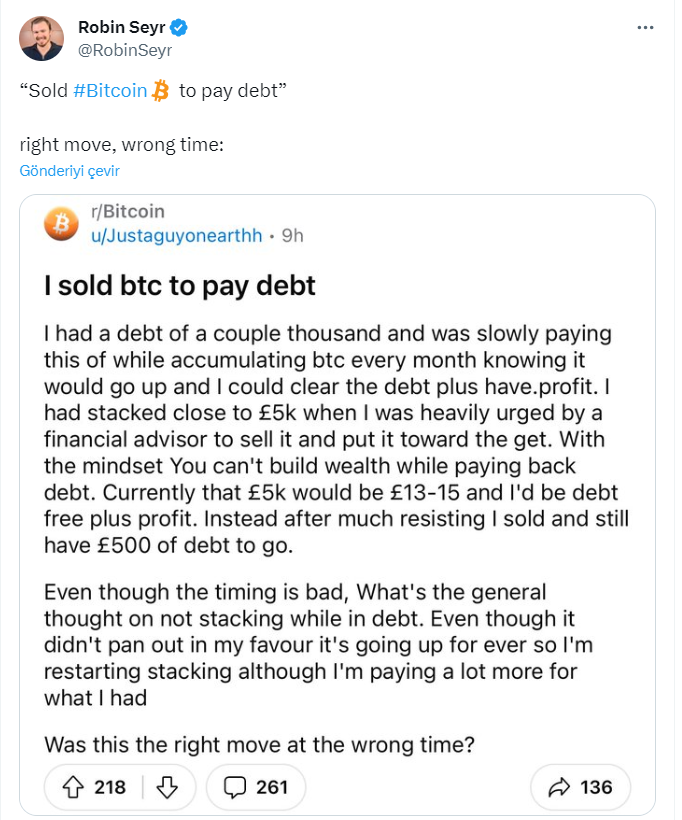

Accordingly, the crypto currency community is questioning whether it was the right move at the wrong time, shedding light on a critical decision. The issue was brought up by Robin Seyr from X. Seyr emphasized that the step was a correct move but at the wrong time. The investor’s story is interesting in showing how selling before price increases in the crypto currency field can result in clear outcomes.

Debt Dilemma: Selling BTC to Pay Off Debts

A crypto investor explains a financial solution that led to a strategic move due to a debt of a few thousand pounds. With the belief that monthly accumulation of Bitcoin would be profitable, the investor aimed to clear the debt and earn additional income. After accumulating about 5,000 pounds, the situation changed when a financial advisor strongly recommended selling Bitcoin to accelerate debt repayment. The advisor’s perspective, emphasizing the difficulty of acquiring wealth while paying off debt, led to a very important decision.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Looking back, a different picture emerges now. If the investor had held onto Bitcoin, the initial investment of 5,000 pounds would have significantly increased to between 13,000 and 15,000 pounds, achieving a debt-free status and additional profits. Instead, the decision to sell left the investor with a debt of 500 pounds, prompting them to consider whether they made the right move at the time.

Balancing Acts: Accumulating Crypto and Paying Off Debt

The investor’s dilemma raises a common question in the crypto community: Is it advisable to accumulate digital assets while managing debts? The narrative reveals the complexity of such decisions, where financial advisors often advocate for clearing debts before building wealth. The conflict between the immediate need to reduce debt and the long-term potential of crypto investments creates a challenging dynamic for investors.

Although the decision did not yield a positive outcome for this investor, the broader consensus in the crypto space is evolving towards the potential longevity of digital assets. By accepting the continuous nature of the crypto markets, the investor encourages a renewed commitment to accumulation, despite the more costly re-entry. The question remains: Was it the right move at the wrong time?

Wrong Timing for Bitcoin Sale

The investor’s experience underscores the complex balance required in the areas of crypto investments and debt management. A retrospective evaluation of missed opportunities, alongside the ongoing upward trajectory of crypto currencies, encourages thinking about the timing and strategy behind such financial decisions.

In conclusion, the investor’s journey serves as a case study for the crypto community and prompts reflection on the delicate balance between debt repayment and crypto currency accumulation. Although the decision to sell BTC to pay off debts did not yield the desired outcome in this instance, it adds depth to the ongoing discussions about financial strategies in the ever-evolving environment of crypto investments.

The inference continues to be subjective, emphasizing the importance of a nuanced approach to navigating the complex intersection of individual financial goals, risk tolerance, and the intricacies of debts and crypto investments.

Türkçe

Türkçe Español

Español