While preparations for spot <a href="https://en.coin-turk.com/breaking-news-why-is-bitcoin-falling-lost-28000-the-reason-for-cryptocurrency-decline/”>Bitcoin exchange-traded funds (ETFs) continue in the cryptocurrency market, executives from all over the crypto community continue to share their views on how the new investment vehicle for crypto could affect the general markets. Currently, the market expectations are shaped around the SEC giving its first approval for ETF applications in January.

Grayscale CEO’s Remarkable Statements

Grayscale CEO Michael Sonnenshein, in an interview regarding the subject, stated that he believes there is a resurgence of positive news flow in the Bitcoin market and that many investors are adding Bitcoin to their portfolios. The executive also mentioned that a portion of the investment community that has not yet had the chance to invest in Bitcoin is eagerly awaiting the launch of spot Bitcoin ETF products to include them in their portfolios. Sonnenshein made the following statement:

“We are talking about a recommended wealth market in the US today that is worth approximately 30 trillion dollars.”

Grayscale is one of the leading companies waiting to receive approval for a spot Bitcoin ETF. Representatives of Grayscale met with the United States Securities and Exchange Commission’s division of trading and markets on November 22 to discuss details regarding the company’s flagship GBTC product, which they wish to convert into an ETF fund.

Bitcoin Price to Reach 1 Million Dollars

In addition to the funds directed towards Bitcoin, Jan3 CEO Samson Mow, who predicts that ETF products could drive Bitcoin prices to 1 million dollars, stated that he believes ETF products could help with the branding and marketing aspect of Bitcoin. Mow explained in a post shared via X how the competition among asset managers for more assets under management (AUM) would encourage an advertising war that would be beneficial for Bitcoin.

On December 19, MicroStrategy co-founder Michael Saylor claimed that Bitcoin ETF funds would be the most significant development on Wall Street in 30 years. Saylor explained that ETF products would be a factor that increases demand for Bitcoin. The executive believes this step will open the door for mainstream individual and institutional investors to invest in Bitcoin.

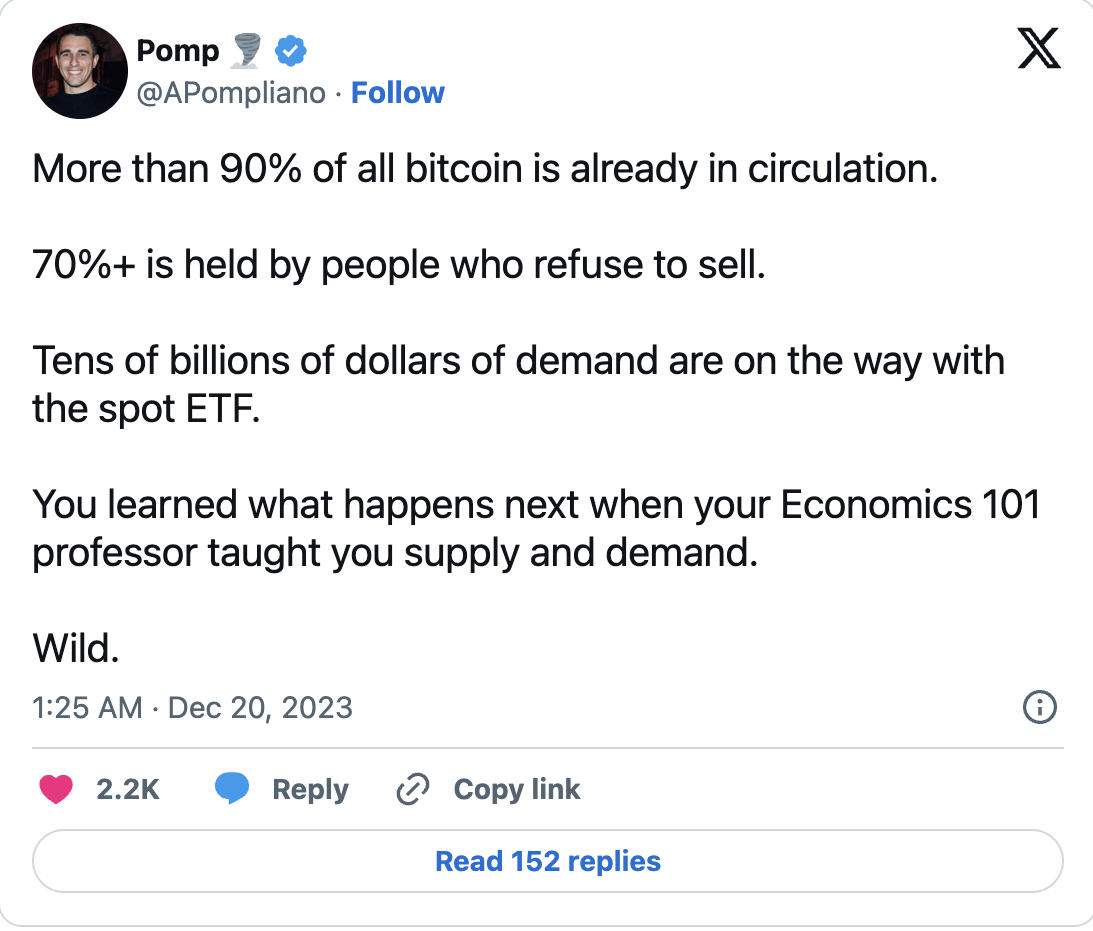

While some experts predict that the price of Bitcoin will rise, others believe that even with ETF approvals, the price will not double overnight. Crypto investor Anthony Pompliano stated that he believes ETF products are an extremely bullish development but will not move a large market.

Amidst all these developments, Bitcoin investor Oliver Velez compared buying Bitcoin ETF products to buying spot Bitcoin. According to Velez, buying a spot Bitcoin ETF product is like buying spot Bitcoin with an annual fee. Buying real Bitcoin, however, is a one-time cost for life. The Bitcoin investor pointed out that real Bitcoin investors will continue to trade with real Bitcoin, which has no custody cost.

Türkçe

Türkçe Español

Español