Crypto currency continues to stay relevant in the DeFi space and is also continuing its development. According to DefiLlama data, the total locked value of the Ethereum restaking protocol based on EigenLayer has risen to $3.162 billion. Significant protocols in this area have reached impactful figures in total locked value. Let’s look into the details.

Extraordinary Growth Centered on Ethereum

EigenLayer reaching a locked value of $3.162 billion is indicative of the growing interest in this sector. Following EigenLayer, protocols with significant amounts of TVL include:

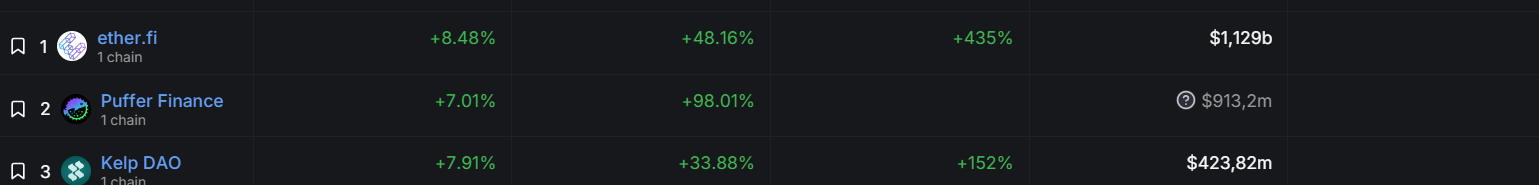

- ether.fi: Has reached a total locked value of $1.129 billion, drawing attention in the DeFi space with a monthly growth rate of 435%.

- Puffer Finance: Despite being launched less than 15 days ago, the protocol has reached a TVL of $913 million and is widely discussed in the crypto currency space.

- Kelp DAO: With a total locked value of $423 million, the protocol maintains its position with an impressive monthly growth rate of 152%.

The increase in total locked value signals strong interest and adoption of Ethereum restaking protocols. Moreover, it indicates a dynamic shift in the DeFi environment. The meteoric rise of Ether.fi, supported by an impressive growth rate of 442%, is noteworthy as it shows new players are entering the DeFi field.

Similarly, the rapid ascent of Puffer Finance in a short time is notable. As excitement in the crypto currency space increases, such protocols may attract more value. On the other hand, the growth in Kelp DAO highlights the agility and appeal of newcomers in capturing market share. Kelp DAO’s growth could indicate that crypto currency investors are in search of alternatives.

What Can Be Said About the DeFi Ecosystem?

Ethereum restaking protocols experiencing rapid growth can be seen as a testament to Ethereum’s place within the DeFi ecosystem. This situation is also significant for the future of Ethereum. As a major player in the DeFi space, Ethereum’s price could be influenced by such developments.

The increases in the mentioned protocols could be explained by an appetite for passive income in the crypto currency space. As known, recent price increases continue to attract investors to this area. This not only shows investor appetite but also indicates that competition in the DeFi space is quite intense.

Lastly, the possibility of the US Federal Reserve cutting interest rates this year could also contribute to the prominence of DeFi protocols and enable investors to earn more passive income from this area.

Türkçe

Türkçe Español

Español