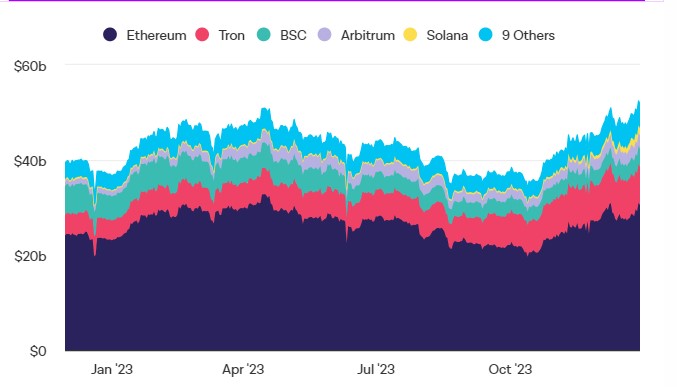

The total value locked in decentralized finance protocols has reached a new level of $52 billion, which is an unprecedented amount since the collapse of FTX in November 2022. Considering the turbulent past overshadowing the industry following the collapse of FTX, Terra, Three Arrows Capital, and firms like Celsius, and the widespread uncertainty around both central and decentralized finance protocols resulting from these events, the resurgence is noteworthy.

DeFi Hits a Yearly Peak

Both sectors have shown signs of recovery in recent months. Particularly in DeFi, since the beginning of 2023, the total value locked (TVL) has jumped from approximately $38 billion to its highest annual level of $52 billion, a 36% increase in dollar terms. However, the TVL metric is not exempt from the volatility of token prices, which can significantly affect its value.

The recent uptrend can be partly attributed to the increasing market values of major cryptocurrencies like Bitcoin and Ethereum, as well as the continuous influx of investments from investors. Along with the market’s recovery, specific improvements and upgrades in certain DeFi protocols have also contributed to the recent increase in TVL. In 2023, there was a significant rise in the integration of real-world assets (RWA) within DeFi, particularly at MakerDAO, which integrated nearly $2.5 billion in RWA collateral, primarily U.S. Treasury bonds, to support the Dai stablecoin.

MakerDAO’s TVL Surpasses $8 Billion

As a result, MakerDAO’s reliance on centralized stablecoins like USDC has decreased. MakerDAO’s locked value has risen above $8 billion, along with an increase in annual revenue. Maker also implemented a lending protocol called Spark, which attracted significant inflows in the second half of the year. The platform allows users to deposit their DAI stablecoins using the DAI Savings Rate (DSR) and exchange them for sDAI, thus earning interest while maintaining liquidity.

Similarly, liquid staking protocols like Lido Finance have gained attention, allowing users to earn rewards without locking their Ethereum with validators. Lido continues to be the largest DeFi protocol in terms of TVL, with over $21 billion in deposits. Additionally, Uniswap launched its v3 protocol in mid-2023, offering enhanced capital efficiency for on-chain investors.

Türkçe

Türkçe Español

Español