Solana (SOL), the most trending altcoin of 2023, caused storms in the cryptocurrency world from the beginning of November to the beginning of December. The price of the trending altcoin increased by 500%, in other words, a tenfold rise to $125.65 in this short period. Since this peak level, SOL has struggled to gain momentum and investors have started questioning whether the rally in the altcoin is over.

Momentum Loss Brings Solana Down to $105

Closing down for three consecutive days, SOL is now trading around $105.80 and has fallen over 16% since the beginning of the week. This pullback came after a decrease in trading volumes and excitement following a 12-week buying craze.

Technically, it was observed that Solana’s Relative Strength Index (RSI) had risen to overbought levels in mid-December. The RSI reached peak levels above 85 in the daily timeframe, signaling an impending correction.

The RSI has now retreated to the 65 level, which suggests that the price may find support around the psychologically important level of $100 and could rise. If the downward trend continues, it is expected that SOL will find support around the $75 level from the 50-day Exponential Moving Average (EMA).

On the other hand, after the decline in SOL’s price, Binance‘s altcoin BNB reclaimed the 4th position in market value. Moreover, SOL’s daily spot trading volume also took a slight hit. This indicates that investors are reassessing their positions in the altcoin.

Ethereum Captures a Significant Opportunity

While Solana struggles to regain momentum, its main competitor Ethereum (ETH) has started to gain an upward momentum. ETH has risen over 7% in the last few days to around $2,3450 and has significantly outperformed SOL during the same period. Consequently, there was a sharp decline in the SOL/ETH trading pair, indicating that investors are moving capital from SOL to ETH. This fund flow raises questions again about Solana’s ability to maintain its strength while Ethereum is recovering.

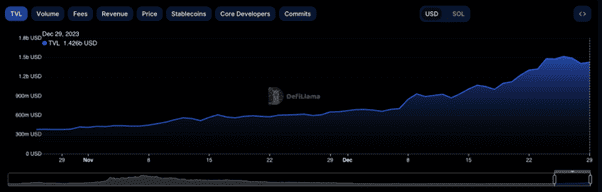

According to DeFiLlama, the total value of assets locked (TVL) in the Solana network has been falling, dropping by about $100 million since December 26. This increases the pressure on the altcoin. Because less SOL being locked in ecosystem applications means more supply circulating freely and potentially entering the market. This potential increase in selling liquidity is preventing the price of Solana from rising.

Türkçe

Türkçe Español

Español