The Bitcoin Lightning Network emerged as a significant innovation in the crypto market. Despite its growing popularity and user base (currently over 328 million), only a very small percentage of crypto exchanges utilize this technology. The adoption journey of the Lightning Network contains many challenges, but it always carries the potential for broader acceptance in the crypto industry.

Adoption of the Bitcoin Lightning Network

A recent report shared by leading Bitcoin infrastructure company Kaminari suggests that the user base of the Lightning Network could grow significantly by 2024. The adoption of this technology by major exchanges like Binance and OKX seems to have contributed to its widespread accessibility and awareness.

Despite adoption by major exchanges like Binance and OKX, market data announced that only 14 out of 224 active centralized crypto exchanges have integrated the Lightning Network into their systems. Kaminari analysts confirmed this, stating:

Crypto exchanges are the most commonly used applications in the crypto ecosystem. Binance alone has 150 million users as of August 2023. OKX has 50 million, and Bitstamp, which has 5 million users, should also be mentioned. Currently, only 6% of crypto exchanges use the Lightning Network for Bitcoin transactions.

The slow adoption rate raises many questions about the network’s scalability and user-friendliness, especially for individual users.

Despite the benefits of reducing costs and facilitating Bitcoin transactions, the technical complexities on the Lightning Network side and the high fee situation during peak times have generally made the network used for storage purposes.

Kaminari analysts made the following statement on the subject:

Of the more than 350 wallets analyzed, only 30 (15 for storage purposes and 14 for non-storage purposes) have integrated Lightning. Notably, among the top 10 most popular wallets by user count, only Exodus and BitPay have adopted Lightning. These findings indicate a significant area for expanding the user base through broader wallet integration.

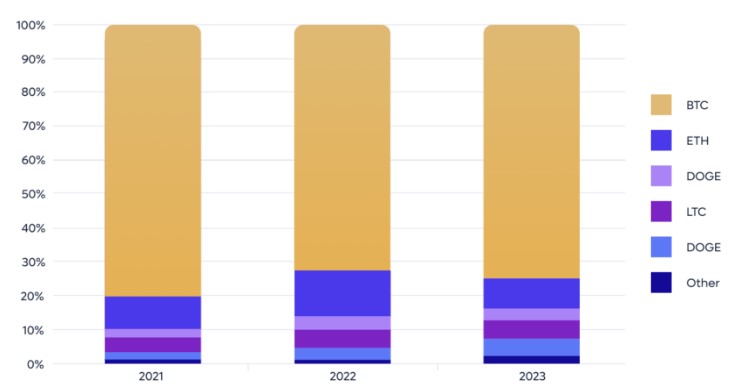

High Potential in BTC Transactions

The Bitcoin blockchain itself continues to demonstrate strong growth with a record number of transactions emerging in 2023. The expanding number of nodes and capacity of the Lightning Network showcases the potential for increased adoption and integration in cryptocurrencies.

Additionally, with the addition of stablecoins to the Bitcoin blockchain, preparations for a revolution in the stablecoin market are underway. If the billions of dollars in USDT transactions were to suddenly shift from the Tron and Ethereum networks to the Lightning Network, the stablecoin sector could change rapidly.

Kaminari analysts:

According to our estimates, if even 5-10% of Tether transactions switch to the Lightning Network, the annual turnover could reach $257 – 514 billion. As stablecoin users increasingly recognize the advantages of Lightning, these figures are expected to rise significantly. Tether’s (USDT) entry into the Lightning Network will be a very important moment that reshapes the landscape of the stablecoin market.

Türkçe

Türkçe Español

Español