Significant activity has been detected in a wallet address connected to TRON ecosystem founder and famous cryptocurrency billionaire Justin Sun. On-chain data indicates that Sun has invested over $3.5 million in five altcoins including Chainlink (LINK) and Shiba Inu (SHIB).

Sun Invests $3.5 Million in 5 Altcoins

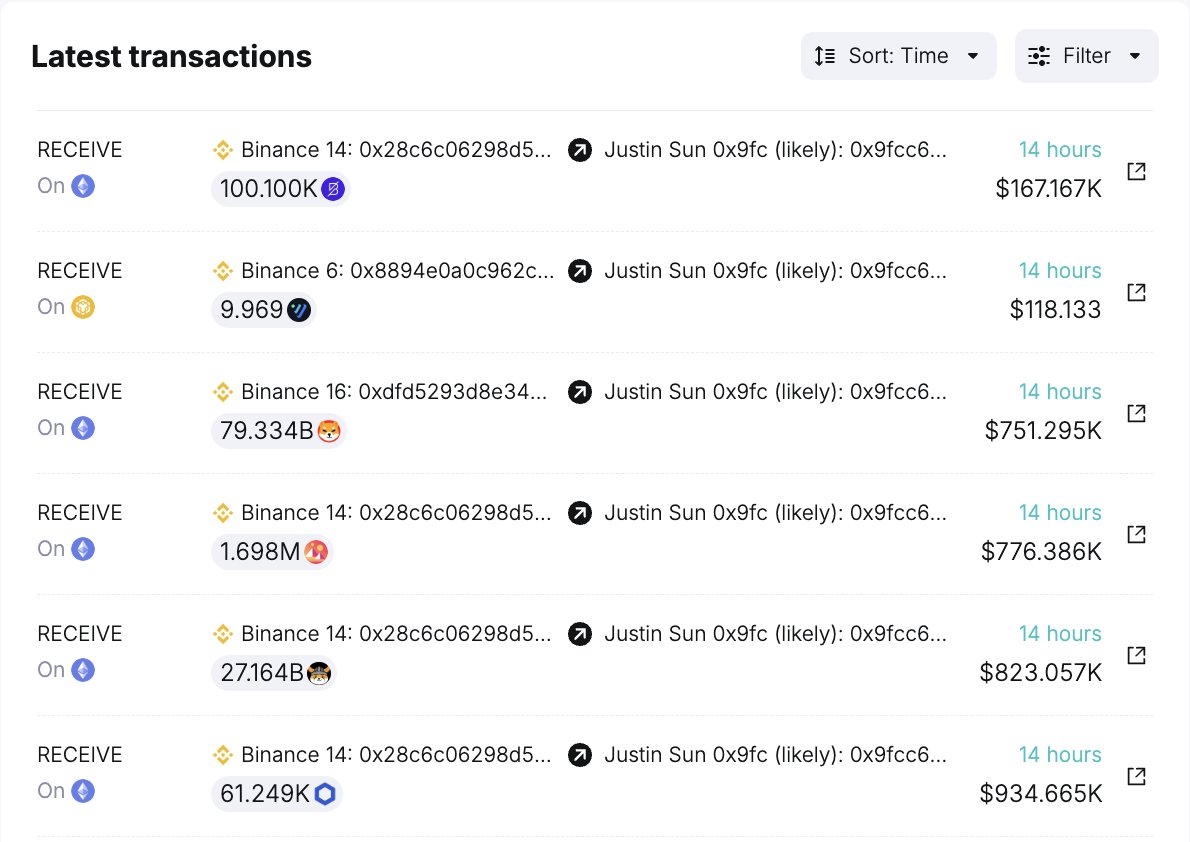

On-chain data provider Spot On Chain reported that a wallet address starting with 0x9fcc… linked to Sun has made a substantial altcoin investment from the cryptocurrency exchange Binance. According to the wallet address data compiled by Spot On Chain, the famous cryptocurrency billionaire invested $3.54 million in LINK, SHIB, Floki Inu (FLOKI), Decentraland (MANA), and Band Protocol (BAND).

The data shows that Sun withdrew altcoins worth $3.54 million from Binance to his personal wallet address about 14 hours ago. Spot On Chain also added that Sun had previously purchased and withdrawn 500 billion SHIB worth $5.22 million from Binance on December 19, 2023.

Sun’s $3.5 Million Altcoin Investment Leads to Speculation

Sun’s recent altcoin investment of over $3.5 million has led to various speculations in the cryptocurrency world. Many suggest that this investment, made during a period when the crypto market is showing weakness, could be highly strategic and a preparation for an expected strong rally.

The current status of the altcoins acquired by the famous cryptocurrency billionaire indicates that all of them may be in a consolidation phase. According to recent data, SHIB has seen a decrease of 0.81% to $0.000009518 in the last 24 hours, while LINK has increased by 4.57% to $15.33 in the same time frame.

Furthermore, FLOKI, MANA, and BAND have changed hands at $0.00003174 (up 2.89%), $0.4588 (up 0.10%), and $1.70 (up 1.07%) respectively in the last 24 hours at the time this article was prepared.

Sun’s investment in multiple altcoins indicates he is practicing “Portfolio Diversification”. This strategy is where investors spread their funds across various assets instead of placing them in a single one. The aim is to reduce risk, with the expectation that if one asset performs poorly, others will compensate with better performance.