Crypto intelligence firm Coin Metrics has conducted significant research. Their latest study indicates that the exorbitant costs involved now make it financially impractical for nation-states to carry out a 51% attack on Bitcoin (BTC) and Ethereum (ETH) networks.

Nation-States Bound by High Costs in Bitcoin and Ethereum Affairs

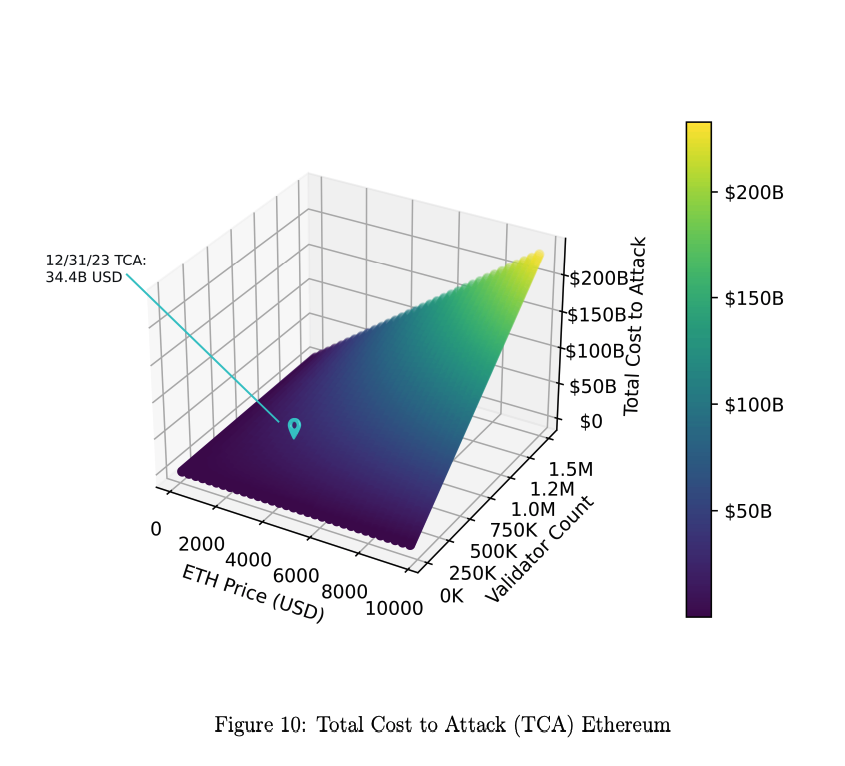

Coin Metrics researchers Lucas Nuzzi, Kyle Waters, and Matias Andrade, in their report dated February 15, introduced a new metric called “Total Cost of Attack” (TCA) to measure the cost of executing a 51% attack on a blockchain network. Using this metric, the researchers concluded that the current capital costs and operational expenses make it unprofitable for nation-states or other malicious actors to carry out such attacks on the Bitcoin or Ethereum network.

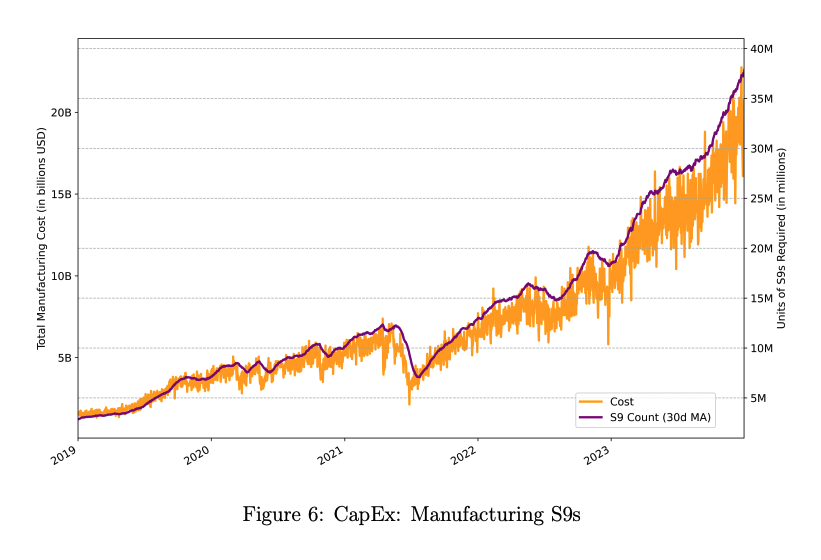

According to the report, even in the most profitable double-spend scenario, where an attacker could potentially earn 1 billion dollars after spending 40 billion dollars, the return rate is only 2.5%. The magnitude of resources required to carry out a 51% attack is quite astonishing. For instance, attacking Bitcoin would require purchasing approximately 7 million ASIC mining rigs, which would cost around 20 billion dollars, and such an amount of mining equipment is not available in the market. Even if a nation-state attacker were capable of producing its own mining equipment, the cost would still exceed 20 billion dollars.

As is known, a 51% attack occurs when a malicious actor controls more than 51% of the mining hash rate in a proof-of-work system like Bitcoin or 51% of the staked cryptocurrency in a proof-of-stake network like Ethereum. This level of control allows attackers to manipulate the blockchain, for example, by preventing the confirmation of new transactions or carrying out double-spending attacks.

Similarly, concerns about a potential 34% stake attack on Ethereum by Lido validators were also deemed baseless by the report. While the growth of Liquid Staking Derivative (LSD) providers like LidoDAO has raised concerns, the report concluded that carrying out such an attack would be both time-consuming and very expensive. The report estimates that an attack on Ethereum would take six months and cost over 34 billion dollars, requiring the management of more than 200 nodes and significant expenditures for cloud computing services.

Nic Carter: Research Extremely Important

Nic Carter, a partner at Castle Island Ventures, described Coin Metrics’ research as “extremely important” and said it provides the first rigorous and comprehensive analysis of the feasibility of 51% attacks.

Carter emphasized the significance of this analysis in eliminating uncertain or theoretical ideas about such attacks.