BTC price underwent an expected temporary correction and bounced back to $43,200 after profit-taking, with altcoins remaining relatively positive. SOL and MINA, among many cryptocurrencies, did not suffer massive losses despite the recent correction. This indicates that investors’ appetite for risk in altcoins has not disappeared as the year-end approaches.

2023 End-of-Year Expectations

The king cryptocurrency has increased by 160% this year, reaching its 19-month high of $44,730. It is currently below this region and tried to surpass it over the weekend but did not test new highs during the Christmas holiday. In the last 12 months, there have been major developments such as massive network growth, increased mining difficulty, and record-high hash rates. Bitcoin metrics have seen peaks, but not the price.

Credible Crypto, Crypto Ed, and Crypto Chase

Starting with predictions from analysts, let’s begin with Credible Crypto. He maintained his optimism in previous comments, and his opinion has not changed in his latest comment. The analyst, stating that everything looks great, believes new highs could be seen by the end of the year. The order books show strong support with less resistance upward.

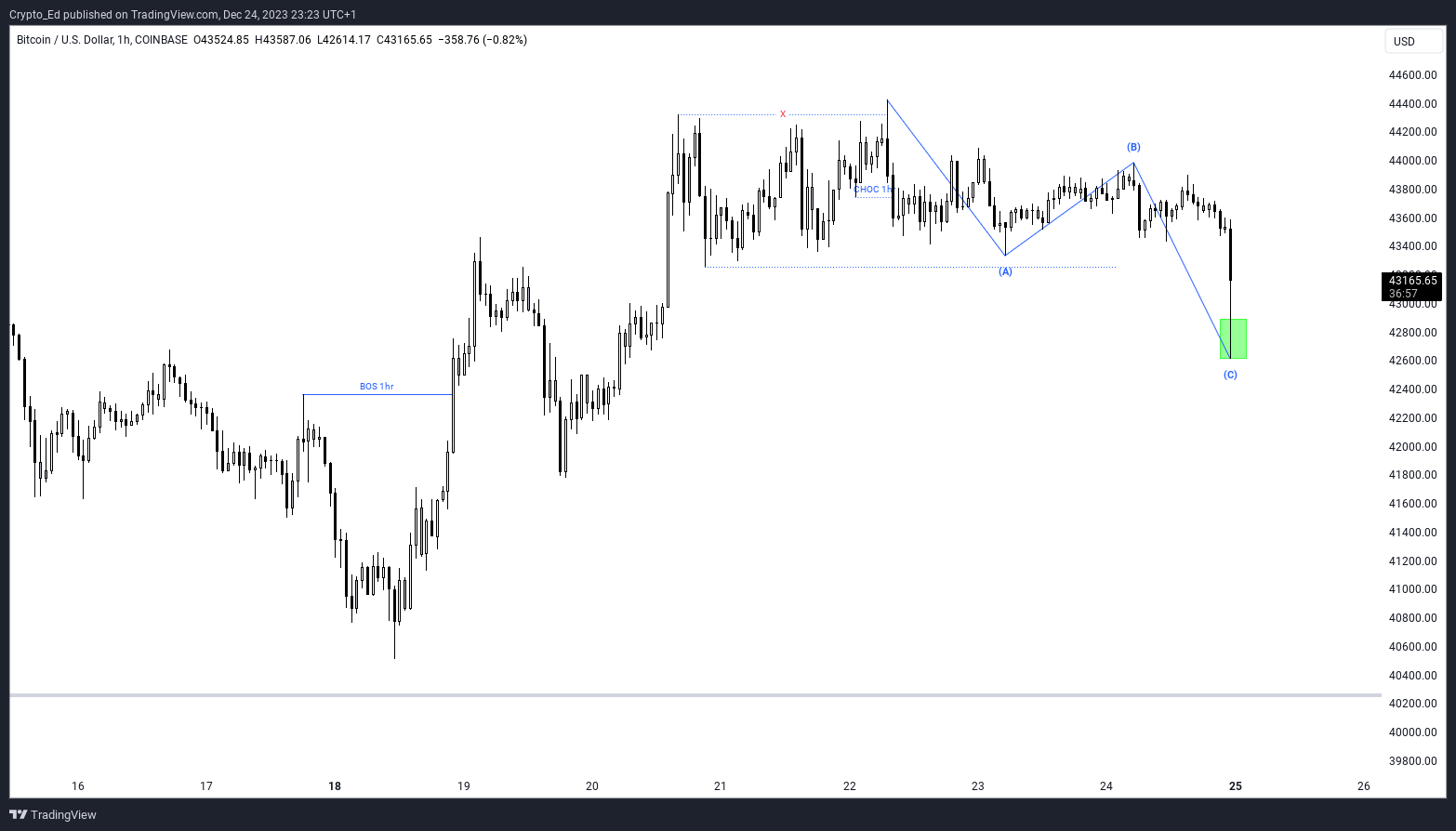

Crypto Ed mentioned that current levels should trigger a reversal. Similarly, Crypto Chase said that lingering around $43,000 would exhaust the bulls’ strength.

Crypto Chase believes that the local peak has been seen while preparing for ETF approval, feeding short positions from the $43,000 region.

QCP Analysts

In the latest QCP analysis we shared with you the same day, there was talk of a “sell the news” event. However, QCP did not foresee the last major surge and there is a possibility they could be wrong this time as well. They emphasized that the sell the news event might not lead to a long-term decline but could trigger a few weeks of pullback.

Interest Rate Hikes Completed

On the macro front, things are going well and PCE has come in significantly lower. This is exciting because it means Fed members have dropped below their year-end inflation targets. If this is possible, why not expect more than the anticipated 75 basis point cut next year?

US markets are closed today and many countries’ stock markets will not be trading for the remainder of 2023. US unemployment claims will be the last data of the year to be announced on December 28. This situation leads to cautious optimism in the markets about major macro policy changes next year. The US data announced for months has almost invariably supported the narrative that inflation is on the decline.

Türkçe

Türkçe Español

Español