Ethereum (ETH), the largest altcoin by market value, had been trading below $2,800 for an extended period before surpassing this key level this week. However, due to Bitcoin‘s price volatility and the expected decrease in volume over the weekend, it had dropped below this critical region at the time of writing. The ETH rally, which is also crucial for the rise of other altcoins, may not have started yet.

Ethereum (ETH)

In the last 10 days, the ETH price has risen by approximately 21%, surpassing $2,800. The altcoin king, buoyed by the excitement of BTC’s new 2024 high of $52,572, was trading below this level at the time of writing. From the perspective of the rise, the average inflow of $450 million into spot Bitcoin ETFs this week is encouraging.

Moreover, the decisions on spot ETH ETFs expected to be finalized in May are anticipated to create expectations and push the price higher. Another significant development boosting the bulls’ motivation is the Dencun update scheduled for March 13. This hard fork will reduce transaction fees for Ethereum layer2 solutions by 90%.

With ETFs, Dencun, and the Bitcoin halving, there are many developments supporting ETH’s price rise in the medium term. However, despite all these, ETH is struggling to close above even $2,800. If the weakening altcoin in the ETHBTC pair can reach the January 2024 level (in ETHBTC terms), $3,100 (with the current BTC price) will become possible.

Will ETH Price Fall?

A few metrics need to be examined because the price catalysts mentioned in the first section are not things that will yield immediate results in the short term. The Ether futures premium rose above the neutral zone on February 10. Normally, trading with a premium of 5-10% is considered normal and neutral. As the premium climbed from $2,300 to $2,800, the futures premium reached 15%, indicating that professional traders benefited from leverage in the rise.

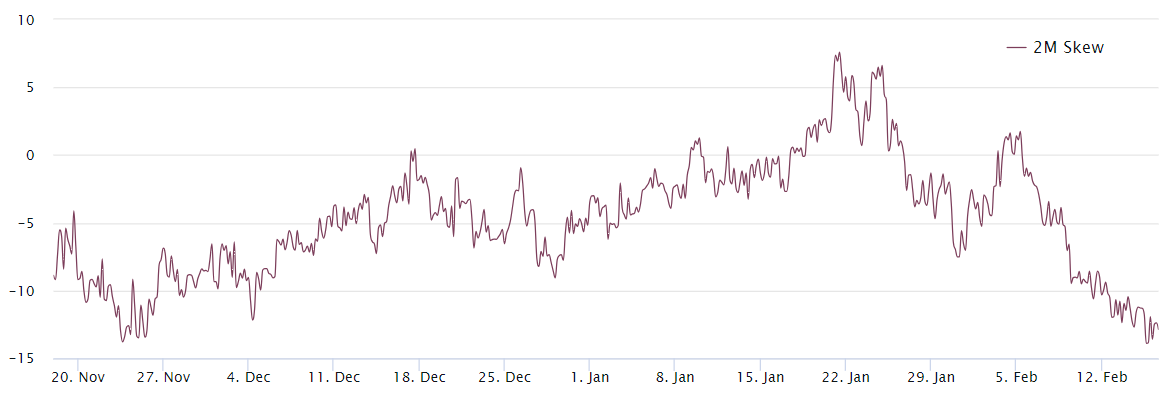

Here, we receive the first potential signal of a decline since we see a relaxation area in the neutral zone. On the other hand, the 25% delta skew is a useful indicator to understand the position of professional investors. If this is above 7%, it indicates an expectation of a decline, and the opposite is indicated around -7%. This is at the lowest level in three months, and there is a significant area like the futures premium that indicates a weakening of excitement.

Analysts pointing to the possibility of a correction in the BTC price have been more vocal these days, so it wouldn’t be surprising to see rapid sales begin. On the other hand, Bloomberg ETF analysts’ probability of approval for spot Ethereum ETFs (decision date May 23) is at 70%.

Türkçe

Türkçe Español

Español