Ripple (XRP) has been witnessing numerous price corrections lately as it shows a downward momentum in both daily and weekly charts. Considering the latest data, the token’s price could drop to a significant support level before it starts to rise again.

Analyst Views on Ripple

In the last seven days, the price of XRP has fallen by more than 3%. In fact, according to CoinMarketCap, the value of XRP has dropped over 2% in just the past 24 hours. At the time of writing, it is trading at $0.6066 and has a market capitalization of over $32.67 billion. As the token’s price fell, an increase in volume confirmed the downtrend. However, as cryptocurrency analyst Ali indicated through X, the token’s price could drop even further. Ali noted that XRP was moving within a rising parallel channel. Considering the formation, the token could drop to $0.55 before recovering from this level.

The analyst then addressed the liquidation levels of XRP to understand at which points the token witnessed selling. According to the expert, XRP’s liquidation increased near the $0.644 level, and then the price began to fall. However, the good news for the cryptocurrency is that the token also has a significant support level at $0.59.

Santiment Data on XRP

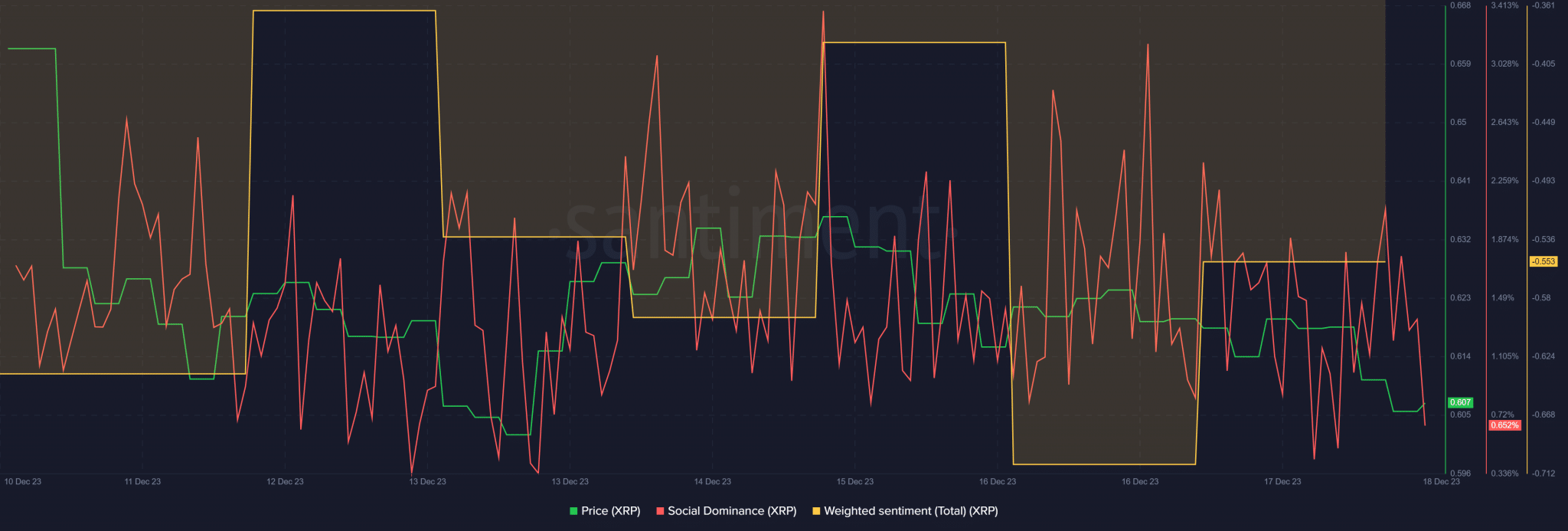

If successful in testing this level, XRP may not fall to $0.55. As the token’s price fell, negative sentiment about the token increased, evident from the decline in weighted sentiment. However, its social dominance remained high throughout the week, clearly reflecting its popularity in the crypto space. According to Santiment data, XRP’s MVRV ratio declined last week.

During the same time frame, XRP’s Binance Funding Rate remained on the rise while its price fell. This situation may indicate that derivative investors are actively buying the token at lower prices, increasing the likelihood of a further downtrend. According to analyses of XRP’s daily chart, the Bollinger Bands indicate that XRP’s price has entered a less volatile region, suggesting a minimal likelihood of a major price drop. The Money Flow Index (MFI) also recorded a slight increase, which could indicate the possibility of an upcoming reversal in the trend.

Türkçe

Türkçe Español

Español