In a recent development, it appears that the Ethereum Foundation has conducted an over-the-counter (OTC) sale of ETH. The sale has already started to be questioned within the cryptocurrency world. The reasons behind this move are not clear. Let’s now examine the details of this transaction and its effects on the foundation’s cryptocurrency assets.

Deciphering the Details of the Ethereum-Centric OTC Transaction

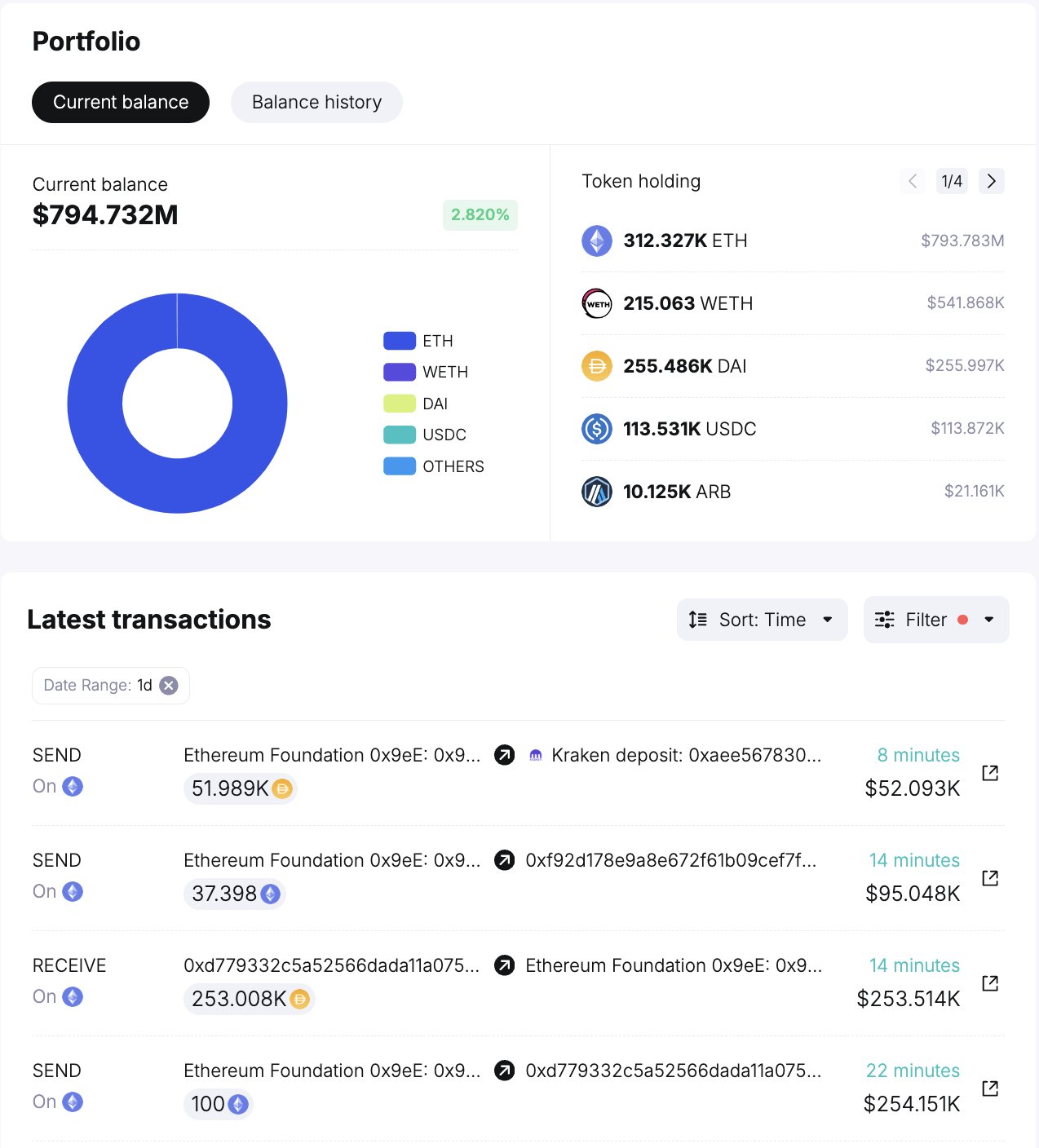

The wallet labeled as “Grant Provider” associated with the Ethereum Foundation is the 0x9ee wallet. This wallet transferred 100 ETH worth $253,000 to the 0xd77 address, marking a significant movement. Subsequently, the same wallet acquired approximately 253,000 DAI about 20 minutes later.

As of this transaction, the Ethereum Foundation is in possession of a significant cryptocurrency portfolio, holding an estimated 312,000 ETH equivalent to $794 million.

OTC Dynamics

Over-the-counter (OTC) transactions play a very important role in the cryptocurrency market, especially for organizations like the Ethereum Foundation that possess significant assets. OTC transactions typically involve direct asset exchanges between parties outside of traditional exchanges. This method provides privacy and reduces the potential impact on market prices that large transactions could have on open exchanges.

The decision to participate in an OTC sale of ETH raises questions about the broader strategy of the Ethereum Foundation. Although the specific motivations behind this particular transaction have not been disclosed, OTC activities are often associated with strategic moves such as liquidity management, risk reduction, and even fundraising efforts.

Navigating Crypto Assets: A Dynamic Landscape

The cryptocurrency assets of large organizations like the Ethereum Foundation are subject to continuous adjustments based on market conditions, strategic goals, and evolving priorities. Understanding these movements provides insight into the foundation’s approach to managing crypto assets in a dynamic and constantly changing environment.

In conclusion, the recent OTC transaction involving the Ethereum Foundation’s wallet reflects a dynamic aspect of managing cryptocurrency assets. The movement of 100 ETH and the corresponding purchase of 253,000 DAI indicate that strategic considerations are at play.

As the cryptocurrency ecosystem continues to evolve, monitoring such transactions becomes increasingly important in deciphering the strategies and priorities of major players like the Ethereum Foundation. With a significant asset like 312,000 ETH in its possession, the foundation’s activities in the crypto market will undoubtedly remain a focal point for industry observers and enthusiasts.

Türkçe

Türkçe Español

Español