The largest cryptocurrency, Bitcoin (BTC), has been under pressure since the launch of spot exchange-traded funds (ETFs) in the US last week. Data tracked by Paris-based crypto research firm Kaiko shows that the selling pressure has been concentrated on Binance, OKX, and Upbit, the largest crypto exchanges by trading volume.

Binance Investors Lead the Bitcoin Sell-Off

Bitcoin, the largest cryptocurrency by market value, is currently trading around $42,700, down 12% from the peak of $48,975 reached on the first trading day of spot ETFs. The price drop is believed to have been triggered by investors starting to take profits from their long (buy) positions in anticipation of the launch of spot ETFs.

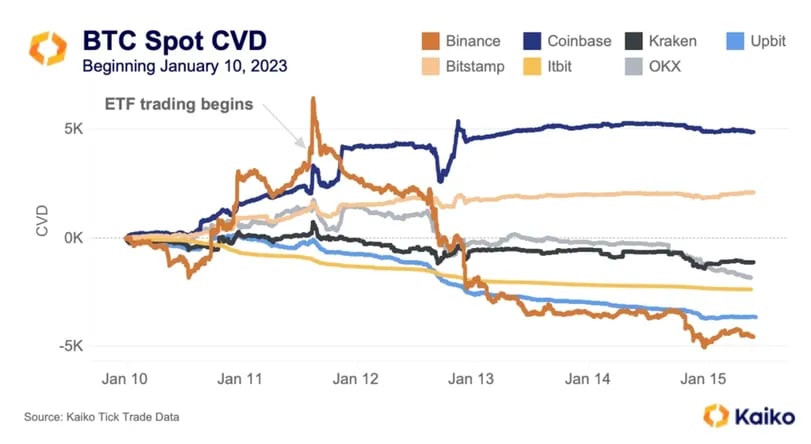

An indicator called Cumulative Volume Delta (CVD) shows that market participants on Binance led the “buy the rumor, sell the news” pullback in Bitcoin. CVD tracks the net difference between buy and sell volumes over time, providing a total of the prevailing bull/bear pressures in the market. A positive value in the indicator suggests excessive buying volume, while a negative value indicates the opposite.

According to Kaiko’s tracked data, Binance’s spot market CVD turned positive on January 13th. Since then, the indicator has continued to decline, showing an outflow of capital equivalent to about 5,000 BTC. South Korea-based crypto exchange Upbit had the second-largest net capital outflow, followed by itBit and OKX exchanges.

After Spot ETFs, CVD Rapidly Shifts from Strong Increase to Negative

In its weekly report published on Monday, Kaiko noted, “ETFs began trading with a strong increase in CVD across all major exchanges last Thursday. Within an hour surrounding the opening of the US trading session, approximately 3,000 BTC were net purchased on Binance, but as some feared, the sell-off news began to take effect, and Binance’s CVD, like OKX’s, quickly turned negative.”

Kaiko also added, “Another institutional exchange, itBit, contributed to the selling pressure despite its lower volume, along with Upbit, and sales were seen with several pullbacks.” On the other hand, the CVD on Coinbase and Bitstamp, which are custodial partners for most of the 11 launched spot ETFs, remained positive, signaling net capital inflows amid price weakness.

According to some analysts, before the pullback slows, Bitcoin’s price could fall to the $40,000 level and below. The initial performance of ETFs remained weak compared to the $4 billion inflow predicted by Bloomberg analysts for just the first day, supporting the possibility of a deeper price drop.