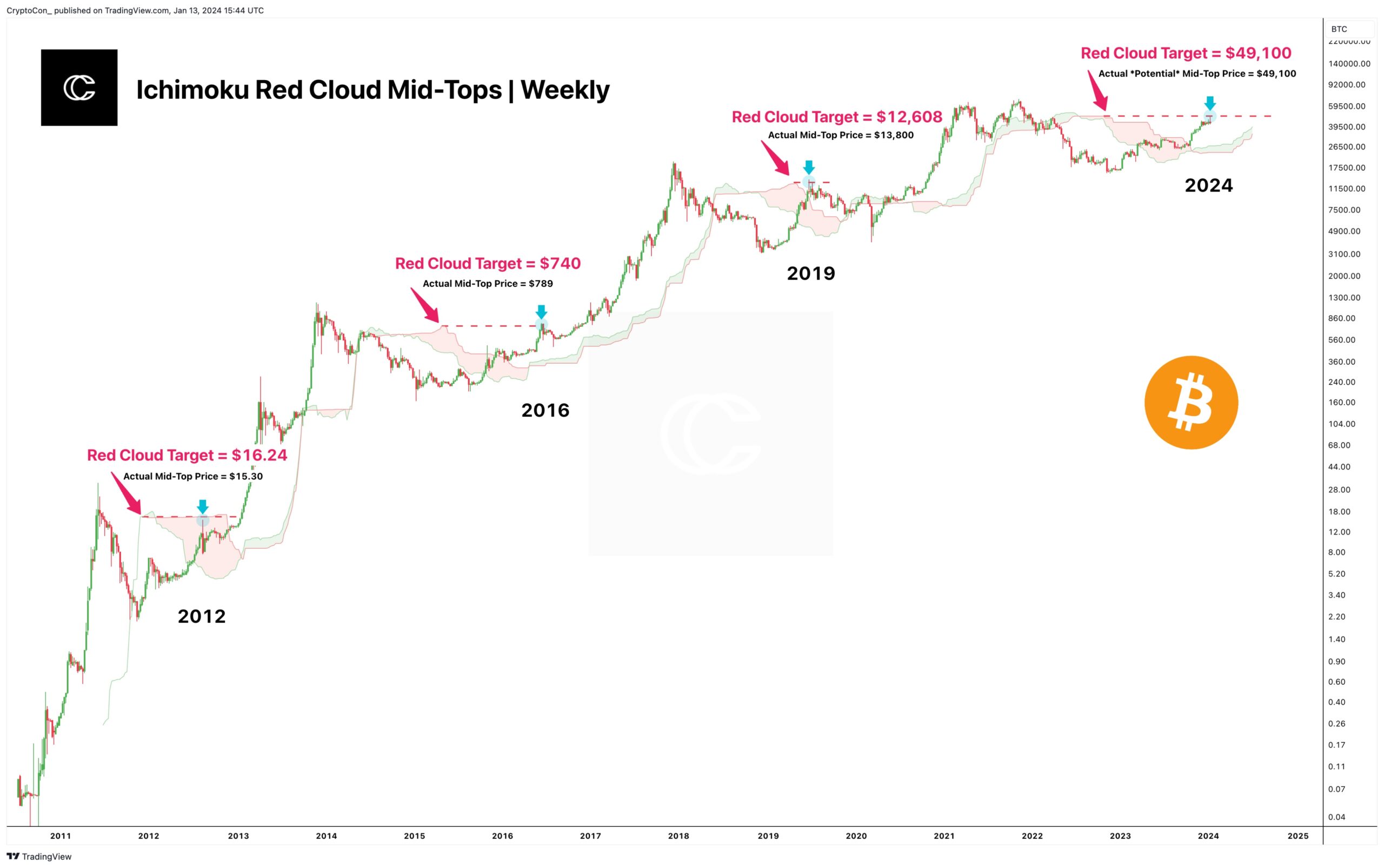

Analyst CryptoCon highlights a crucial moment for Bitcoin touching the $49,000 mark on the weekly Ichimoku chart. The focus narrows to the top of the red cloud, an indicator with notable accuracy in predicting mid-cycle peaks in previous cycles. Although the $49,100 peak is considered a sensitive point, the analyst examines contextual factors surrounding this critical level.

Intersection of Positive News and Price Peaks

The highest level of $49,100 coincided with a significant news event, such as the initiation of ETF trading. Drawing parallels with historical events like the CME futures launch in 2017 and the Coinbase IPO on April 14, 2021, the analyst points out the synchronicity between positive news events and cycle peaks. This observation leads to reflection on market sentiment and patterns of price movements.

Contrary to the belief that ETFs eliminate the possibility of corrections, the analyst challenges this idea by noting that corrections continue even in the presence of ETFs. The narrative that ETF approval would instantly propel Bitcoin to $100,000 is questioned, and the analyst anticipates explanations linking corrections to factors like GBTC sales.

Ultimately, the analyst emphasizes the cyclical nature of market dynamics driven by the recurring interaction of fear and greed. Accordingly, it is not correct to expect BTC to suddenly rise to $100,000. As in previous cycles, this rise requires a certain amount of time.

Navigating Familiar Cycles: Dynamics of Fear and Greed

Analyst CryptoCon underscores the continuity of familiar patterns in the cryptocurrency market by highlighting the enduring impact of fear and greed. Despite optimistic forecasts and technological advancements, the analyst contends that the essence of market behavior remains consistent until clear evidence to the contrary is found.

In the concluding note, the analyst emphasizes that the current market scenario is not significantly different from previous cycles, and the burden of proof lies with the price. As Bitcoin hovers around a critical level like $49,000, investors are advised to stay alert and allow the narrative of price movement to emerge from observing the dynamics.

In summary, CryptoCon’s views offer a perspective on Bitcoin’s recent touchpoint at $49,000, relate it to historical patterns, and highlight the enduring role of market cycles. As the cryptocurrency world continues to evolve, the analyst encourages a nuanced understanding of market dynamics by acknowledging the recurring interplay of fear and greed that defines the crypto journey.

Türkçe

Türkçe Español

Español