Bonk (BONK) saw a significant surge in mid-December. Between December 13-15, meme token buyers got excited and drove the prices up by 256%. However, it now seems that sellers are gaining the upper hand.

Momentum of the BONK Rise

Still, BONK became one of the most popular meme tokens of the year. It is not yet clear whether the bulls can defend the support area where the price was at the time of writing. A move exceeding $0.0000168 could be the first sign of a buyer’s revival. The rally that rose from $0.0000092 in mid-December to $0.000035 was used to draw a series of Fibonacci retracement levels.

In the popular altcoin, the $0.0000147 level was expected to act as support at the 78.6% level, and the bullish breakout block just below it was seen as an additional intersection point. However, sellers were strong last week. The OBV saw only a slight decline, but the Relative Strength Index (RSI) fell below the neutral 50 and retested it as resistance. This could mean that momentum is definitely on a downward trend.

BONK Price Movement

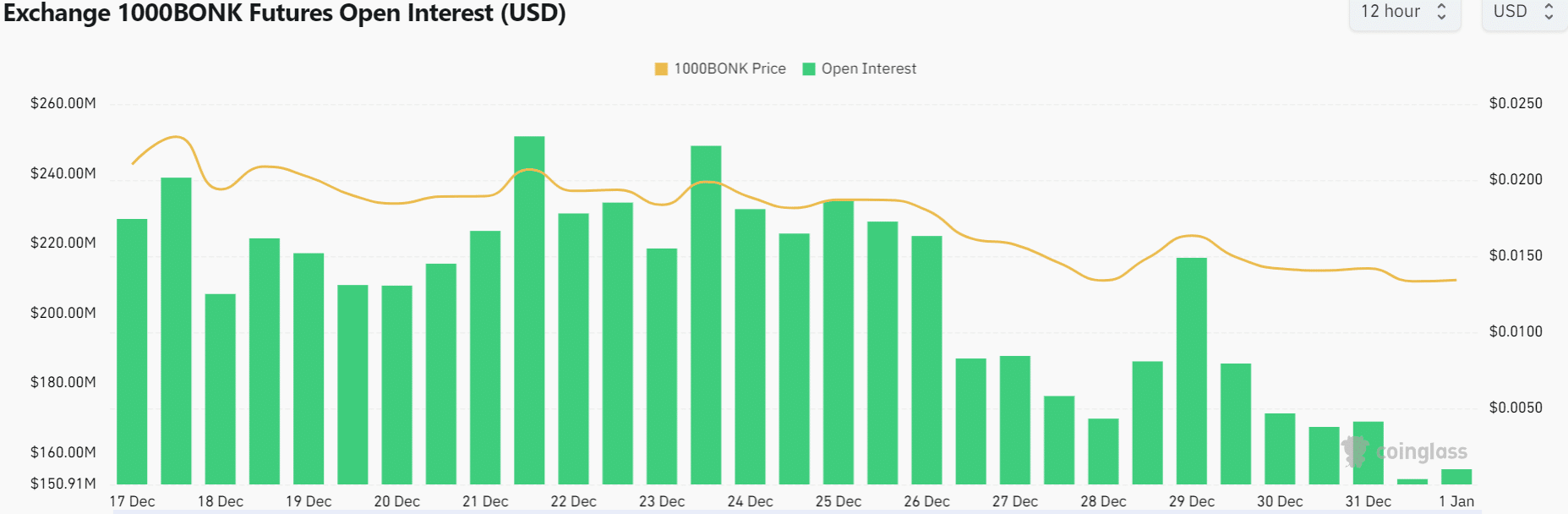

According to experts, the cryptocurrency was also in a downward trend in the 12-hour chart. Therefore, it is likely that BONK will move towards the levels of $0.0000118 and $0.00000925 to the south. Since December 24, the open interest chart has been sliding downwards. The token’s prices fell by 33%, dropping from $248 million to $155 million on January 1.

This could be a strong indication that short-term market sentiment is bearish. It can be assumed that the bears took control because the bulls could not turn $0.0000147 into support during the rise on December 29. Therefore, Bonk buyers may wait for the structure to shift to an upward trend before bidding. Bonk experienced a 256% rise in mid-December but is now under the dominance of sellers. Buyers are uncertain whether they can defend the support area. The Relative Strength Index and open interest chart indicate a short-term downward trend, so buyers may wait before expecting a rise.

Türkçe

Türkçe Español

Español