The king cryptocurrency is currently at $40,600 as a result of the January 12th decline. The sales that came with ETF approval accelerated with Grayscale outflows. Moreover, the new day started with a decline in ETFs. So, what do the experts think, will the Bitcoin decline continue?

Why Is Bitcoin Falling?

Bitcoin is falling due to massive BTC transfers from asset manager Grayscale to the Coinbase exchange. The trust-like GBTC could not be redeemed, which caused its negative/positive premium to fluctuate as the value per share of the total reserve constantly varied. GBTC, which started trading with a negative premium in 2021, faced serious issues.

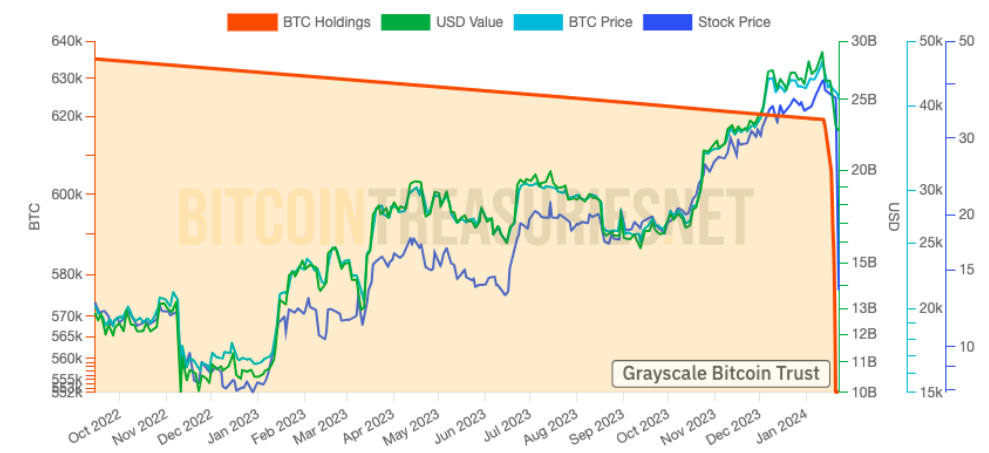

GBTC was sued due to its high annual management fee, and investors lined up to sell when the long-awaited ETF approval came and the negative premium was eliminated. Now, the outflows continue rapidly. The amount of BTC in the company’s reserves has decreased by approximately $5 billion.

These assets are sold to other ETF issuers or investors through OTC by Coinbase. However, the increase in supply for sale still negatively affects market sentiment.

Expert Opinions

Alex Thorn, the research director at crypto investment firm Galaxy, claimed that the total GBTC outflows amounted to $700 million. However, considering that Alameda’s sales alone are thought to be $1 billion, a net outflow of $2 million seems more logical. On the other hand, since the company’s visible BTC reserve dropped by $5 billion, $700 million seems like a weak estimate.

Eric Balchunas from Bloomberg Intelligence warned that the sales coming to the custodian Coinbase in the form of transactions could be too large to be absorbed by other ETF players.

“I can only hope it will be a bit less than this. These could exceed the demand from ETF issuers.”

According to Bitcoin Treasuries’ figures, GBTC still holds more than $20 billion in assets, and the negative premium has dropped below 0.3%. So, in light of all this, what is expected for BTC? Although definite expectations in crypto often do not materialize, there is now a growing expectation among investors for a support test below $40,000.

Material Indicators, which examines the liquidity in the order books, wrote that bids are increasing around the $38,500 region;

“Bitcoin saw very intense movements in the first 1-2 hours after the US Market opened. This is likely due to many of the ETF flows occurring at the start and end of the trading day. I think we will break $40,000 and could see a drop to $35,000.”

Arthur Hayes, the former CEO of BitMEX, was also among those expecting a decline.

Türkçe

Türkçe Español

Español