In the world of cryptocurrency, a decision made by a company on August 10, 2020, had created a bombshell effect in the industry. The software company Microstrategy had announced its adoption of the Bitcoin standard and had made BTC purchases within this framework. Since then, the company continues to buy Bitcoin. Each purchase creates excitement in the world of cryptocurrency. An important graphic about the value increase from that day to today was shared by the company’s CEO.

Data Comes From the Bitcoin Whale Company’s CEO

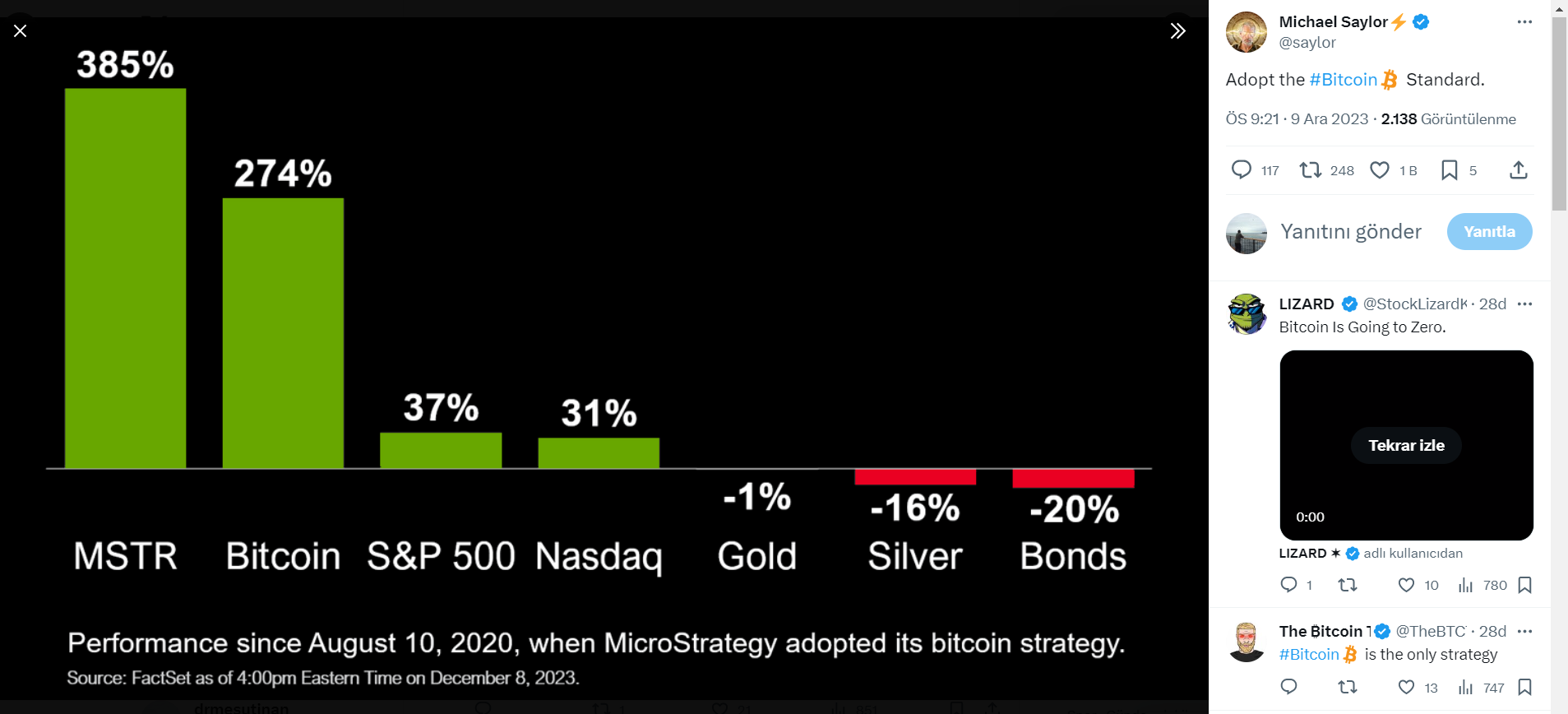

Microstrategy CEO Michael J. Saylor shared significant data today. In his sharing from X, there is a special emphasis on the Bitcoin standard. Saylor compares the increase in his company’s value since August 10, 2020, with the increase in Bitcoin and the S&P 500.

Of course, the data that Saylor compares is not limited to this. The relevant graph includes Nasdaq, gold, silver, and bonds. Frankly, Saylor shares the data with such an appetite that it is striking in terms of showing how correct his investment decision was.

The Company’s Growth Competed with Bitcoin

The increase in the company’s value being over 385% must be pleasing for Saylor. Because Bitcoin has increased approximately 274% since August 10, 2020. This increase could, of course, fall to second place with BTC’s price increase tomorrow. However, the important point here is the poor performance of others.

For example, the increase of the S&P 500 since August 10, 2020, has remained at only about 37%. It is necessary to pay attention to the magnitude of the distance. On the other hand, Nasdaq has shown 31% growth.

In gold, silver, and bonds, we see that negatives are in question. Accordingly, gold is 1% negative since the relevant date. While silver has experienced a 16% decline, the most painful investment has been bonds. If those who entered these investment products that day are still holding them, they are at a loss.

While Saylor reveals this situation, he actually gives two messages to his followers. The first message is to emphasize that the Bitcoin investment has made a significant contribution to the company’s growth. The other message is to show how profitable it is for those who do not want to invest in Bitcoin. What do you think? Isn’t Microstrategy CEO Michael J. Saylor right in this sharing?

Türkçe

Türkçe Español

Español