Bitmex’s founder and former CEO Arthur Hayes has warned the crypto world following the anticipation of the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF. Hayes suggested that if spot Bitcoin ETFs offered by leading traditional finance (TradFi) companies like BlackRock are successful, it could lead to the extinction of Bitcoin (BTC).

“TradFi Could Kill Bitcoin”

In his latest blog post, Hayes expressed his concerns about the potential efforts of TradFi companies to kill Bitcoin, raising a red flag for the crypto community. The famous crypto billionaire warned that if ETFs managed by leading TradFi companies become extremely successful, they could completely destroy Bitcoin, saying:

If you dug a hole and filled it with gold and paper stacks and returned after 100 years, the gold and paper would still exist. Bitcoin, however, is different. Bitcoin is the first monetary asset that can only exist if it moves within the history of humanity.

Hayes highlighted BlackRock, the world’s largest TradFi asset management company, and its plan to accumulate BTC. He suggested that BlackRock would store Bitcoin, offer high-level security at exchange points, and people would buy Bitcoin ETF derivatives instead of holding Bitcoin in their own wallets.

Furthermore, Hayes added another striking claim, suggesting that in the future, there will be no real-world use left for the Bitcoin Blockchain, and this will force miners to shut down their devices. According to him, miners will only be able to earn Bitcoin income by using the network, and eventually, they will have to withdraw from the network. Hayes stated that the death of the network without miners is an inevitable end, at which point Bitcoin is expected to die.

According to Hayes, 2024 Will Be the Year of Bitcoin

Despite his extremely negative claims, Hayes stated that due to reasons such as the approval of a spot Bitcoin ETF by the U.S. SEC, the U.S. presidential election, and the resumption of money printing by central banks worldwide, the year 2024 will be a Bitcoin year.

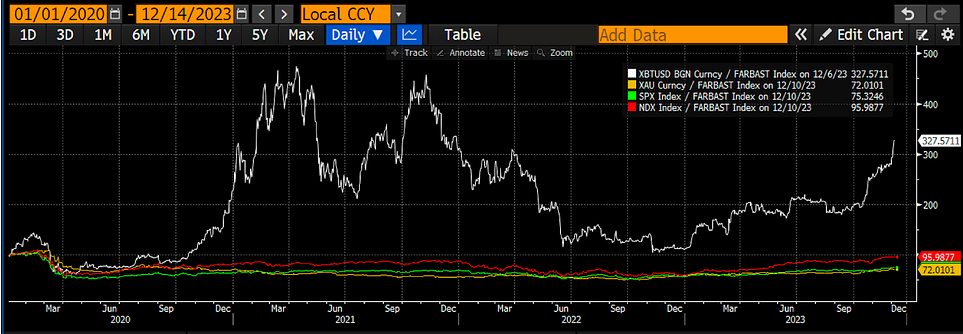

The crypto billionaire also shared a chart showing the path Bitcoin has already taken. According to the chart shared by Hayes (the above graph), since 2020, Bitcoin’s (white line) price has increased by 228% compared to gold (yellow line), S&P 500 (green line), and Nasdaq 100 (red line).