In the final months of last year, one of the altcoins that caught attention was Chainlink (LINK), which perhaps triggered a mini rally with its rise. LINK posted a fantastic performance last week with a 24% gain.

Comments on Chainlink (LINK)

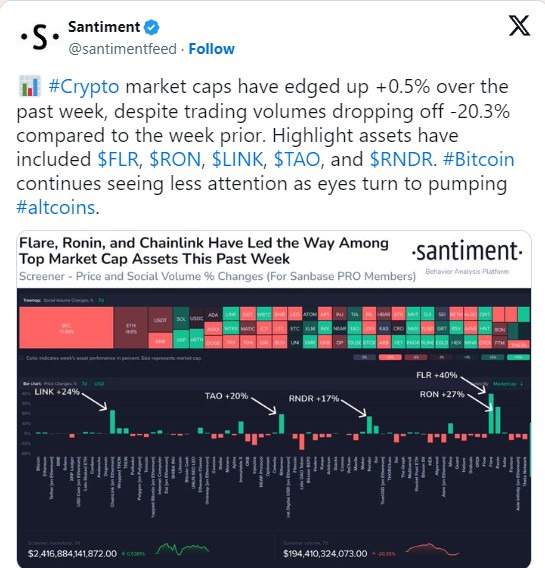

According to a post by Santiment on X (formerly known as Twitter), the social interaction rate appeared to be on the rise for some altcoins, and LINK was among them. LINK had been trading between $12.85 and $16.6 since November 17, but things changed.

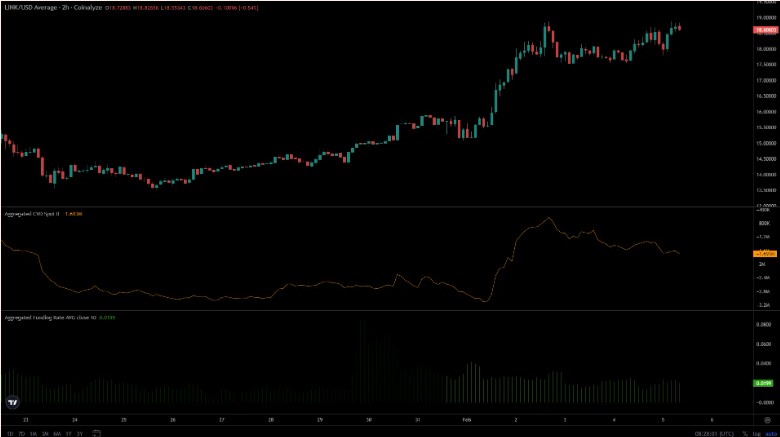

When the dates showed February 1st, LINK bulls triggered a daily close above $16.6, paving the way for an upward breakout.

On the other hand, analysis of data from the famous analytics firm Santiment showed that opinions about LINK on social media platforms were trending positive. This positive atmosphere was reinforced by a clear increase in Open Interest in the Futures market.

This situation presented a sharp rise in appearance but also brought some potential issues and warnings. According to an announcement by Santiment on X (formerly known as Twitter), the trading volume in the crypto market decreased by 20.3% compared to the previous week.

Bitcoin (BTC) seemed to encounter resistance between the $43,000 and $44,000 region, and as a result, a pullback could occur in the market after a potential reversal from this point. The Santiment graph above showed a decrease in both development activity and the average age of cryptocurrencies.

The decrease in development activities was one of the most significant drops seen in the last six months, raising concerns among investors. Despite prices overcoming the resistance at $16.6, the decrease in the average age of cryptocurrencies could indicate that investors are selling to realize profits.

When combined with the increase in Open Interest (OI), the surge towards $18.88 in the spot market could be driven by rumors aside from actual demand.

Will Chainlink (LINK) Price Drop?

Analysis of traders’ behavior in spot markets by Coinalyze provided investors with different perspectives. Spot CVD showed a downward trend after a significant jump on February 1st.

On the other hand, the LINK price continued to rise along with OI. During this period, the Funding Rate remained positive, indicating a short-term upward trend. While all this was happening, the LINK price was trading just below $19, with an increase of over 2% at $18.95.

The only obstacle seen in daily and monthly reviews for LINK is at the $20 level, and if it is surpassed, no significant resistance is seen before $25. Nevertheless, a pullback to the support level of $16.6 could occur, and investors may consider this drop as a potential buying opportunity.

Türkçe

Türkçe Español

Español