As a result of increasing market volatility, the total liquidation amount in the futures market has exceeded $138 million in the last 24 hours. According to data from the blockchain data analysis platform Coinglass, the majority of these liquidations involve long positions, with losses exceeding $120 million. Short positions accounted for approximately $18 million of the total liquidations.

What’s Happening on the Bitcoin Front?

Bitcoin‘s price has fallen by 1.66% in the last 24 hours, dropping below the $41,000 level. According to Tradingview data, Bitcoin was trading at $40,905 at the time of writing. Since the SEC’s approval of spot Bitcoin ETF applications twelve days ago, the market value of the largest cryptocurrency by market cap has suffered a loss of more than 7%.

After the approvals, Bitcoin’s price managed to rise above the $48,000 level before recording a sharp drop to around $43,000 on January 10th. Now, some analysts predict that the price will fall further below the $40,000 level. BitMEX co-founder and Maelstrom CIO Arthur Hayes warned investors of further downward movement with a price prediction of $35,000:

“Bitcoin looks very heavy. I think we will break the $40,000 level. I took a put option at $35,000 on March 29th in a post.”

A put option is a contract that gives the holder the right to sell the underlying asset at a specified strike price, but not the obligation.

Noteworthy Data on Bitcoin

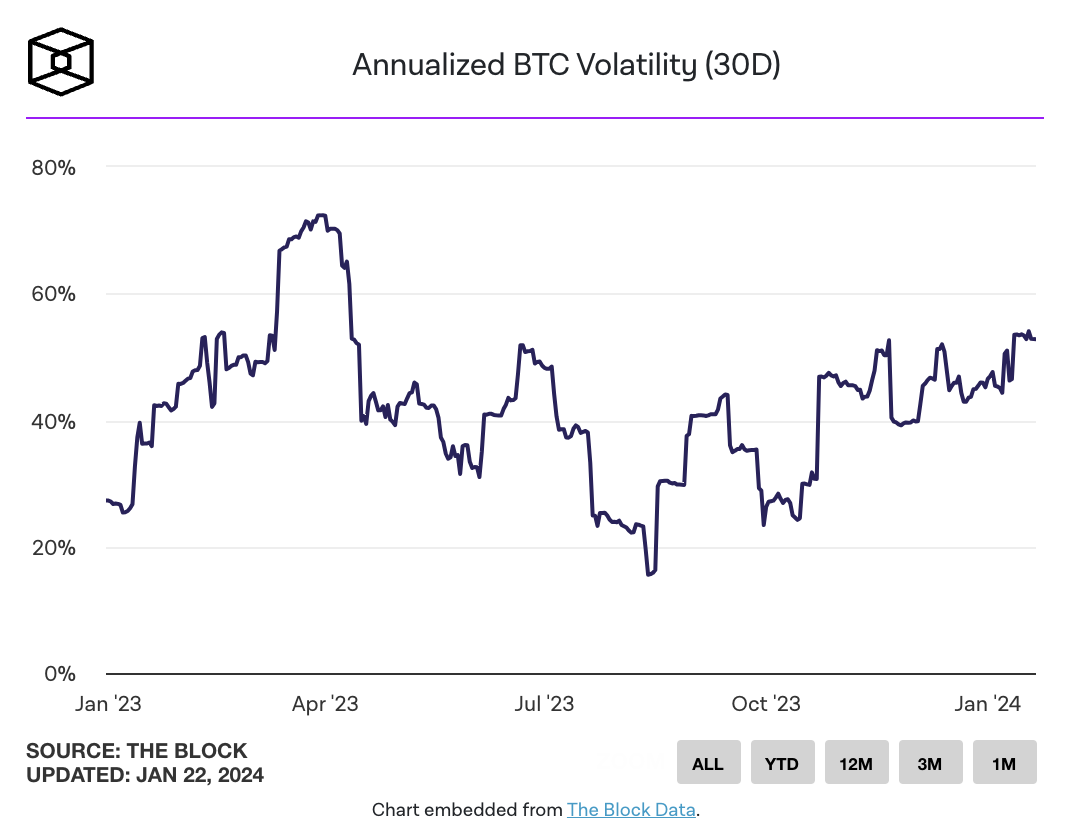

Since the SEC’s approval of spot Bitcoin ETF applications, annual Bitcoin volatility has increased. According to The Block’s Data Dashboard, the annual Bitcoin volatility was around 46% before the approval, but it has now risen above 52%.

The volatility led to the liquidation of approximately $30 million worth of Bitcoin futures positions. Data from Coinglass indicates that the majority of Bitcoin liquidations are from long positions, with over $24 million in Bitcoin long positions being wiped out in the last 24 hours.

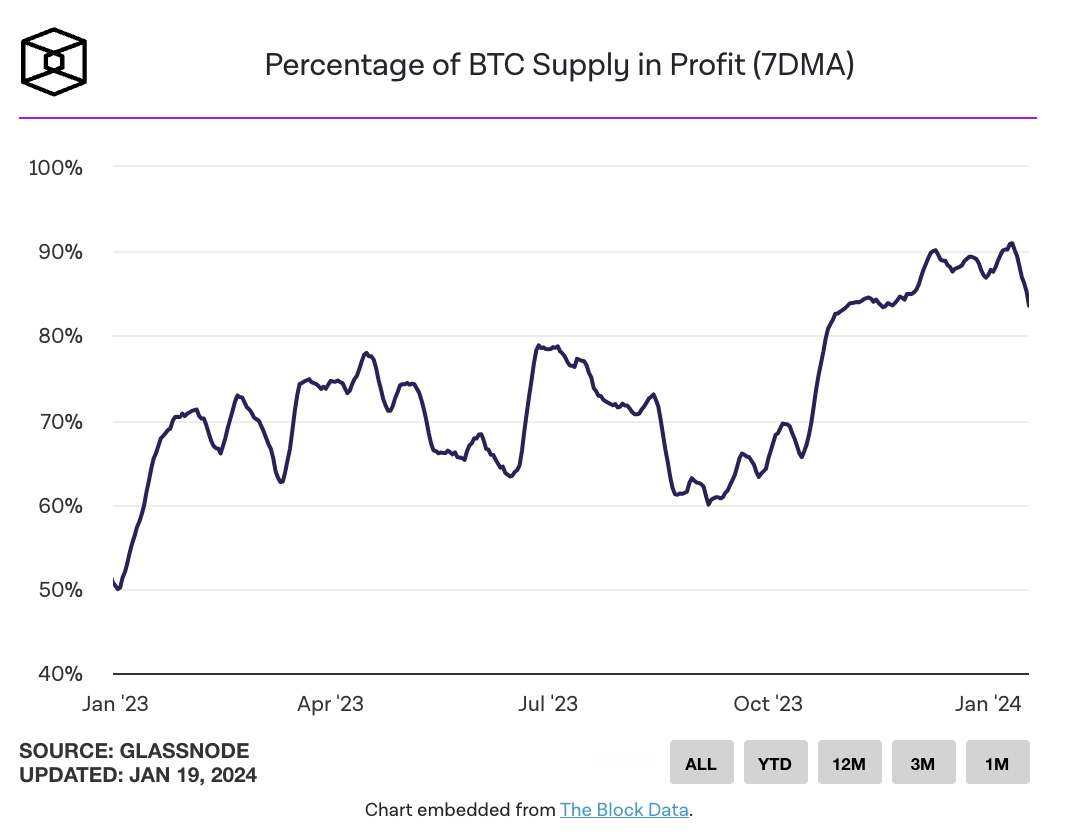

Unrealized profits among Bitcoin holders have dropped from the high levels observed after the launch of spot ETF products on January 11th, which could provide some relief to the increase in selling pressure. According to the data dashboard, the supply of profitable Bitcoin in circulation has dropped from a recent high of 90% to 83%.

Türkçe

Türkçe Español

Español