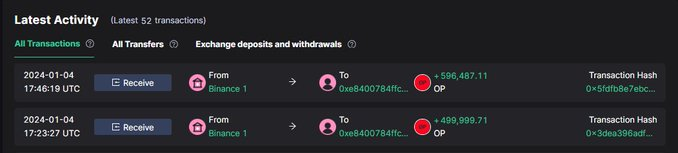

In a recent development, a whale has made a notable move by withdrawing approximately 4 million dollars worth of 1.09 million OP from Binance in the last 10 hours. Analyzing the transaction details reveals interesting information about the investor’s strategy and history with OP, which has become a topic of discussion in the cryptocurrency world.

Transaction Timeline: Deciphering the Actions of an Altcoin Whale

The transaction history paints a dynamic picture of the whale’s relationship with the altcoin OP. Specifically, the whale initially purchased OP at around $1.46 in value. Following this purchase, the entire sum was later deposited into the cryptocurrency exchange at a higher value of approximately $1.7.

The emerging question is whether this whale investor is once again implementing a range trading strategy with the altcoin OP. Range trading, often known as price range-bound trading, involves capitalizing on price fluctuations within a defined range. This strategy typically includes buying at the lower boundary and selling at the upper limit of the set range.

Fundamental Inferences and Observations for Crypto Asset OP

The significant withdrawal of altcoin OP worth a total of 4 million dollars indicates a decisive move by the whale investor. Understanding the motivations behind such a withdrawal can provide valuable insights into perceptions of market conditions.

The whale’s initial purchase of altcoin OP at around $1.46 and subsequent deposit at a higher value of $1.7 suggests a calculated approach to take advantage of price differentials.

Speculations that the whale is potentially range trading with altcoin OP are based on historical data that shows a pattern of buying at lower levels and depositing at higher levels. If consistent, this strategy indicates a deliberate effort to capitalize on price fluctuations within a certain range.

Market Implications and Investor Forecasts

The actions of significant players in the crypto market, such as whale investors, often influence market dynamics. Understanding their strategies provides valuable information for other investors navigating the crypto world.

In conclusion, the recent withdrawal of 1.09 million altcoin OP by a whale investor from Binance has led to an investigation into the investor’s historical relationship with the token. The hypothesis of group trading based on previous models adds a layer of complexity to the narrative. As the crypto market continues to evolve, monitoring the movements of influential players becomes essential for making informed decisions in an environment characterized by volatility and strategic maneuvers.