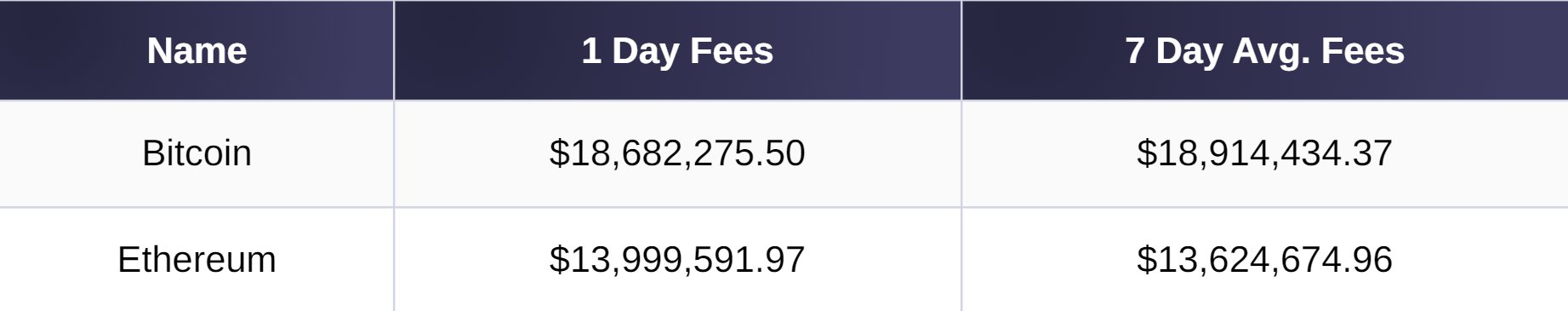

Bitcoin has experienced a notable revival, surpassing Ethereum in transaction fees and reaching price levels reminiscent of the 2017 cryptocurrency boom. With average weekly fees of $19 million compared to Ethereum’s $14 million, Bitcoin is asserting its dominance in the digital currency landscape.

In recent weeks, Bitcoin has seen an increase in transaction fees to levels not witnessed since the historic bull run of 2017. This rise has positioned Bitcoin as the leader in transaction fees, leaving its tough competitor Ethereum behind.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Latest data reveals that Bitcoin is now generating an impressive average of $19 million in fees per week, eclipsing Ethereum’s $14 million.

The current surge in Bitcoin’s transaction fees points to the monumental period of 2017, when the cryptocurrency market experienced unprecedented growth. During this time, Bitcoin reached all-time highs, capturing the attention of investors and enthusiasts worldwide.

Now, as Bitcoin’s fees once again reach levels reminiscent of that historic period, it signals a renewed increase in interest towards the leading cryptocurrency.

Comparing the transaction fees of Bitcoin and Ethereum provides insight into the evolving dynamics of the cryptocurrency market. Bitcoin’s rise to an average of $19 million in weekly transaction fees demonstrates its resilience and ongoing relevance. While Ethereum maintains a strong position with $14 million in weekly fees, it lags behind Bitcoin in this particular metric.

Bitcoin’s resurgence in transaction fees has broader implications for the world of cryptocurrency. As the pioneer and most recognized digital currency, Bitcoin’s performance often sets the course for the entire market. Increased fees indicate rising activity on the Bitcoin network, potentially attracting more participants and fostering greater adoption.

The current developments in Bitcoin’s transaction fees reflect not only network activities but also influence investor and market sentiment.

Higher fees may indicate increased demand for Bitcoin transactions driven by institutional investors, individual investors, or a combination of both. This positive sentiment could contribute to a favorable market environment for Bitcoin enthusiasts.

Türkçe

Türkçe Español

Español