Ethereum’s (ETH) price has recently made a significant surge, drawing attention as it has risen over 16% in just the last 7 days, surpassing $2,500. The momentum of the altcoin king came after the approval of a spot Bitcoin ETF, sparking speculation that spot Ethereum ETFs may soon be approved as well.

Spot ETF Expectations Fuel Market Optimism

The cryptocurrency market is optimistic following the approval of 11 spot Bitcoin ETFs in the United States on January 10, 2024. This development has increased expectations for the approval of spot Ethereum ETFs later in the year. Bloomberg ETF analyst Eric Balchunas increased market enthusiasm by predicting a 70% chance of an Ethereum ETF approval by May.

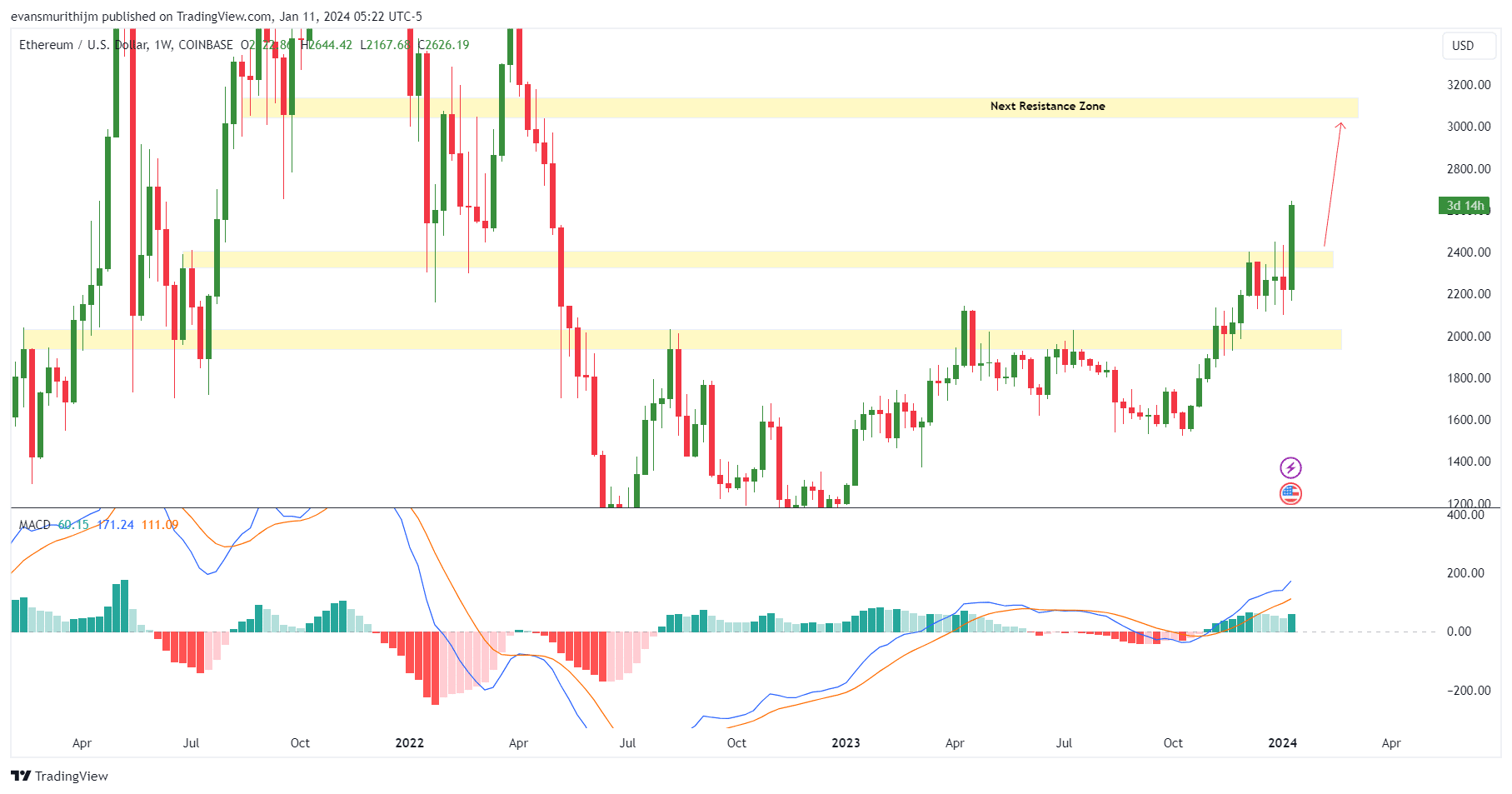

If the bulls maintain their momentum and manage to push Ethereum above the resistance level of $2,700, the path could be cleared for the altcoin king’s price to test $3,000. Sustaining above this level could lay the groundwork for an attempt to surpass the $4,000 resistance in the short term.

On the other hand, if the upward momentum cannot be sustained, a pullback to $2,500 and even down to $2,450 could be expected for Ethereum.

Technical Indicators Point to a Bullish Trend

Ethereum’s market outlook is reinforcing a bullish sentiment. The Moving Average Convergence Divergence (MACD) indicator is showing a rising green histogram, indicating that buying pressure is dominant over selling. The MACD and signal lines are currently above the zero line, which points to bullish pressure. Additionally, the Chaikin Money Flow (CMF) indicator is at a positive 0.42 level, indicating a strong buying trend.

Four-hour technical indicators also support this bullish outlook. The Relative Strength Index (RSI) has crossed into the overbought territory, surpassing the 70 level, indicating strong buying pressure. Furthermore, the 20-day Exponential Moving Average (EMA) is positioned above the 50 EMA, confirming the bullish outlook. The majority of moving averages and oscillators on the four-hour chart indicate buying pressure, suggesting a continued bullish trend for the asset in the short term.

Türkçe

Türkçe Español

Español