After the SEC gave the green light to eleven spot Bitcoin ETFs on January 10th, Bitcoin faced selling pressure and its price fell by 20%. As a result, the price of BTC retracted to as low as $38,500 earlier this week. Although the selling pressure continues, it is observed that Bitcoin whales consider every dip as a buying opportunity and are purchasing.

Bitcoin Whales Are Buying at the Bottom

Experienced cryptocurrency analyst Ali Martinez reported a surprising trend among Bitcoin whales who are not showing signs of slowing down amid the ongoing market correction. Accordingly, Bitcoin whales are actively engaged in accumulating BTC.

Martinez highlighted a significant development in the cryptocurrency world, pointing out the increase in the number of major players in the Bitcoin market. According to the analyst’s analysis, there are currently 46 new Bitcoin whales, each holding a thousand BTC or more. This corresponds to a significant 3% increase in the number of high-volume Bitcoin whales in just the last two weeks. Martinez’s analysis offers valuable observations about the power display of Bitcoin whales during the current period of uncertainty affecting the market as a whole.

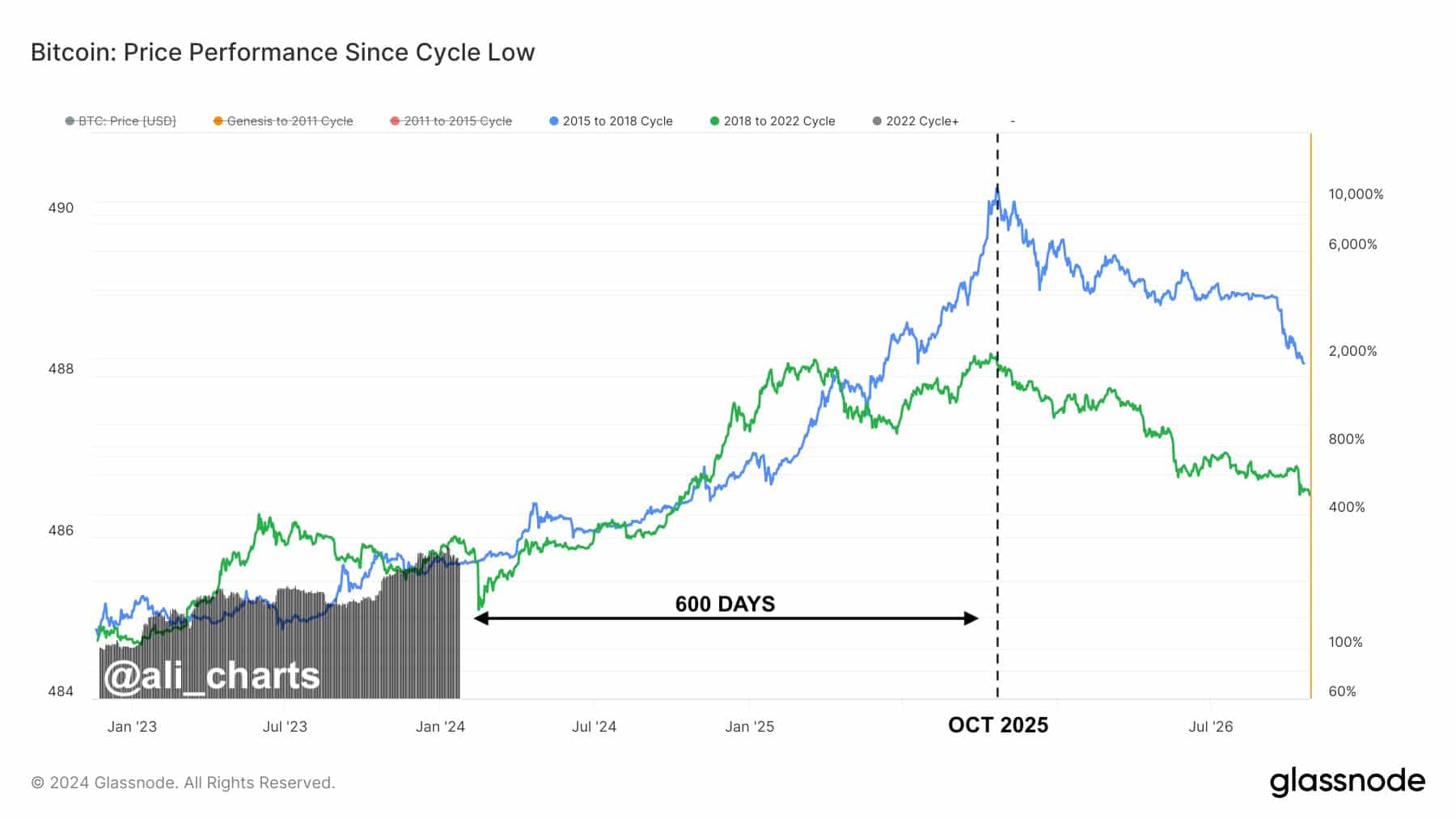

Furthermore, by examining past data, the analyst drew parallels between the Bitcoin bull runs that occurred particularly between 2015-2018 and 2018-2022. Martinez’s analysis suggests that if the current market trajectory reflects these past patterns from their respective market bottoms, predictions indicate that the next market peak for Bitcoin could be seen around October 2025. According to Martinez’s analysis, this intriguing prediction means that BTC could still have about 600 days of upward momentum ahead.

High Interest in Spot Bitcoin ETFs

On the other hand, there is a high interest in spot Bitcoin ETFs in the US, resulting in significant inflows. BlackRock’s spot Bitcoin ETF (IBIT) reached approximately $4.2 billion in inflows after its launch. Rachel Aguirre, Head of iShares Products at BlackRock in the US, said in an interview with Yahoo Finance regarding the success of the IBIT ETF shortly after it started trading:

In the first two weeks of trading, there was a significant increase in the trading volume of the IBIT ETF, reaching $3 billion. This demonstrates the rapid and effective presence of our ETF in the market. Strong inflows show that there is a high appetite among investors for crypto-related investment products. Therefore, the ETF launch could be a cornerstone for a long-term BTC price rally.