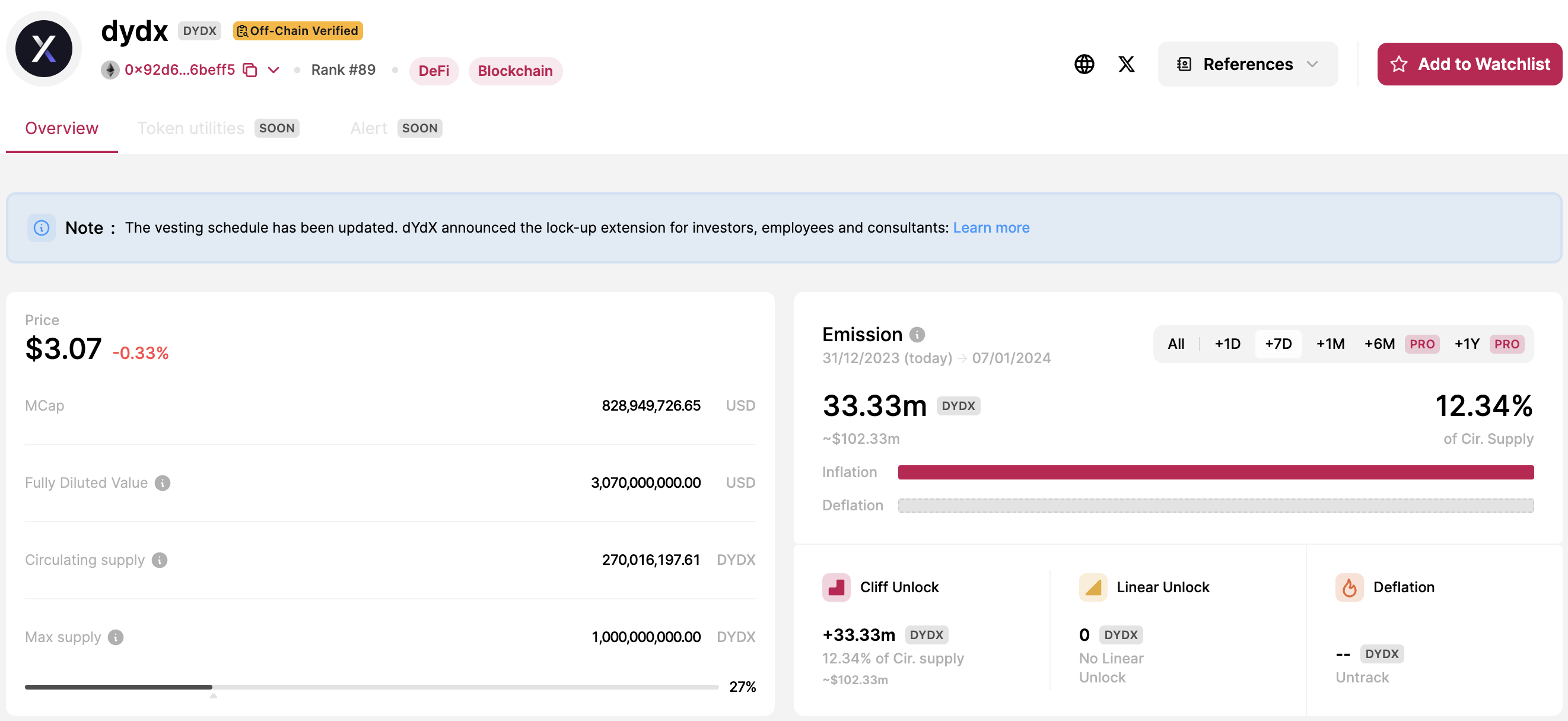

In the cryptocurrency market, token unlock events are one of the important data points that provide hints about token performance. According to the Token Unlocks platform, which closely follows these events, tokens worth 147.15 million dollars will be unlocked in the next seven days. Tomorrow, the token unlock event for DYDX, a decentralized exchange (DEX) operating within the Cosmos ecosystem, is an event that should be closely monitored.

Final Hours for DYDX

According to data provided by Token Unlocks, which shares token unlock events with its users, token unlocks worth 147.15 million dollars will occur next week, marking some of the largest token unlock events of the recent period. Among these unlocks is DYDX, a significant decentralized exchange within the Cosmos ecosystem.

The event, which will take place tomorrow (January 1) at 03:00, involves a token amount equivalent to 12.34% of the total supply of DYDX tokens and has a market value of 102.33 million dollars. With just hours left for the event, investors are eagerly following the process, and at the time of writing, the DYDX token was trading at 3.07 dollars. The DYDX token unlock event is one of the most notable upcoming token unlock events in the coming days.

DYDX Chart Analysis

The first notable formation structure on the DYDX daily chart is the rising channel formation. According to this formation, after a bar close above the EMA 200 (red line), DYDX gained upward momentum, encountered selling pressure after resistance contact, and is currently continuing to trade in a narrow range.

The most important support levels to watch on the daily chart for DYDX are; 3.00 / 2.74 and 2.53 dollars respectively. Especially a daily bar close below the 3.00 dollar level, which has served as significant support in the last bar closes, will lead to selling pressure on the DYDX price.

The most important resistance levels to follow on the daily DYDX chart are; 3.16 / 3.52 and 3.95 dollars respectively. Especially a daily bar close above the 3.16 dollar level, which has been a major obstacle in the recent upward moves, will help the DYDX price gain momentum.