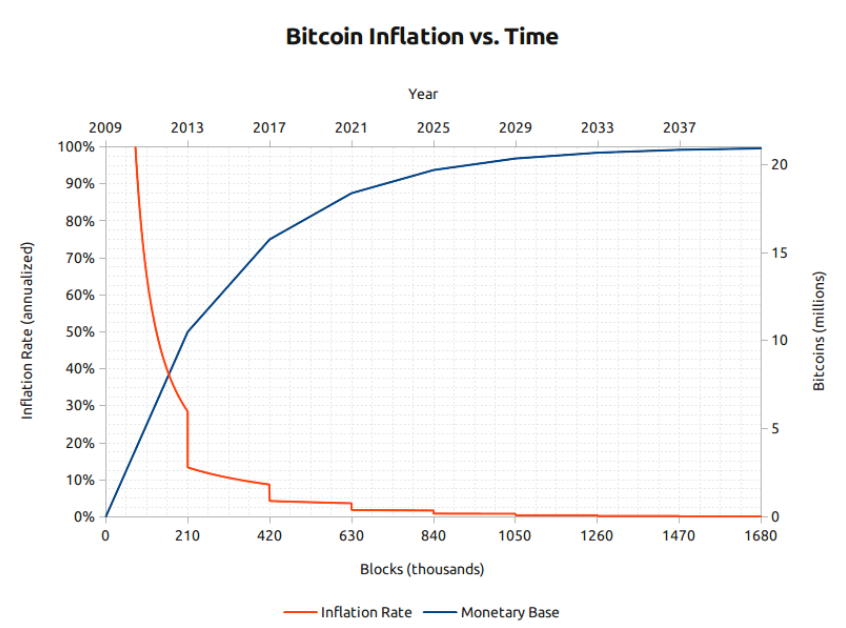

CoinGecko and OKLink teams estimate that the Bitcoin halving event expected in April is drawing closer, with less than 100 days or 14,500 blocks remaining. With the halving event, the block reward given to miners in the Bitcoin ecosystem will decrease from 6.25 Bitcoins to 3.125 Bitcoins. So, what are the details to follow about the halving event? Let’s examine together.

Countdown Begins for the Halving Event

The countdown to the event is based on Bitcoin’s average block creation time of 10 minutes, and the potential date according to analysts is April 22. Bitcoin halving events are programmed to occur automatically every 210,000 blocks, which is roughly every four years.

After this date, miners will receive 50% less Bitcoin reward for each block they verify and add to the blockchain ecosystem. Miners will continue to earn transaction fees per block as usual with this development.

To date, three halving events have occurred in Bitcoin’s history, with the reward dropping from 50 Bitcoins to 25 Bitcoins in the first halving event in 2012. Then in 2016, the reward dropped to 12.5 Bitcoins and in the last halving on May 11, 2020, it dropped to 6.25 Bitcoins. Bitcoin’s total supply is 21 million, and halving events will continue until the last Bitcoin is expected to be mined around the year 2140. After this stage, miners will only generate income from transaction fees.

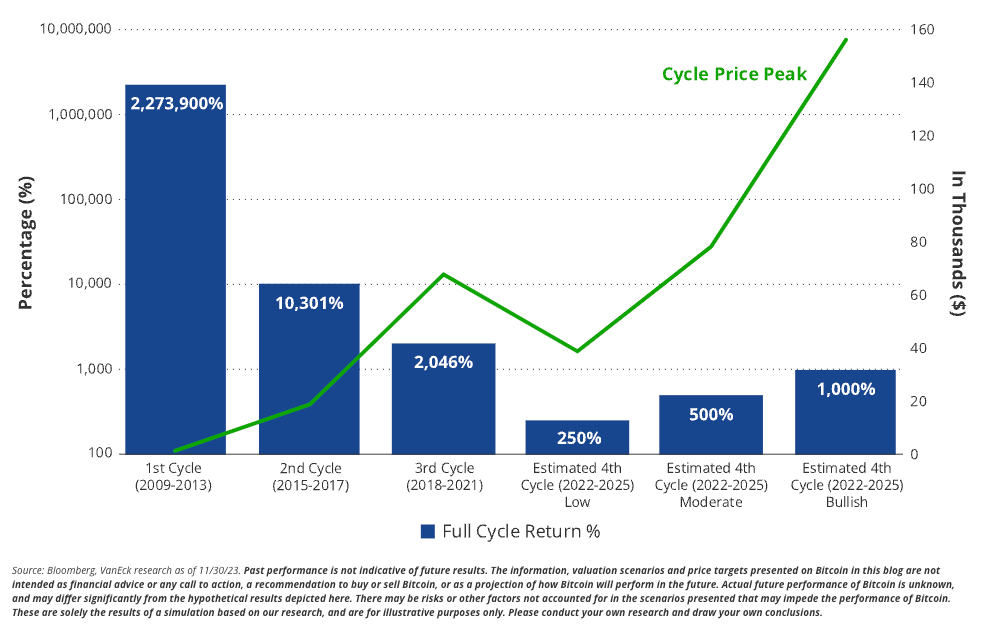

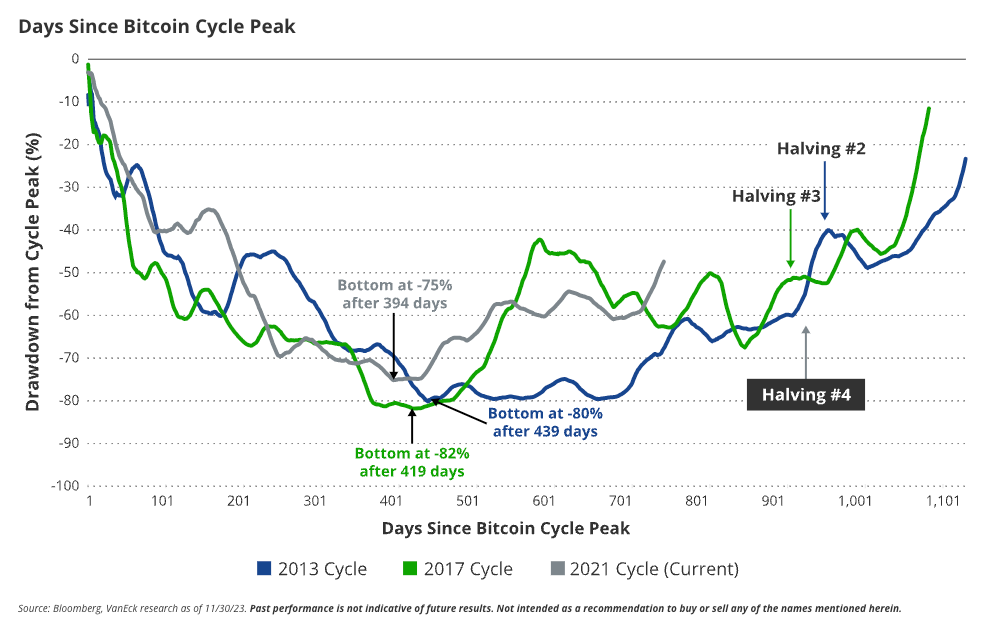

Historically, Bitcoin halving events have been associated with significant price increases in the cryptocurrency. Although there is no direct cause-and-effect relationship, these events usually occurred before major bull runs in the Bitcoin market.

Striking Predictions for Bitcoin

Last month, analysts at VanEck, the issuer of a spot Bitcoin ETF, predicted that following the halving event, Bitcoin’s price would rise above $48,000 and miners would face little difficulty thanks to much better balance sheets, resulting in the event having less impact on the price than expected.

Following these statements, analysts expect Bitcoin to reach an all-time high by November of this year, due to developments related to the US elections, and then to a final cycle peak of up to $160,000:

“Bitcoin, if it reaches $100,000 by December, we are making a long-term call for Satoshi Nakamoto to be selected as Time Magazine’s ‘Person of the Year’.”