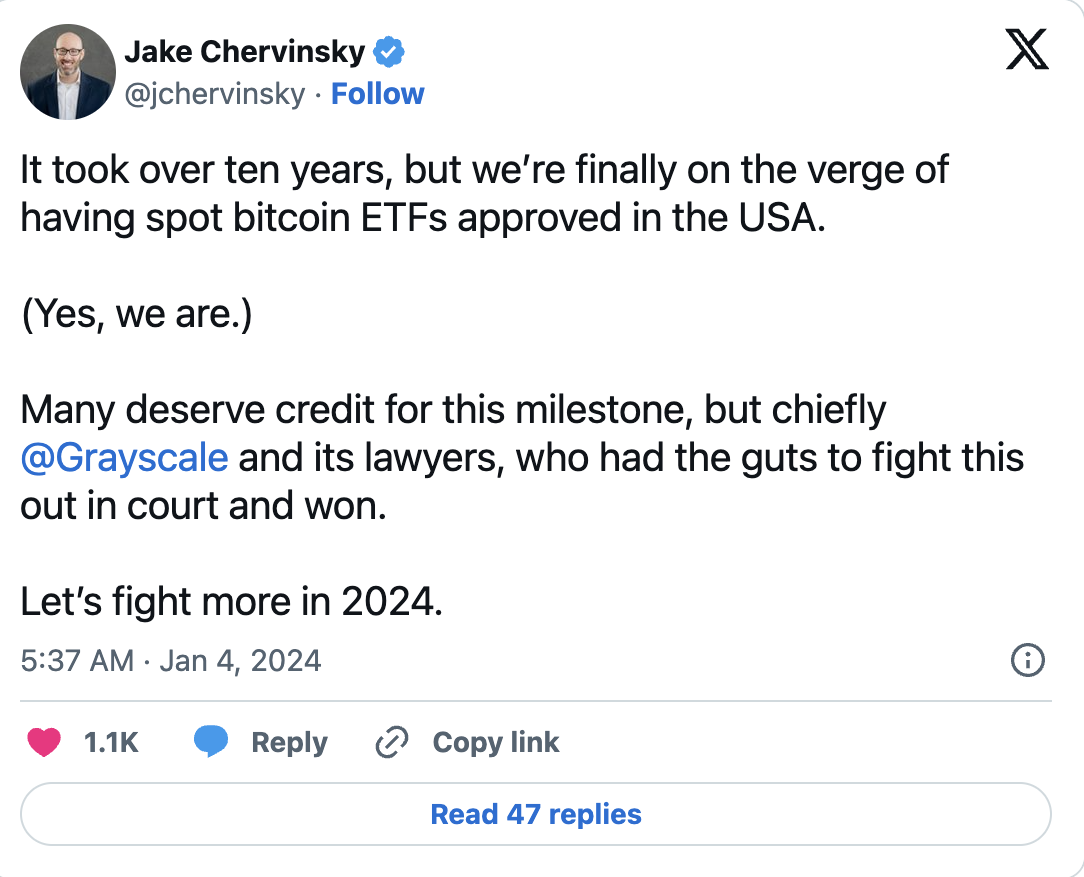

It has been announced that crypto asset manager Grayscale Investments is in discussions regarding a potential role for the proposed spot Bitcoin ETF product with firms like JPMorgan and Goldman Sachs. According to sources familiar with the matter, Bloomberg reported on January 4th that Grayscale had talks with both investment banks for this role.

Steps Being Taken Towards the ETF Process

The news comes shortly after Grayscale filed an amended S-3 application with the SEC without listing any authorized participants. Additionally, according to a previous report in the press, Goldman Sachs was also in discussions to act as an authorized participant for its own ETF product with BlackRock. BlackRock had previously identified trading firm Jane Street and JPMorgan as the authorized participants for its ETF application in an amended S-1 filing.

An authorized participant plays a key role in the management of an ETF service by facilitating the creation and redemption of shares in the fund. An ETF issuer can name multiple financial firms to act as authorized participants to the SEC. Particularly, ETF applicants do not need to specify their authorized participants in the relevant S-1 or S-3 applications, which means there is still an open door for other financial firms to step in on the matter.

JPMorgan has already been named as an authorized participant for several proposed spot Bitcoin ETF services, but Goldman Sachs could potentially join other Wall Street giants given the role of authorized participant for various issuers, including Cantor Fitzgerald and trading firm Jane Street.

USA and the Cryptocurrency Market

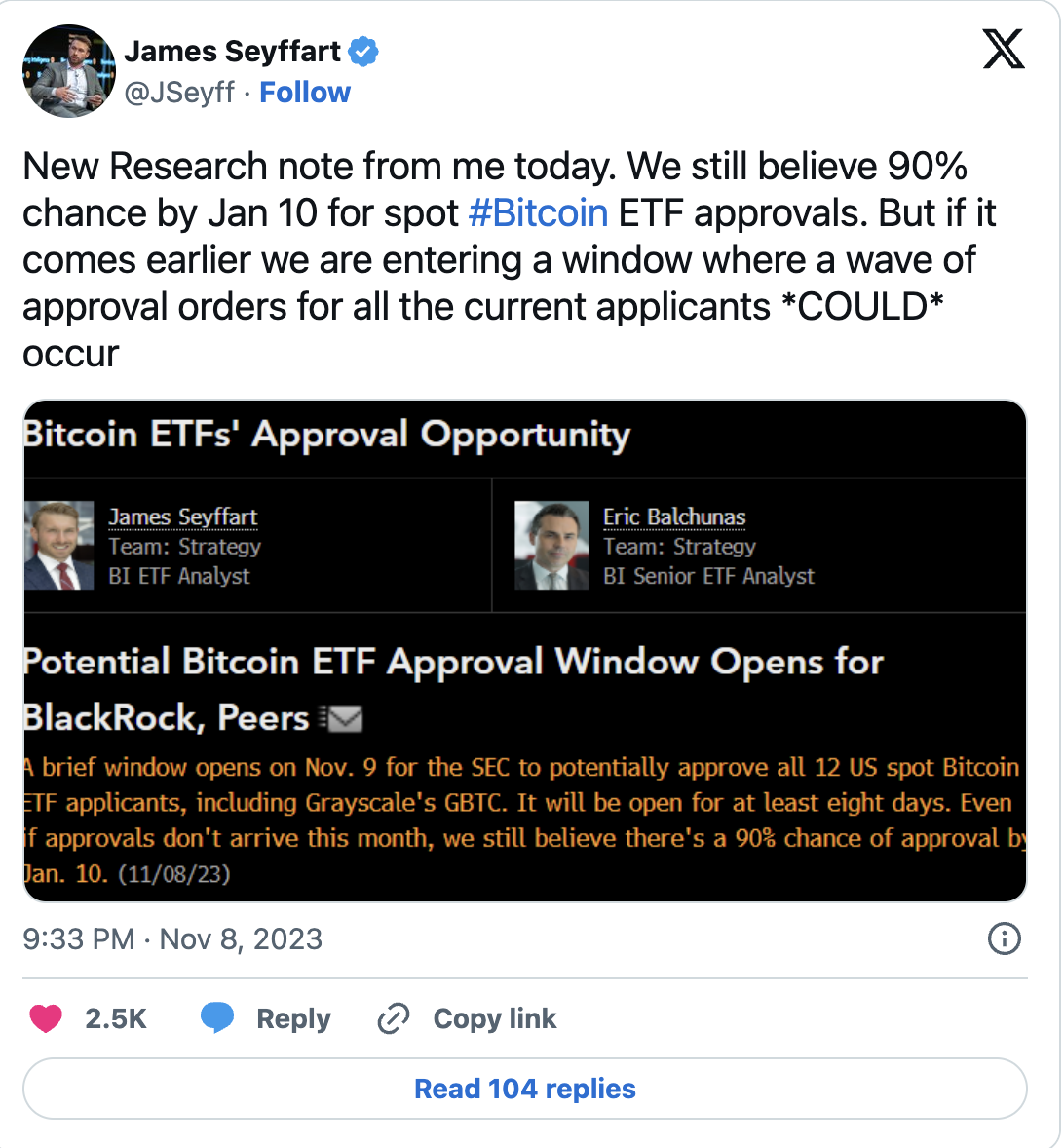

Goldman Sachs has historically maintained a neutral stance towards cryptocurrencies and the crypto asset sector. Matthew McDermott, head of crypto assets at Goldman, stated in an interview with Fox Business on December 27th that approval of a Bitcoin ETF would help mature the crypto market and invite broader institutional investments into crypto assets.

To date, no spot Bitcoin ETF application has been approved in the United States. However, ETF analysts estimate a 90% chance of approval before January 10th of this year. Currently, there are 14 asset managers in the United States wanting to issue a spot Bitcoin ETF service, which would allow institutional investors to invest directly and in a regulated manner in Bitcoin.

Türkçe

Türkçe Español

Español