The leading cryptocurrency has been going through a period similar to the dull days of last year for the past few days. Let’s hope the outcome is different because after such inactive days, we saw major declines for most of the year. However, there are companies willing to tie their fate to Bitcoin regardless of its price.

Tether and Bitcoin Reserves

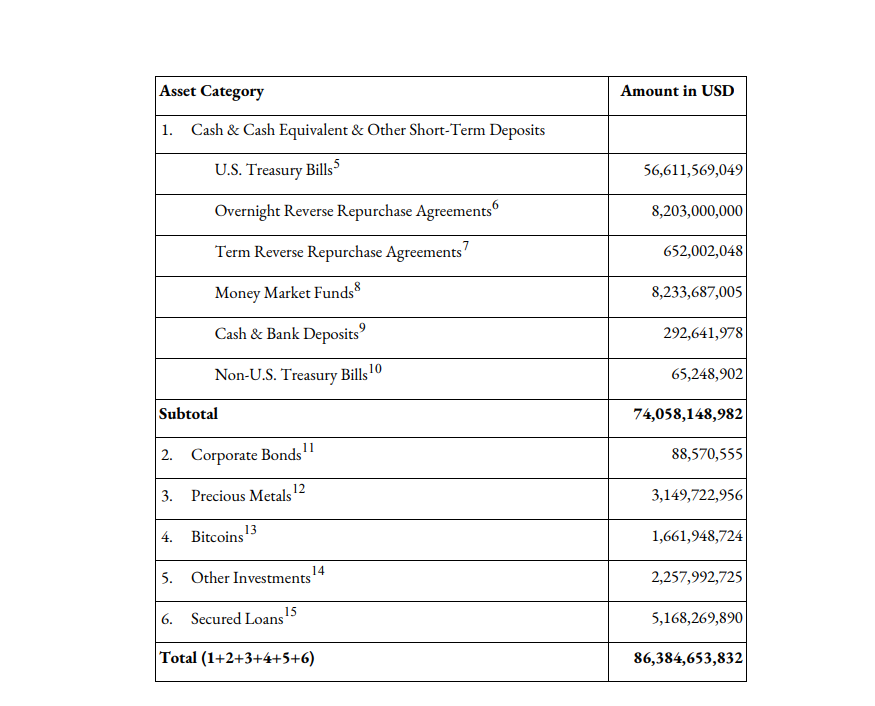

Stablecoin issuer Tether purchased an additional $380 million worth of Bitcoin at the end of the last quarter, raising its total reserves to 66,645 BTC, or $2.8 billion. The initial purchase in September 2022 was worth 33,980 BTC, and since then, the company has consistently accumulated Bitcoin every quarter. In March 2023, the company made its second-largest purchase of 15,915 BTC, and in the last quarter of the previous year, it bought 8,888 BTC, which was the third-largest transaction.

These purchases, revealed in the first audit report of 2023, reflect the company’s belief in Bitcoin. An address identified and verified by Analyst Tom Wan in August of last year tells us that the company is the 11th largest BTC whale.

Risk in BTC Reserves?

Although it sounds great, the story of bolstering reserves with BTC reminds some of what the Terra team did in 2022. Before the company went bankrupt due to a poorly designed peg mechanism, it had significantly convinced the market of an uptrend. However, the situation is different for Tether because the company is using its reserve surplus to purchase BTC.

Tether CEO Paolo Ardoino had said that the company would make purchases of up to 15% of its quarterly profits last year. Tether, the largest stablecoin by market value, has faced many challenges and has managed to get out of them by converting the risk assets in its reserves to safer bonds. Subsequently, it took the necessary steps for audits.

The company has also committed to investing up to half a billion dollars in the Bitcoin mining sector. The company’s audit report for the last quarter is expected to be published next month. Since the BTC address has been disclosed, we know that there has been no new purchase; perhaps we might see some ETFs added in the next quarterly report.