Cryptocurrency markets might not have experienced significant volatility following the latest speech by Powell, but it contained important details. We expected to receive signals about the interest rate path for the rest of the year at this meeting, and we saw some early warnings. So, what is the most important detail we should pay attention to in the statements made by Powell?

Powell and Cryptocurrencies

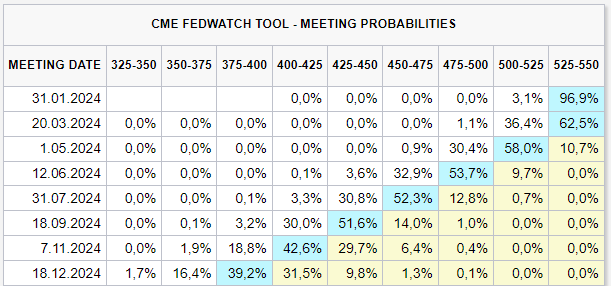

Federal Reserve Chairman Powell has just concluded his speech, addressing significant details about the economic outlook and interest rates. We shared these updates with you live. As expected, the Fed kept interest rates steady, but the expectations for a cut in March have significantly weakened. As we mentioned hours ago, the first cut this year should be in May.

On average, 9 months after announcing the interest rate ceiling, the Fed will start cutting rates as late as possible, considering the sticky inflation risk in the current challenging economic environment, which indicates a possible 25 basis points cut in May.

Following the Fed’s announcements, market expectations have shifted towards May. BTC fell below $43,000 again, but volatility is expected to continue increasing.

Critical Details

Powell confirmed that the policy interest rate is at its peak and that there will be a cut this year. If the economy doesn’t surprise us, there will be a 75 basis point cut. However, he already signaled that if particularly bad data comes from the PCE side, the cut could be missed in May as well. He will specifically emphasize this at the March meeting.

Powell, addressing the risk of a delayed interest rate cut for the first time, is now preparing the markets for a cut. The focus should be on “employment.” Powell mentioned that if they see a relaxation in employment, they might cut rates earlier. On Friday, February 2, new employment data will be released, and surprise figures could increase volatility.

Reminding us that there is a long way to go for a soft landing, Powell said that the decline in inflation will not be limited to 6-month data and will continue. Based on the discussions at the last meeting, I can say that they will not cut interest rates in March, and as expected today, the Fed Chairman started to take out the froth in the market.

From now on, investors following risk markets will focus on employment data and continue to monitor the expected decline in inflation.

Türkçe

Türkçe Español

Español