A one-month trading session has concluded, and the report card for spot Bitcoin ETFs is now available. Things seem to be going quite well. As we can see from the ongoing recovery in the Bitcoin price, the panic in the markets has been alleviated. The stabilization of Spot Bitcoin ETF performance has played a significant role in this.

Spot Bitcoin ETFs and the Future of Cryptocurrency

ETFs were discussed as not triggering the usual “sell the news” events before, during, and after approval. Even though we experienced a speculative drop due to a $5 billion spot sale surprise in a single day, the Bitcoin price soon returned to the levels of this time last month.

This recovery happened despite negative U.S. financial data, strong employment figures, and shattered expectations of an early interest rate cut. The future of cryptocurrencies will be significantly shaped by the inflows brought by spot Bitcoin ETFs. We will even see days when volatility decreases with deepened liquidity as net inflows reach more serious levels.

Of course, these are predictions for the future from today’s perspective. However, recent conclusive data is convincing experts to adopt such projections.

Surpassing $10 Billion

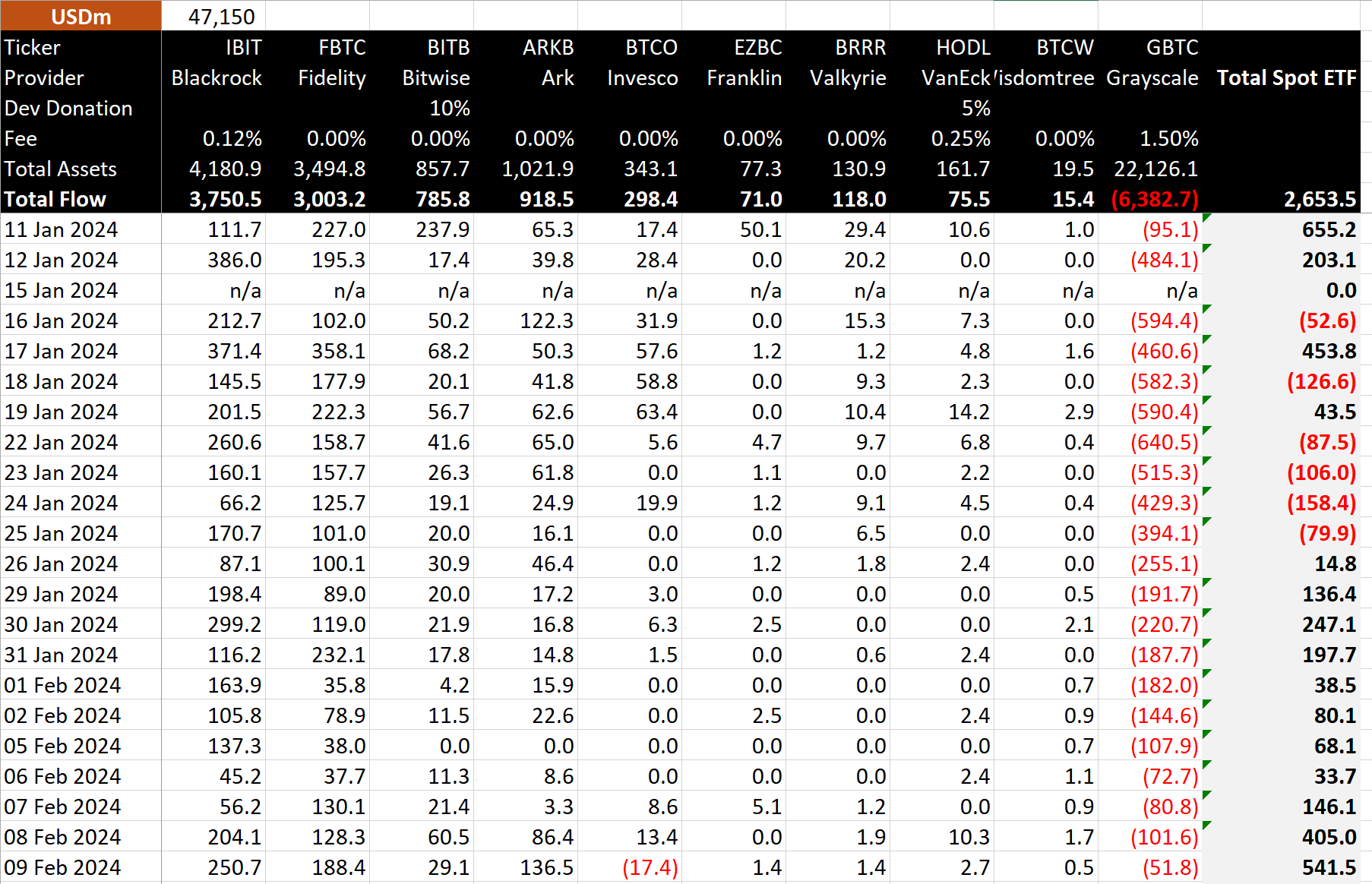

According to BitMEX Research, as of the last trading day’s close, BlackRock held $4 billion and Fidelity held $3.4 billion in BTC. The reserves of just these two alone approached $8 billion. ARK 21Shares’ fund also reached the billion-dollar milestone, holding approximately $1 billion in Bitcoin in its portfolio. In summary, excluding GBTC, the total reserves of ETFs that started from scratch have surpassed the $10 billion threshold.

GBTC funds, which saw an outflow of $6.3 billion in 30 days, only experienced an outflow of $51.8 million on the last trading day. This figure is extremely significant because, in the early days, as BTC was melting, outflows were over 10 times higher, around $600 million.

Bloomberg analyst Eric Balchunas was surprised by the current situation and mentioned that the slowdown in GBTC outflows, coupled with the strong inflows into other ETFs, is very positive. It was thought that GBTC investors had been transitioning to other ETFs for a long time, representing a significant portion of the volume, but the latest data suggests that cumulative net inflows could quickly increase.

Türkçe

Türkçe Español

Español