Analyst Mags today evaluated the rise in Ethereum, making a comparison with last year. The analyst draws attention to the highlights of Ethereum’s opponents just a year ago. Among the highlights were calls for crypto enthusiasts to part ways with their Ethereums (ETH) and predictions that the price would return to a value of $500. However, that did not happen. The analyst points to a new level.

Last Year’s Predictions for Ethereum Did Not Come True

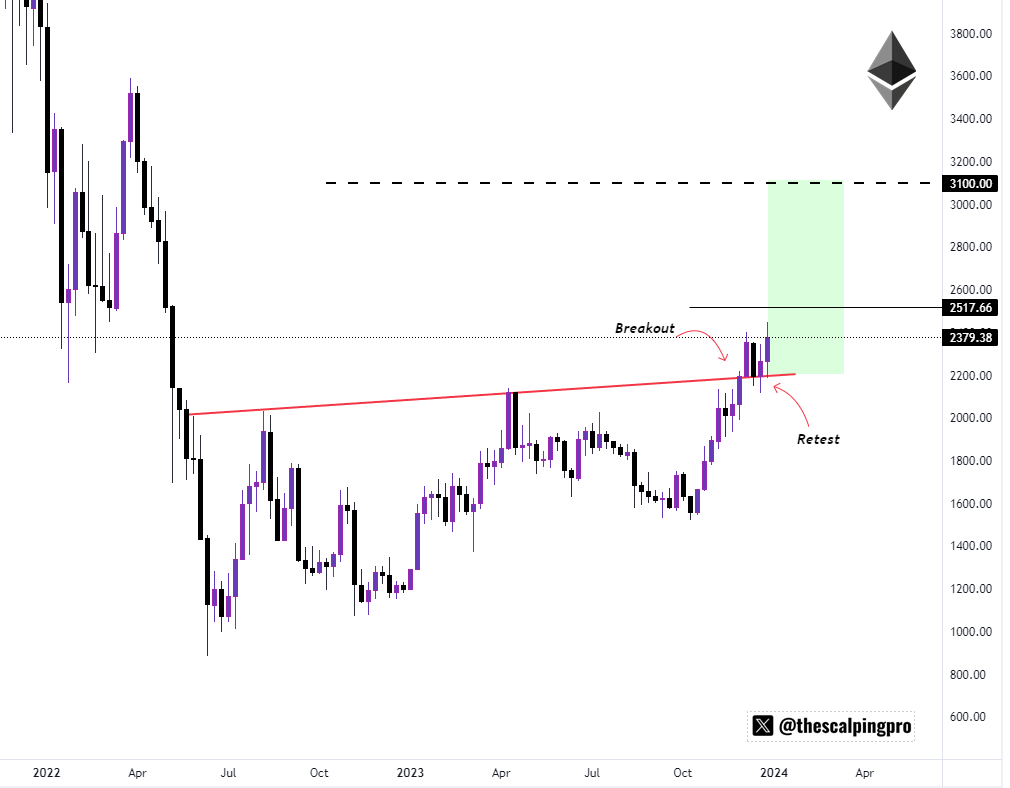

Ethereum surprised skeptics and demonstrated its resilience against market fluctuations, undergoing a significant transformation. Contrary to ominous predictions of retreating to $500, the cryptocurrency recently reached and tested the $2,450 level.

This success underscores Ethereum’s ability to overcome challenges and possess a value far beyond what some had anticipated. This increase is not just a temporary moment, but evidence of the sustainable momentum that Ethereum has built over time.

As the broader crypto community watches Ethereum’s rise, many wonder if this journey will continue towards a milestone that seemed illogical just a year ago, namely the coveted $3,000 mark.

Assessing the Potential for ETH to Reach $3,000

The claim that Ethereum could soon reach $3,000 is not merely speculative but a projection based on observed trends and market dynamics. Ethereum is experiencing a wave of positive sentiment influenced by factors such as increased adoption, the rise of decentralized finance (DeFi) platforms, and broader acceptance of Blockchain technology.

Reaching the $3,000 milestone would be a significant turning point for Ethereum and its investors. It would mean the continuation of the rise and confirmation of Ethereum’s position as a leading player in the cryptocurrency space. However, considering the inherent volatility of the crypto market, it is very important to approach such predictions with caution.

Factors Driving Ethereum’s Momentum

Various factors contribute to Ethereum’s ongoing momentum and the optimism surrounding its potential to rise to $3,000. The continued development of decentralized applications (DApps) and smart contracts on the Ethereum Blockchain has increased Ethereum’s utility and relevance. Moreover, Ethereum’s role in facilitating the evolving NFT market has added another layer of value to the platform.

Additionally, the broader acceptance of cryptocurrencies and Blockchain technology in mainstream finance has contributed to Ethereum’s positive performance. As institutional interest in the crypto space grows, Ethereum will continue to benefit from increased investment and recognition.

Risks and Unknowns

Although the outlook is positive, it is very important to acknowledge the inherent risks and uncertainties of the crypto market. Price predictions are subject to various factors, including market sentiment, regulatory developments, and unforeseen events. Investors and enthusiasts should approach such predictions with a balanced perspective, considering both potential rewards and associated risks.

In conclusion, Ethereum’s journey has defied previous predictions and positioned the cryptocurrency for significant milestones. The recent testing of the $2,450 level indicates a noteworthy achievement in Ethereum’s ongoing evolution, increasing the likelihood of reaching $3,000.