Bitcoin experienced a notable increase on January 11, known as ETF Day, coinciding with the opening of Wall Street, and at the time of writing, it continues to trade at the level of $48,468, with a 3.80% increase in the last 24 hours. So, what is expected in the coming period with today’s volume records being broken on the ETF front? Let’s examine together.

The ETF Process and Bitcoin

The United States’ first spot Bitcoin exchange-traded fund (ETF) was approved, focusing the Bitcoin price target on the $50,000 level. Bitcoin continues to trade below this region, but exchange statistics reveal that no one is leaving things to chance behind the scenes.

As noted by Gaah, a contributor to the analysis platform CryptoQuant, even Bitcoin miners have taken their own measures against volatility. The famous analyst made the following statements through X:

“Before the official approval of the Bitcoin Spot ETF product, there was a net inflow of 10,000 Bitcoins into miners’ wallets. After the approval, following the most recent price peak, there was a net outflow of 9,500 Bitcoins from miners’ wallets.”

According to CryptoQuant, this outflow marked the biggest net decrease so far in 2024 and draws attention to the current downward trend in miners’ Bitcoin holdings.

Noteworthy Details on the Bitcoin Front

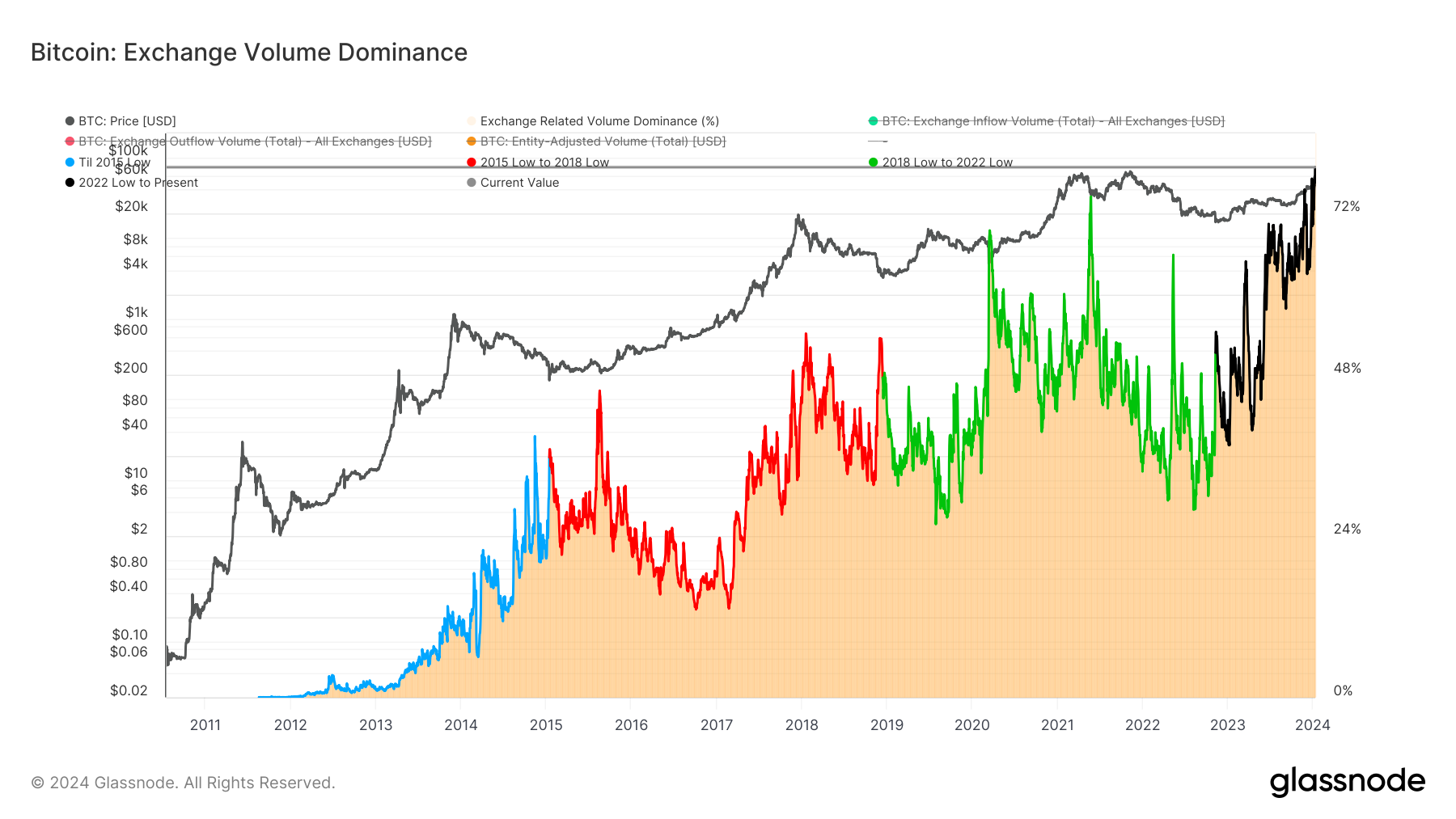

Blockchain data analytics firm Glassnode has pointed out that there is frenzied trading activity among exchange users as a whole. The firm announced that the transaction volume ratio conducted by exchanges on January 10 might have reached a new peak, exceeding 78%. On January 9, this ratio had already reached unusually high levels:

“Exchange activity, with 76.4% of Bitcoin’s on-chain volume entering and exiting exchanges, continues to remain significantly high, just a notable amount below the highest level of 77.4%.”

With these developments, during a period when prices are still volatile, popular commentator British HODL examined the short and long term for bullish signals in Bitcoin’s price. The well-known figure shared the following with his followers through X:

“The fact that the price has not yet moved does not mean it is not priced in.”

British HODL drew attention to the halving event, expected to occur in April, which will reduce the reward paid to miners per block by 50% to 3.125 Bitcoins.