Bitcoin (BTC), following the widely anticipated spot ETF approval process, fell below $41,000 for the first time in six weeks. So, what is the reason for the decline in the cryptocurrency?

The Grayscale Effect on BTC

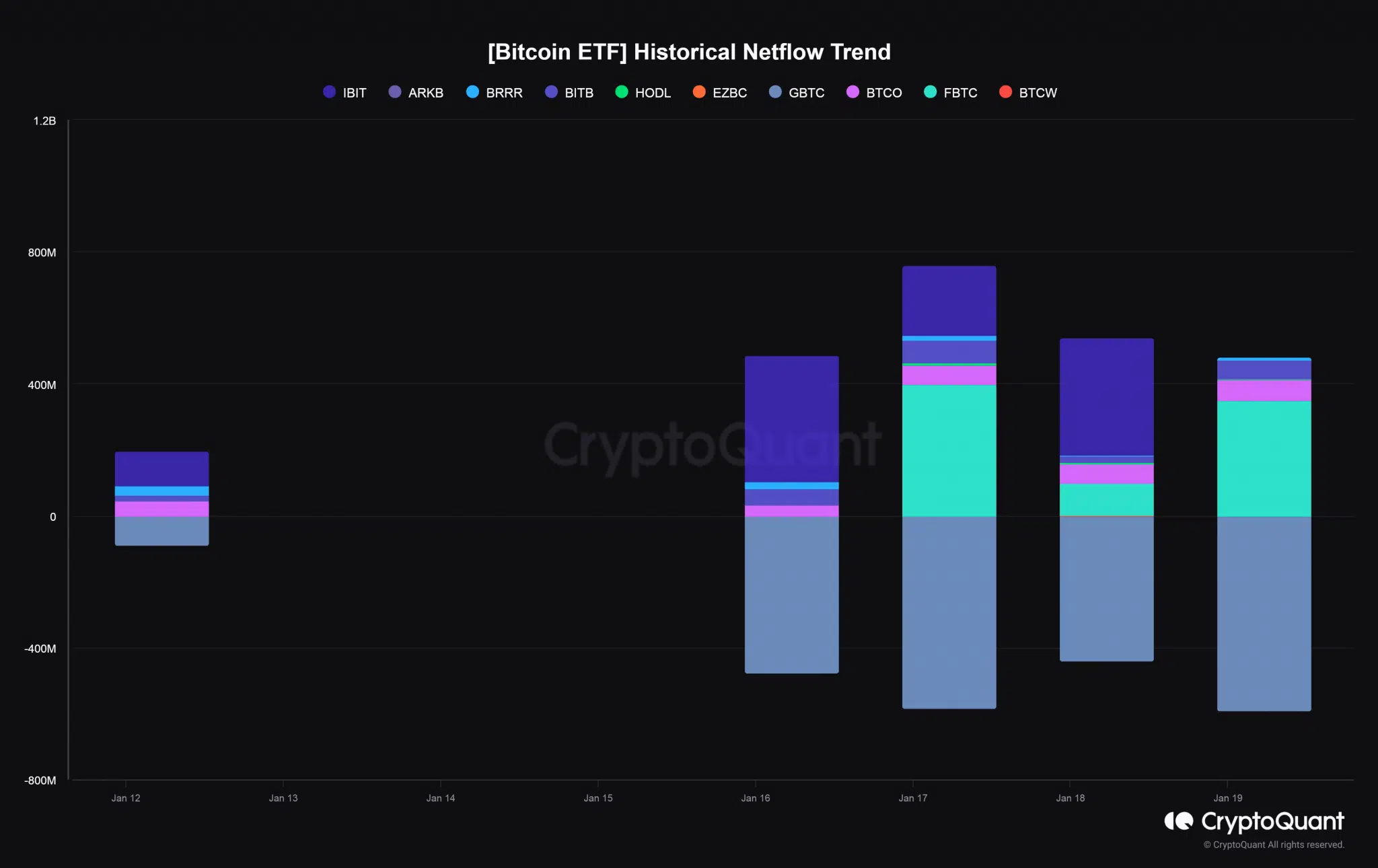

As investors considered the drop an opportunity to buy BTC, the price was pulled down to $40,365 at the time of writing. The transition of the Grayscale Bitcoin Trust (GBTC) to a spot ETF, resulting in billions of dollars worth of Bitcoin outflow, became the main catalyst for the downtrend. Considering that Grayscale holds more than 566,000 Bitcoins, concerns about long-term bearish conditions may still exist. Crypto analyst Chris J Terry stated that the value of the leading cryptocurrency could move sideways or continue to fall until the remaining Bitcoins, worth approximately $25 billion, are completely liquidated:

Grayscale’s decision to keep the ETF yield at 1.5% will go down in history as the biggest strategic mistake in cryptocurrency history.

Furthermore, the management fees demanded by Grayscale were the highest among all ETF issuers, with most approved ETFs charging fees between 0.2% and 0.4%. Grayscale defended its high fees. Grayscale Investments CEO Michael Sonnenshein recently said in an interview with CNBC:

Investors heavily weigh factors such as liquidity, past performance, and the identity of the actual issuer behind the product. Grayscale is a crypto expert. And indeed, it paved the way for the emergence of most of these products.

Expert Opinion on Bitcoin

However, there are opposing views to the narrative that all GBTC tokens will be sold. It may be noteworthy that Mike Novogratz, CEO of Galaxy Digital, disagrees with Terry’s claims. Mike Novogartz stated:

While I think people will sell GBTC, I believe most will switch to other ETFs. This indigestion will end, and BTC will rise even higher in 6 months.

However, using data from CryptoQuant, the expert determined that net inflows into other ETFs were less than outflows from GBTC at the time of writing. Time will show how Bitcoin will overcome the downward pressure in the short and near term. However, a capital inflow worth billions of dollars can be expected in the long run.