Ethereum’s (ETH) strongest Layer-1 competitor Solana’s (SOL) price has recently surged to $120, marking an increase of over 21 times since the beginning of the year. This indicates that the popular altcoin continues to make strong moves. Currently, Solana’s weekly gain percentage is at 60%, and its monthly gain percentage is at 100%, with experts expecting the altcoin to shine in 2024 as well.

Could Solana’s Price Rally Continue?

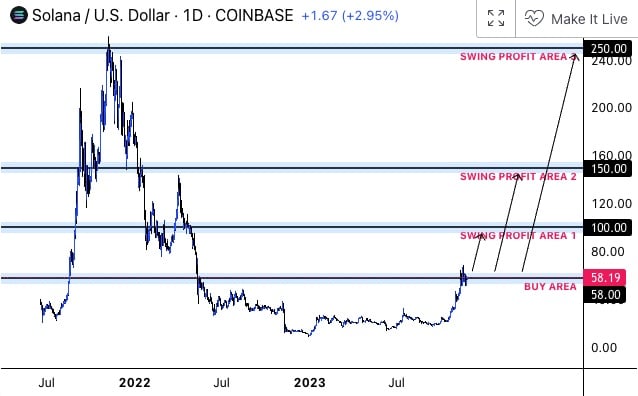

After Solana’s unstoppable price increase, investors are looking for a pullback as an opportunity to accumulate more. According to analyses shared on Tradingview, there seems to be a potential buying opportunity level for accumulating more SOL in the short term. Although it is difficult to recommend making a large investment in SOL after the gains it has made since the beginning of the year, and especially in the last quarter, the $100 level currently stands as the best buying point for the altcoin.

When looking at SOL from a broader perspective, surpassing the critical level of $113 without encountering significant resistance suggests that the rise could continue. Moreover, the $143 level is considered an important resistance level in projections for Solana for 2024.

Next year, the crypto market could become more attractive for investors with the anticipated approval of spot Bitcoin ETFs in the US. This could also trigger a new influx of institutional funds into the market. As expected, the approval of spot ETFs will benefit not only Bitcoin but also altcoins, and many experts believe that SOL’s price could exceed $250 by the end of 2024.

SOL Surpasses ETH in Trading Volumes

On the other hand, Solana has surpassed the altcoin king ETH in the continuous futures trading volume over a 24-hour period, a significant metric in the cryptocurrency market. According to CoinMarketCap, Solana has reached an impressive trading volume of 5.56 billion USDT, surpassing Ethereum’s 4.68 billion USDT. This shift in market dynamics coincided with an increase of over 5% in Solana’s price in the last 24 hours.

Perpetual futures, a type of derivative contract without an expiration date, allow investors to speculate on future prices. These instruments play a vital role in the liquidity and price discovery of the cryptocurrency market. Considering Ethereum’s historical dominance in the market, Solana’s leadership in this metric is particularly noteworthy.

In terms of spot trading volume, Solana also surpassed Ethereum’s 4.61% trading volume, reaching a dominance rate of 8.43%. Additionally, Solana has strengthened its position as a significant player in the cryptocurrency market by achieving a market value of over $50 billion. Another notable achievement for the altcoin was surpassing Ethereum in the last 24-hour decentralized exchange (DEX) trading volume.

Türkçe

Türkçe Español

Español