The volatility in the cryptocurrency market continues at full speed. Following the Federal Reserve’s interest rate decision, Bitcoin‘s (BTC) reorientation upwards triggered double-digit rises in many altcoins. One of the altcoins that experienced such a rise was Multibit (MUBI), but on-chain data is officially sounding the alarm for MUBI.

They Accumulated MUBI a Month Ago

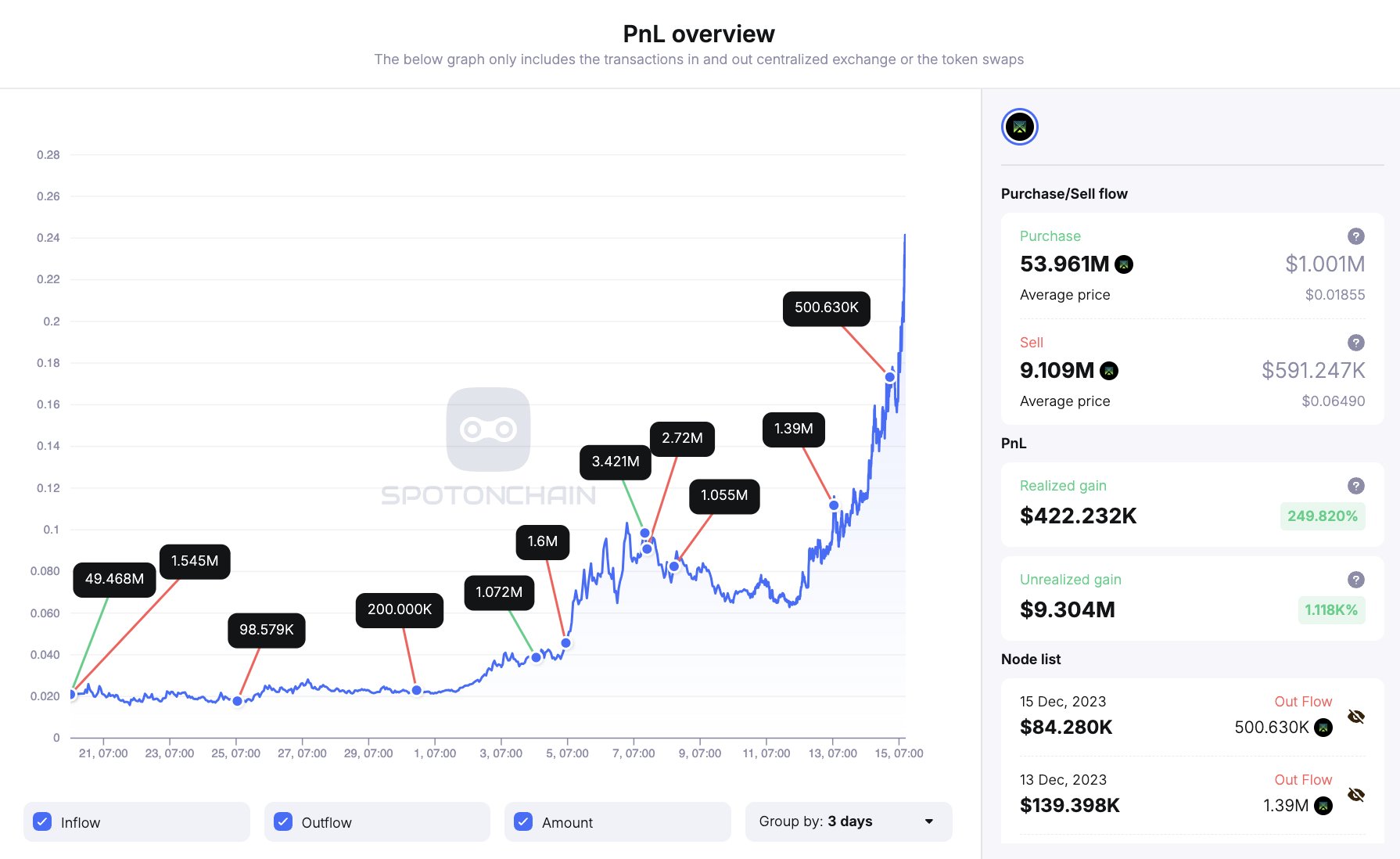

According to data provided by the on-chain data platform Spot On Chain, in the last 24 hours, MUBI’s price increase reached up to 77 percent. The data platform issued a high-profit warning for the altcoin, which rose due to the BRC-20 trend.

Currently, the data shows that the unrealized profits for the 11 largest wallet addresses holding MUBI, outside of cryptocurrency exchanges, amount to $9.3 million. The most striking aspect of these wallet addresses is that they started accumulating the altcoin about a month ago, before the price surged sharply. Moreover, 44.8 million MUBI coins, valued at $10.1 million, are held in 12 wallet addresses and in staking.

In light of all these data, it would not be wrong to say that the alarm bells are ringing for MUBI. The main reason for this is the high likelihood that the said wallet addresses might start realizing profits. Indeed, after a 77 percent increase and the price crossing the $0.24 threshold, the altcoin quickly turned its direction downwards. Having lost about 50 percent of its gains, MUBI is currently trading at $0.20.

What Is Profit Realization?

Profit realization, a financial term, refers to a situation where an investor cashes in on the realized profits of asset values. An investor’s assets, like cryptocurrencies in the case of MUBI, can consist of various financial assets whose values may fluctuate over time. Profit realization for an investor indicates the value increase of these assets over a certain period.

The term also implies that the profit an investor has made during a certain period is realized profit. This means that the investor’s profit, made during a specific period, comes from selling the asset values or cashing in on the revenues, thereby realizing the profit.