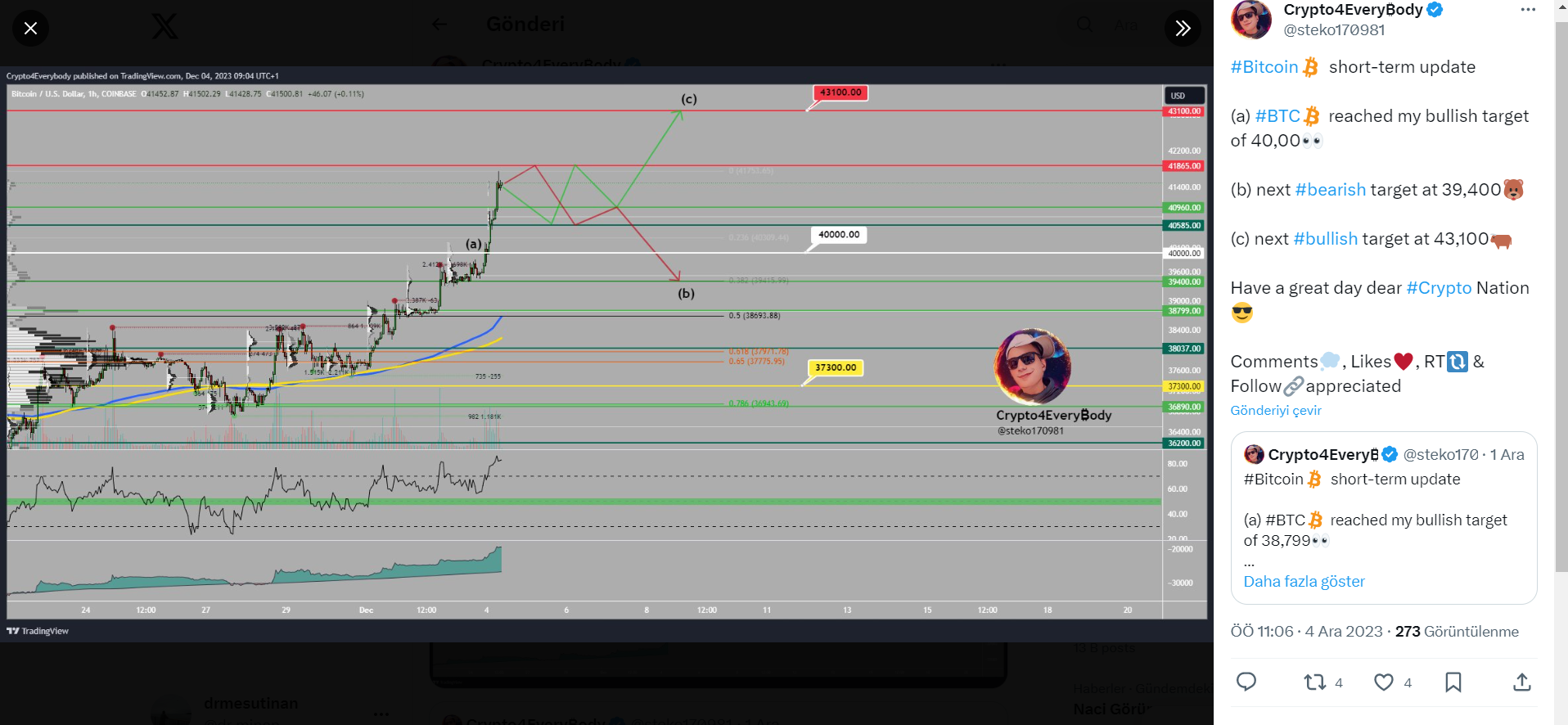

Known for his posts in the world of cryptocurrency, Crypto4Every₿ody today announced new resistance and support levels after the price increase in BTC on his page at X. Crypto4Every₿ody noted that Bitcoin’s rise exceeded his expectations.

Bitcoin’s unexpected surge has created excitement in the crypto world, making it a matter of curiosity what the next levels will be. According to the analyst, important support and resistance zones are now in front of us. Accordingly, a resistance level of $43,100 is awaiting Bitcoin. On the other hand, there is a support point at the $39,400 level.

Confidence in the Cryptocurrency Market is Growing

The growing confidence in the cryptocurrency market can be linked to signs of cooling inflation. There is also a belief among investors that the Federal Reserve has completed its series of interest rate hikes. Amidst this backdrop, the cryptocurrency industry eagerly awaits updates on applications submitted by major players, including BlackRock, for the potential introduction of U.S. spot Bitcoin ETFs.

As of December 1st, Matrixport reported a bullish trajectory for Bitcoin, predicting that the price will rise to $63,140 by April 2024 and to $125,000 by December 2024. These forecasts add an extra layer of excitement to the current Bitcoin rally and shape a positive narrative for the future of the crypto market.

Bitcoin’s recent surge past $41,500 has infused new optimism into the crypto world. While the next support and resistance levels for the cryptocurrency Bitcoin are determined as $39,400 and $43,100, respectively, the crypto community is preparing for potential price movements.

As external factors such as the Federal Reserve’s decisions and the possibility of Bitcoin ETFs emerge, the market’s trajectory continues to remain dynamic. Investors will closely follow these developments, expecting more excitement and potential milestones in the coming days.

Türkçe

Türkçe Español

Español