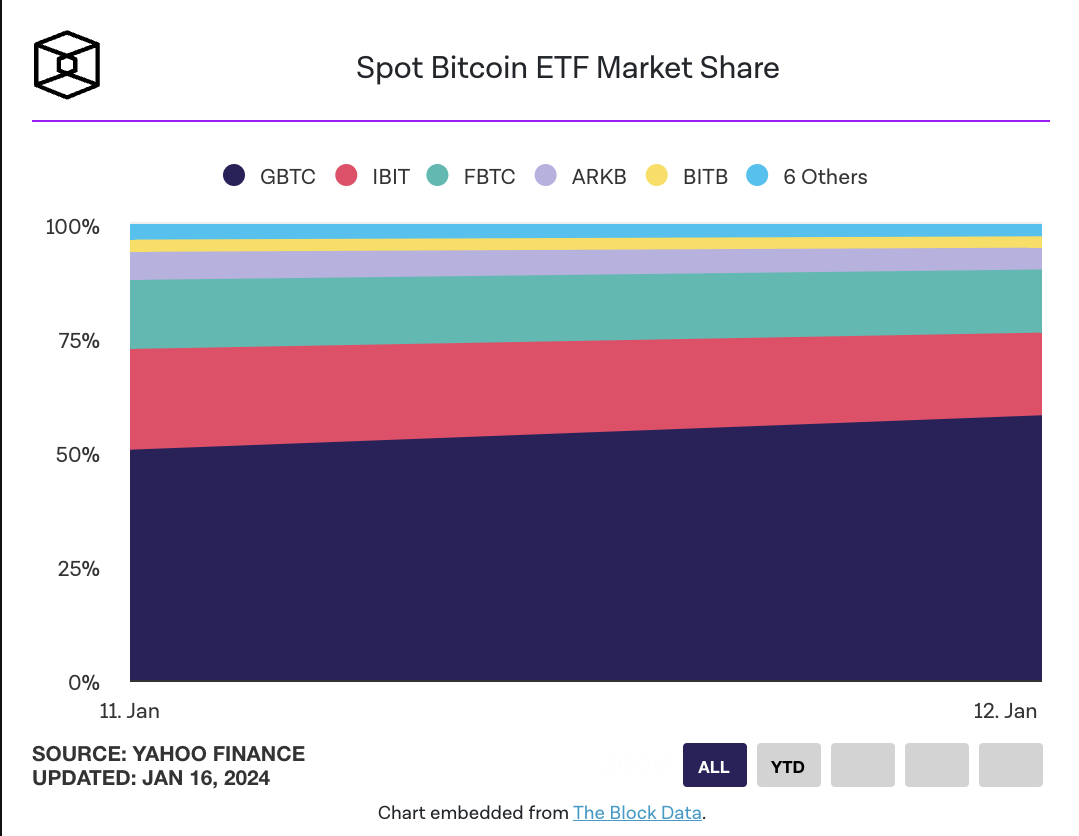

The excitement for spot Bitcoin ETF products continues where it left off. On January 16th, on the third day of ETF trading, Bitcoin ETF products that ranked in the top three in terms of trading volume captured about 90% of the entire market, reaching a position that attracted investors’ attention.

What’s Happening in the ETF Space?

ETF products offered by Grayscale, BlackRock, and Fidelity are currently the clear leaders among the 11 spot Bitcoin ETF products being traded. These new investment tools started trading last week immediately after approval.

According to Yahoo Finance data on spot Bitcoin ETF products, with less than two hours left in the day, the largest three funds accounted for approximately $1.2 billion of the total $1.4 billion trading volume.

Analysts say that the volume on the third day remained well below the $3.1 billion seen on January 12th, but the trend could change with the increases in volume towards the end of the considered period. On the first trading day, January 11th, the total volume was $4.6 billion.

Prominent Analyst Makes Noteworthy Statement

Bloomberg Intelligence senior ETF analyst Eric Balchunas says that although Grayscale is the clear volume leader among new crypto-based products, its flagship GBTC fund, which is being transformed into an ETF, has experienced significant outflows.

According to Balchunas, who shared data on social media platform X on January 16th, Grayscale’s spot Bitcoin ETF product has lost more than $500 million in value since it started trading last week. Balchunas also stated that BlackRock’s ETF product has the highest likelihood of surpassing Grayscale as the Liquidity King.

In contrast, funds offered by BlackRock and Fidelity have seen inflows of over $400 million since they began trading. Balchunas highlighted that trading activities for the new funds have been healthy overall. The cumulative volume seen in the first three days is now over $9 billion.