Cryptocurrency analytics firm Coinglass’s data indicates that Cardano (ADA) has witnessed a significant and positive increase in its funding rate over the past few weeks. On December 23, there was a notable drop in the funding rate. In the last 24 hours, it fell from about 0.04% to approximately 0.01%, then rose again to 0.03% at the time of writing.

Cardano’s Analytical Reports

A positive funding rate suggests bullish price expectations, while a significant increase indicates rising optimism among investors. Cardano’s price chart has been consistently falling over the past few days, which could signal a potential increase in long liquidations depending on press time trends. On December 24, ADA experienced a loss of over 3% and closed around $0.59.

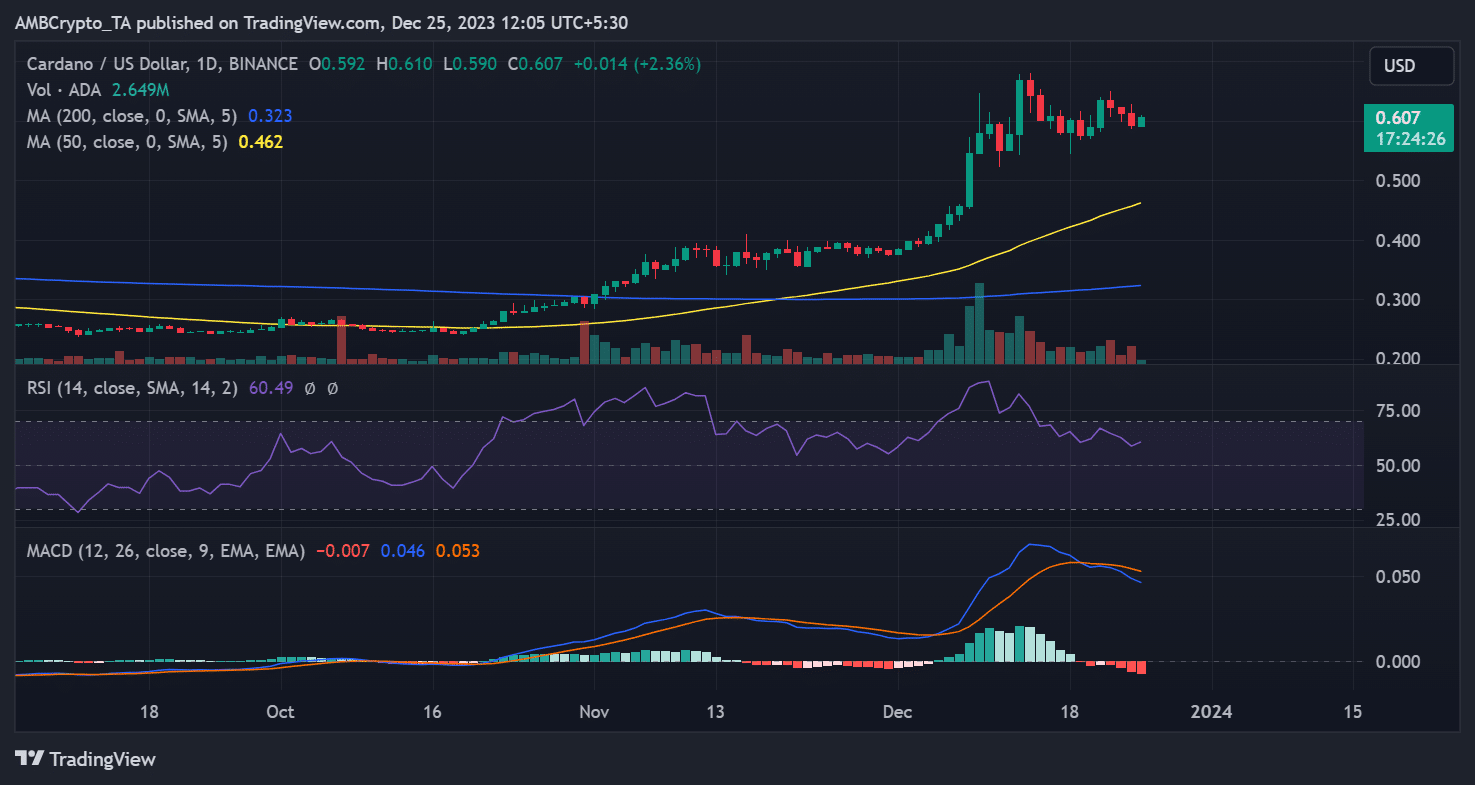

However, at the time of writing, the price showed a more positive trend with a 2% increase to $0.60. This was a welcome recovery after a three-day drop that resulted in approximately a 6% loss in value. Despite volatility, Cardano has maintained a generally positive trend since the beginning of December. This can be seen in its moving averages and Relative Strength Index (RSI).

ADA’s Price Analysis

A positive indicator for a bullish price trend was the short-term average consistently staying above the long-term average. The price sustained above critical levels, reinforcing positive momentum. The RSI also remained consistently above the neutral line, hovering around 60, which could indicate a strong upward trend.

Despite ups and downs, Cardano’s chart analysis over recent weeks could suggest an overall positive trajectory. Beyond the price trend, another encouraging metric for Cardano is its Total Value Locked (TVL). According to the analysis on DefiLlama, the TVL has remained around $400 million since its rise in October, despite volatility. At the time of writing, the TVL was around $407 million.