Bitcoin investor Arthur Hayes continues to draw attention with his price analyses. The well-known analyst recently announced that he anticipates a drop of up to 40% in Bitcoin’s price in March. The former CEO of crypto trading giant BitMEX warned his readers about a week of significant turmoil in the financial markets in a blog post published on January 4th.

Countdown for ETF Applications Continues

As the United States prepares to approve its first spot Bitcoin exchange-traded funds, Bitcoin investors feel quite secure this year. The halving event in April, which will cut block rewards in half, along with these developments, could mark a pivotal year for Bitcoin’s price increase due to institutional money and broader adoption.

However, according to Hayes, not everything is doomed to rise in a straight line, and the reason is the Federal Reserve’s efforts to stabilize an economy struggling with deflation but plagued by instability.

In particular, the Federal Reserve’s Bank Term Funding Program (BTFP), created in response to last year’s regional banking crisis, will end in March. A week later, the Federal Open Market Committee (FOMC) will need to decide whether to raise, hold, or lower interest rates. Hayes stated the following on the matter:

“The BTFP ends on March 12th, and the Fed’s interest rate decision is announced on March 20th. There are six trading days between these two critical decision points. If I’m right, the market will bankrupt a few banks during this period and force the Fed to lower interest rates and announce the restart of the BTFP.”

Bitcoin and the crypto market are extremely sensitive to changes in macro liquidity, and a Fed move will definitely help their cause. However, this can only happen after the initial shock caused by the repetition of 2023’s volatility. Hayes summarizes the issue as follows:

“Due to the withdrawal of dollar liquidity, I can easily see a 30 to 40% correction. That’s why I can’t buy Bitcoin until the decision dates in March pass.”

Striking Commentary on Bitcoin Price

As the countdown to the process continues, ETF approval claims continue to cause volatility in Bitcoin’s price on their own. Concerns about a possible rejection led to a nearly 10% drop in Bitcoin’s price this week. At the same time, various commentators believe that even if ETF applications are approved, Bitcoin still needs to undergo a more significant correction.

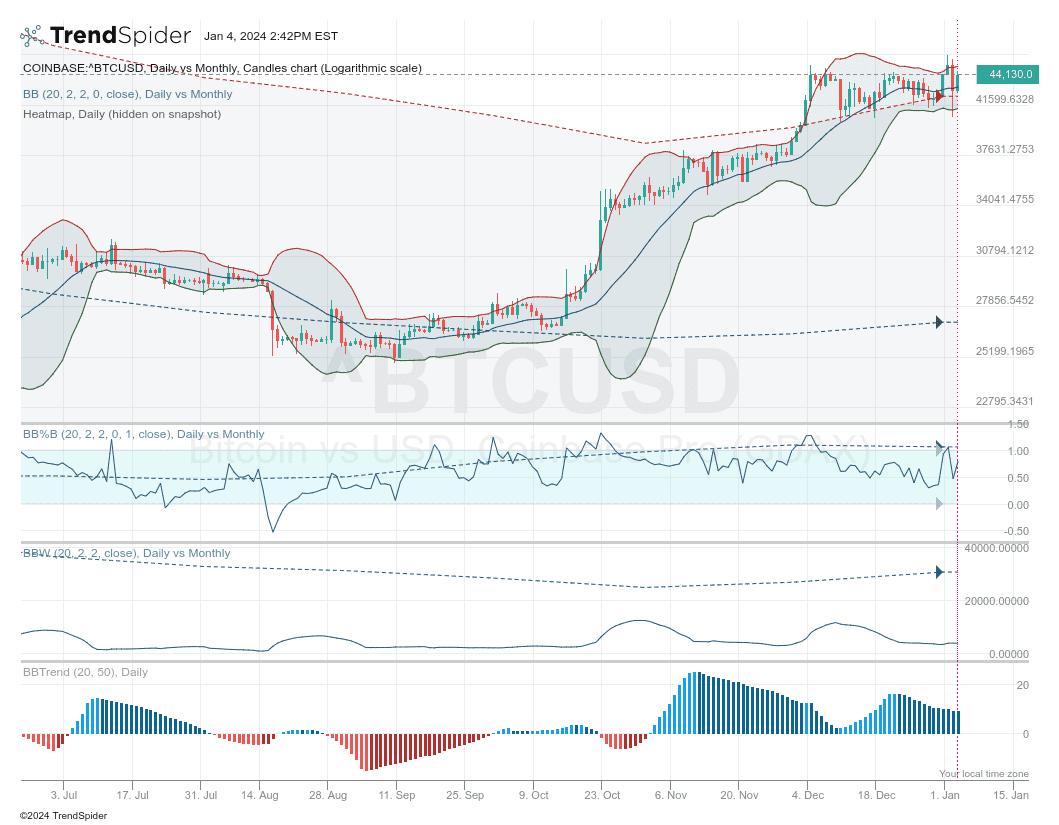

John Bollinger, the creator of the Bollinger Bands volatility indicator, disagrees and predicts a positive response based on the values of his tool. The famous figure announced that he expects a higher breakout for the BTC/USD pair from X.

Türkçe

Türkçe Español

Español