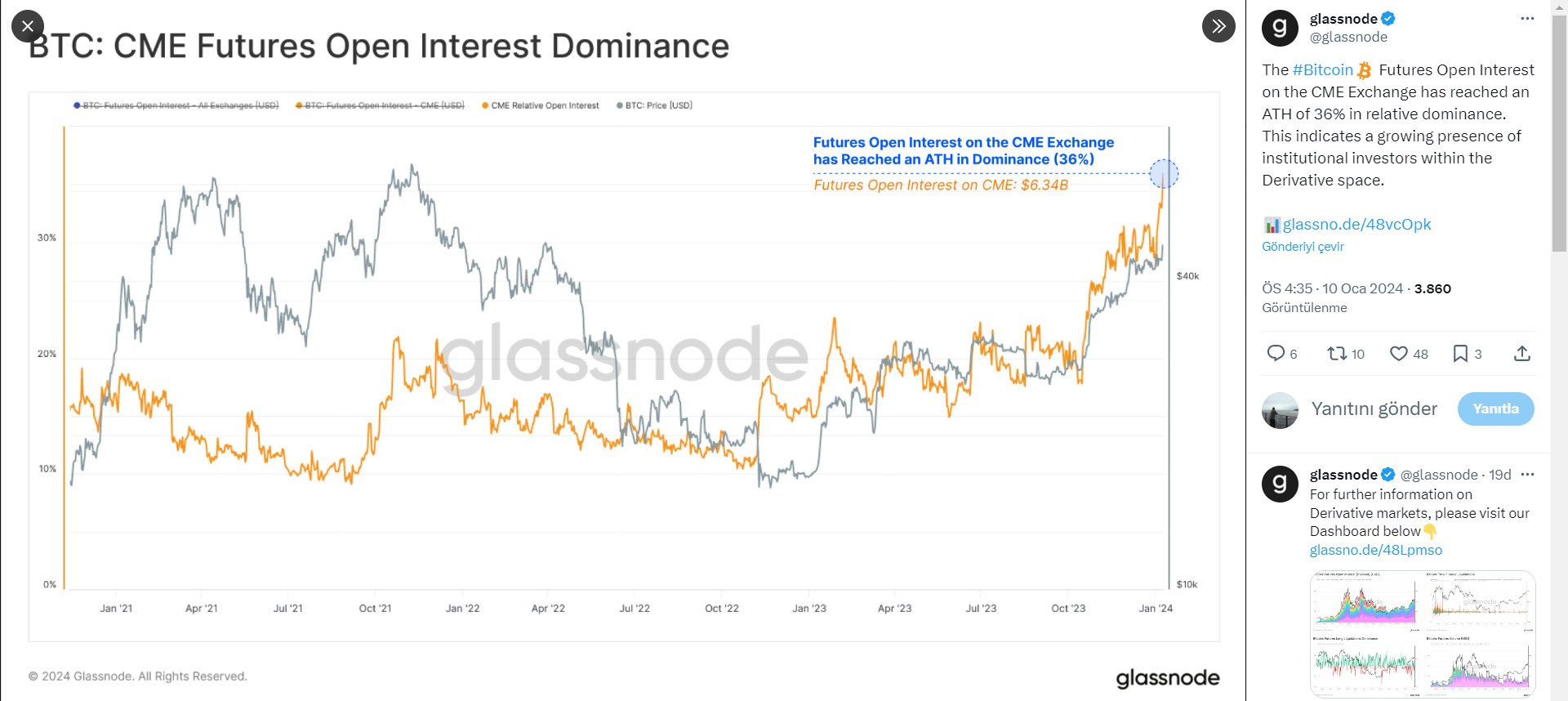

Leading on-chain data analysis provider Glassnode has highlighted the rising open interest in Bitcoin futures at the Chicago Mercantile Exchange (CME). This metric reached an all-time high (ATH) with a notable 36% relative dominance. This milestone underscores the footprint of institutional investors in the cryptocurrency derivatives space.

Increase in Open Positions in the Bitcoin Futures Market

Glassnode’s latest analyses indicate a significant increase in open positions in Bitcoin futures, particularly at the CME Exchange. The metric’s achievement of an all-time high and a 36% relative dominance suggests increased interest and participation from institutional players.

This development marks a very important moment in the maturation of the cryptocurrency market, which continues to be shaped by institutional participation.

Effects of Institutional Presence in Derivative Products

The increase in open positions in Bitcoin futures at the CME Exchange carries profound implications for the cryptocurrency world, especially the derivatives market. Reaching a new peak in open positions indicates an increase in institutional trust and interest in Bitcoin derivatives. Institutional players, often seen as strategic and cautious investors, entering the derivatives space indicates a growing acceptance of these financial instruments.

The increasing relative dominance at the CME Exchange signals the maturation of the cryptocurrency markets. Institutional participation contributes to the overall development and credibility of the market, tending to bring stability and liquidity.

As institutional investors demonstrate their impact on open positions, significant changes in the dynamics of the cryptocurrency derivatives market are likely to occur. This situation can affect trading patterns, volatility levels, and overall market behavior.

Shaping the Future: Institutional Trends in the Crypto Space

Glassnode data showing an increase in open interest in Bitcoin futures serves as a significant indicator of evolving trends in the cryptocurrency space. As institutional players continue to make their presence felt, it becomes increasingly important for market participants to closely monitor these developments.

The future direction of the cryptocurrency market, particularly the derivatives sector, will be significantly shaped by institutional strategies and preferences. Therefore, the indicator cryptocurrencies are laying the groundwork for potential mainstream acceptance.

As more institutions recognize the value and potential of cryptocurrencies, their participation in derivative markets could pave the way for broader adoption of crypto assets and their integration into traditional financial systems.

Türkçe

Türkçe Español

Español