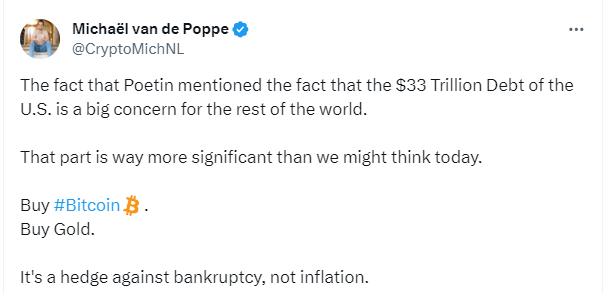

In today’s interconnected global economy, the words of world leaders carry significant weight. When Vladimir Putin drew attention to the United States’ $33 trillion debt burden, he underscored a critical concern that resonated far beyond national borders. Amidst the hustle and bustle of daily life, it can be easy to overlook the seriousness of Putin’s statement. Yet beneath Putin’s words lies a sharp reminder of the fragility of economic stability. As Michael van de Poppe has noted, this observation is not one to be taken lightly.

Navigating Uncertain Waters: Strategies for Asset Protection

“Buy Bitcoin. Buy gold.” Van de Poppe’s succinct directives summarize a proactive approach to protecting oneself against the potential consequences of economic turmoil. While the allure of traditional investments continues, recognizing the distinct advantages offered by cryptocurrencies like Bitcoin and time-tested commodities like gold is crucial. That’s why we say Putin spoke, but the voice came from Bitcoin. Because BTC today has surpassed the $48,000 mark.

In an era marked by financial uncertainty, these assets become more than just financial instruments; they are real lifelines in a sea of volatility. Contrary to popular belief, the value of these assets lies not only in their protection against inflation but more importantly, in their ability to serve as a shield against the specter of bankruptcy.

As economic landscapes continue to change and develop, heeding the wisdom of experienced figures like van de Poppe becomes increasingly imperative. Investors can position themselves not just to survive but to thrive in the face of adversity by diversifying their portfolios to include assets that can weather the storm.

Strengthening Financial Resilience: Embracing Bitcoin and the Paradigm Shift

In a world where uncertainty reigns, complacency is a luxury few can afford. As Michael van de Poppe cleverly reminds us, the time to act may be now. Whether through strategic investments in Bitcoin, gold, or other alternative assets, individuals have the power to strengthen their financial futures in an uncertain environment.

Putin‘s cautionary words are essentially a call to action, a signal for those who wish to chart a course towards financial resilience. As the global economy teeters on the brink of instability, the decisions we make today will have the power to shape our tomorrows.

In conclusion, while the United States’ $33 trillion debt burden may seem immense on the world stage, let us note that it is not an insurmountable barrier. Investors who are foresighted and guided by the views of experts like Michael van de Poppe can navigate these turbulent waters with confidence, knowing they have taken proactive steps to protect their assets and secure their financial futures.

Türkçe

Türkçe Español

Español