Looking back, the focus of many American political figures had fundamentally been on traditional investment instruments such as stocks and bonds. This situation had also brought along rumors. Some politicians who were found to have made large profits through the stock market faced allegations of insider information.

Today, it is thought that the process is changing. As a notable development, a leading American politician recently made a cryptocurrency investment, indicating a move away from the traditional financial environment.

Politician’s Bitcoin Investment

It emerged that this transaction by the politician occurred just a few days before the US Securities and Exchange Commission’s (SEC) approval of a spot Bitcoin ETF.

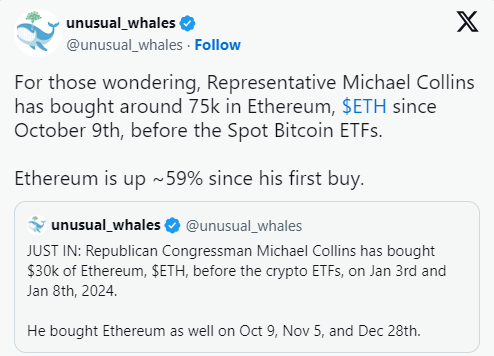

Despite the SEC’s approval of a Bitcoin (BTC) spot ETF last evening, US Representative Michael Collins preferred the king of altcoins, ETH. According to information revealed by the X account, which tracks politicians’ transactions, Collins invested $65,000 in Ethereum (ETH).

According to the information that came to light, Collins made two different Ethereum purchase transactions on January 3 and January 8 of this month. Two days after the last purchase transaction, the SEC approved spot Bitcoin ETFs on January 10.

However, according to the user X, known as Unusual Whales, these were not the first ETHs purchased by Collins. Looking back, it is seen that the representative made three more different ETH purchases. These transactions occurred on October 9, November 5, and December 28 of 2023.

According to user X, the total amount of ETH purchases made by the representative in the past was around $75,000.

The investor seems to have made a profit during this process. Since the first day he purchased Ethereum, there has been a 59% increase in price. What is even more remarkable is that more than 16% of this increase occurred within the last week, during which the price of ETH rose above $2,600.

Is an Ethereum ETF on the Way?

While some maintain expectations for a possible spot BTC ETF, questions arise as to why Collins did not buy Bitcoin, and his determination regarding Ethereum could be interpreted as an investment in the future.

According to Bloomberg’s leading ETF analyst Eric Balchunas, following the SEC’s permission for 11 spot Bitcoin ETFs on January 10, the path for a spot Ethereum ETF has been cleared and could be approved within this year. The analyst believes that the SEC may approve a spot Ethereum ETF by May with a 70% likelihood.

Türkçe

Türkçe Español

Español