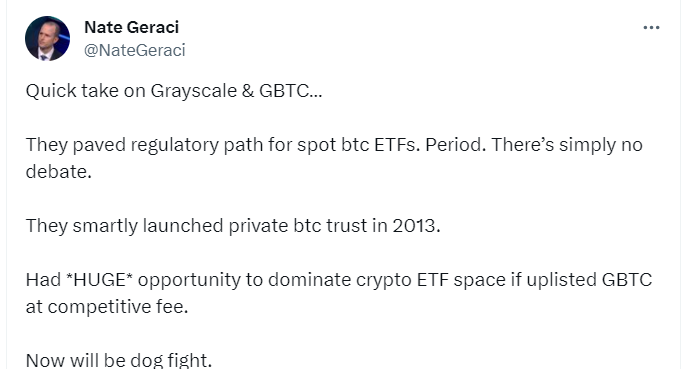

The ETF Institute co-founder Nate Geraci, in a short but effective comment, offers a brief overview of the regulatory environment for Grayscale and GBTC (Grayscale Bitcoin Trust). Geraci’s views shed light on significant moments in the evolving Bitcoin ETF space and missed potential opportunities. Let’s look at Geraci’s assessments.

Grayscale’s Regulatory Effect: Clearing the Path for Spot BTC ETFs

Nate Geraci firmly states that Grayscale and GBTC have played a crucial role in paving the regulatory way for spot Bitcoin ETFs. This claim leaves no room for debate and highlights the instrumental role these organizations have played in shaping the regulatory landscape for cryptocurrency exchange-traded funds.

Geraci emphasizes Grayscale’s strategic move in 2013 by wisely establishing a private Bitcoin Trust. This forward-thinking move positioned Grayscale at the forefront of the evolving crypto environment and laid the groundwork for their future efforts in this area.

Missed Opportunity for Dominance: GBTC’s Competitive Fee Listing

However, Geraci points out a significant missed opportunity for Grayscale and GBTC. Despite their pioneering roles and early entry into the crypto ETF arena, Geraci notes that Grayscale had a notable chance to dominate the space by listing GBTC with competitive fees. But this opportunity seems to have been missed. According to Geraci, the choice not to capitalize on this opportunity will have implications for their positions in the highly competitive crypto ETF market.

An Impending Dogfight

With a succinct expression, Nate Geraci concludes that the current scenario will be a “dogfight.” This term conveys the intense competition and challenges in the Bitcoin ETF space, where players vie for dominance, market share, and investor interest.

As Geraci’s comments suggest, the Bitcoin ETF environment is in flux and holds unanswered questions for the future. The regulatory groundwork laid by Grayscale and GBTC opens doors for further developments, but the missed opportunity to list GBTC at a competitive fee adds an element of uncertainty to their trajectories.

In summary, Nate Geraci’s quick assessment provides a snapshot of the complex dynamics in Grayscale and GBTC’s journey in the Bitcoin ETF arena. From regulatory impact to strategic moves and a missed potential opportunity, the commentary offers a glimpse into the challenges and opportunities shaping the future of these influential organizations. As the Bitcoin ETF space evolves, moving forward on the path ahead will require making strategic decisions and adapting to the competitive landscape.

Türkçe

Türkçe Español

Español