- Sharp correction in crypto market triggers downward trend.

- Bitcoin‘s dominance raises market concerns.

- Legal processes and regulations continue to impact the crypto market.

The crypto market is showing a downward trend today after a sharp correction hit the market over the weekend led by Bitcoin. Bitcoin’s price dropped by 6.5% in just 20 minutes on December 10, losing almost a week’s worth of gains. As investors have a better understanding of the factors behind this sudden correction, price movements in the crypto market continue to be downward.

Noteworthy Data on the Decline

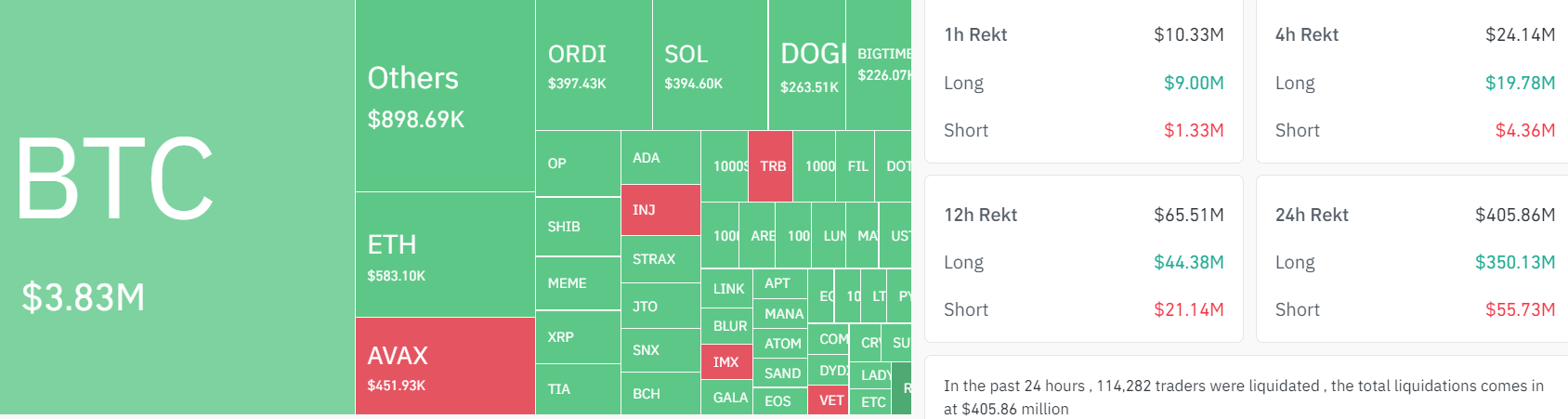

The decline in major crypto assets has led to an acceleration of liquidations in the futures market. Investors were caught off guard by this process, which led to a rapid increase in long liquidations.

In the last 24 hours, over $350.3 million in long positions were liquidated in the crypto market, and $44.3 million was wiped out from the market in the previous 12 hours. Crypto prices are negatively affected when long positions are liquidated in the futures market without buy pressure coming from the trading volume.

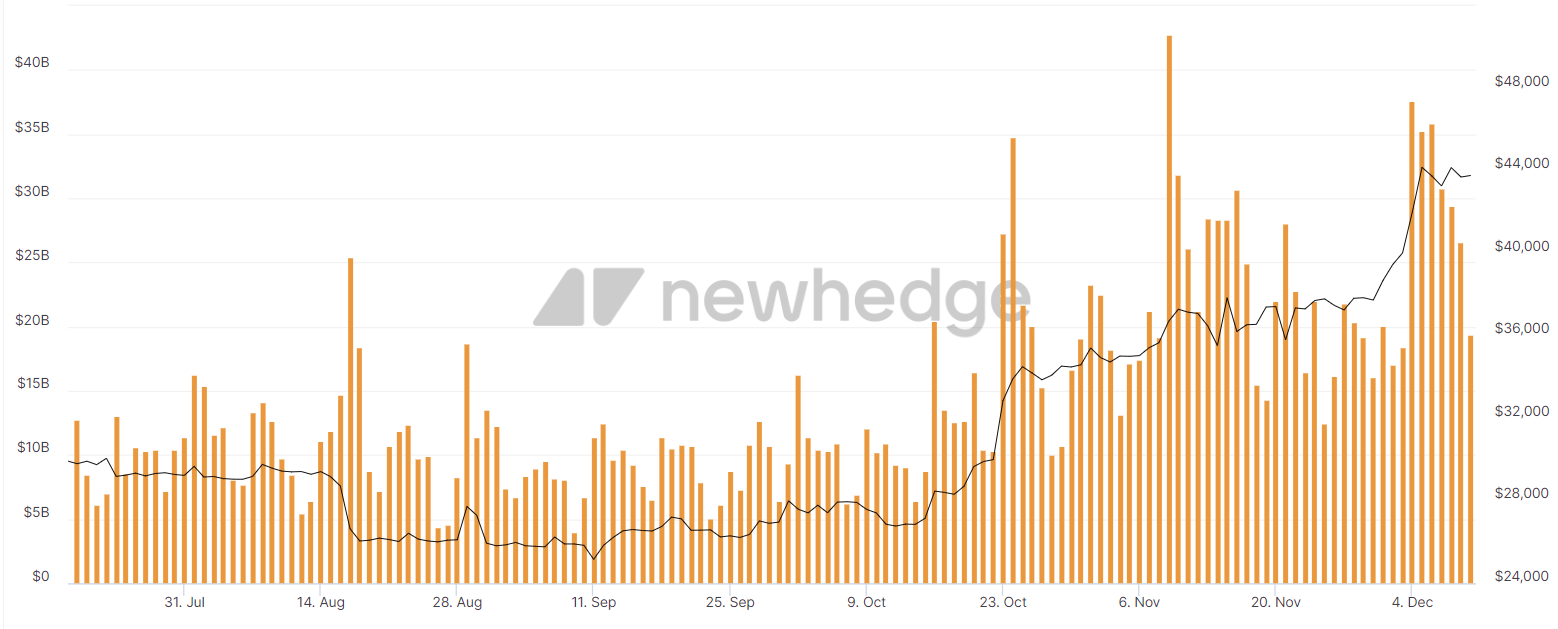

After the total market trading volume rose above $37.6 billion on December 4, a decline was witnessed every day. On December 10, the daily trading volume in the crypto market was only $19 billion.

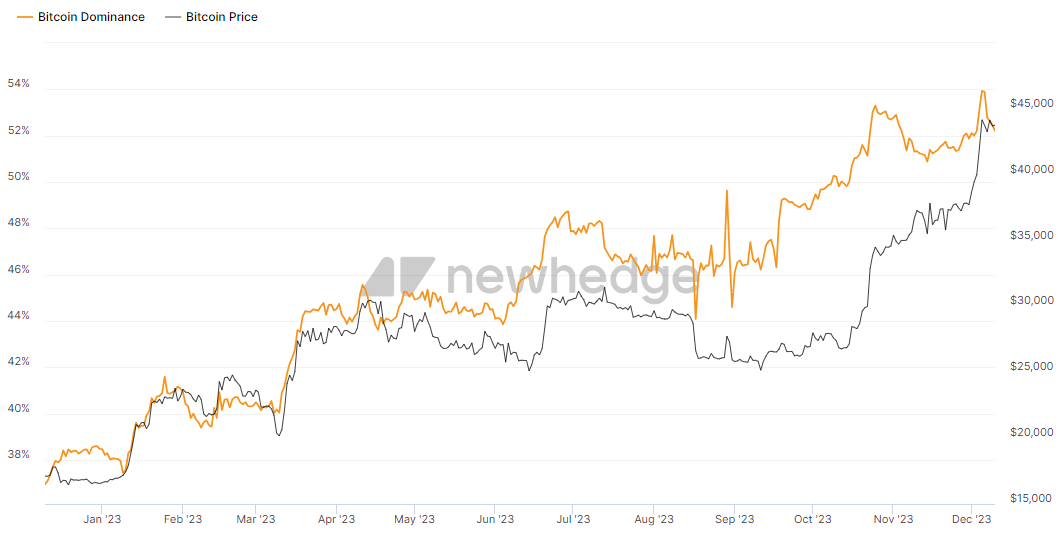

The decline in market trading volume came together with some analysts starting to worry about Bitcoin’s dominance in the market. On December 4, Bitcoin’s dominance reached a monthly peak in a similar way to the trading volume, which caused concerns among many investors.

Legal Processes in the Crypto Market

The crypto industry and legal regulators are causing interesting periods due to various misunderstandings related to the actual use of crypto assets or insecurity in the market. On November 21, the United States Department of Justice (DOJ) announced sanction actions and a settlement regarding CZ and Binance, both of whom admitted their guilt.

Binance’s compliance obligations were announced on December 8, and a comprehensive monitoring process was initiated by the DOJ. Binance’s new compliance obligations also include cooperation to provide access to all documents, records, and resources on demand by US authorities.

Risky assets are greatly affected by investor sentiment, and this includes Bitcoin and altcoins. Serious cryptocurrency regulations discussed so far or the threat of a direct ban in the worst case continue to affect the crypto market on a monthly basis.