The cryptocurrency market continues to experience notable developments, especially with Bitcoin and significant altcoin projects. Accordingly, Bitcoin’s price has managed to please investors with an increase of more than 21% since the beginning of the year. However, analysts have opened a separate discussion noting that the current rate of Bitcoin short liquidations is lower compared to previous years.

What’s Happening on the Bitcoin Front?

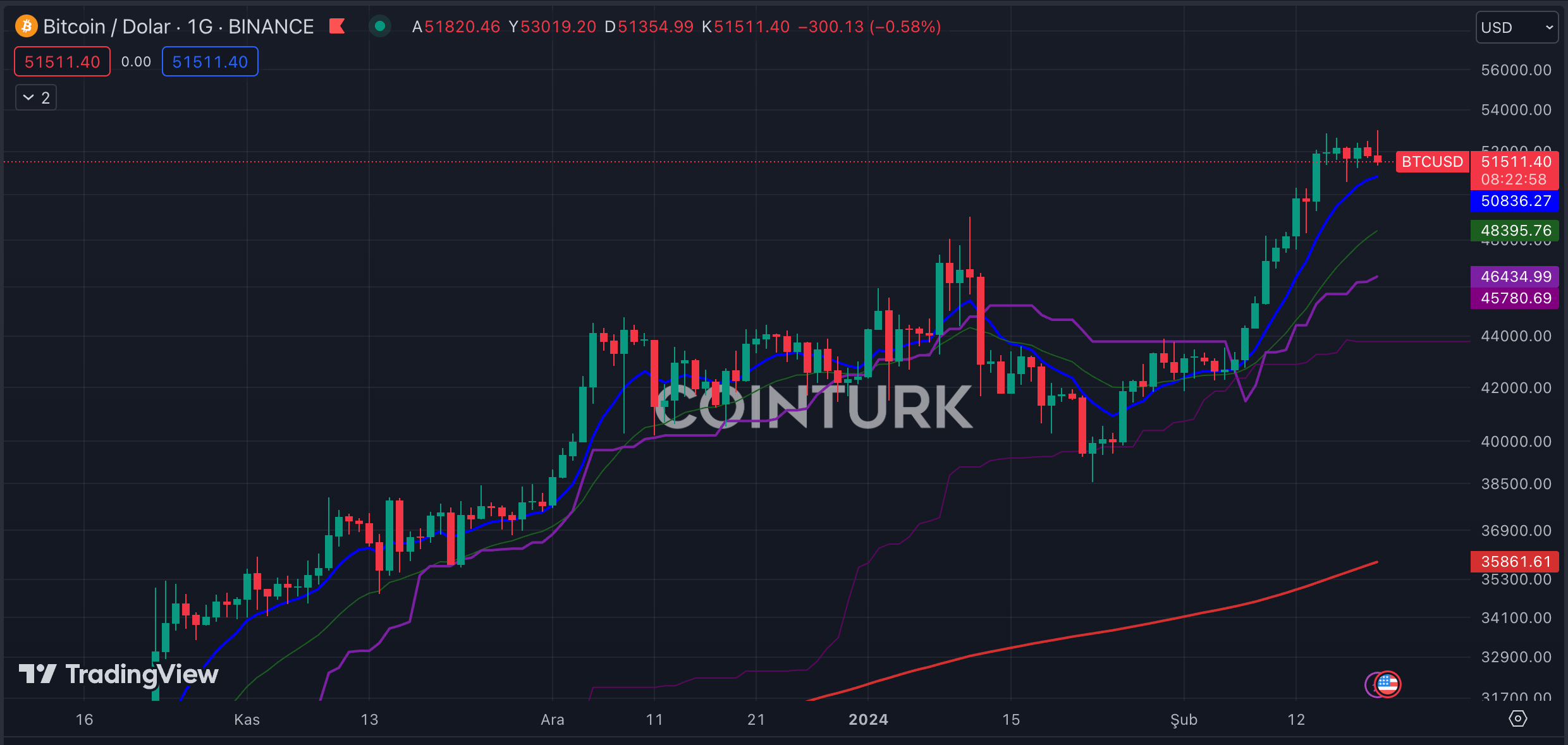

At the beginning of January, Bitcoin’s price was trading around $42,000, while in February, the price of Bitcoin exceeded $52,000 for the first time in 27 months. This rapid increase in price could typically trigger a significant short sale, but recent developments suggest this process might be different from past experiences. The ETF process and the halving event are significantly contributing to the rise in Bitcoin’s price.

However, this week’s Bitfinex Alpha report stated that the magnitude of the short-term decline observed so far this year was smaller compared to the previous year. Bitfinex analysts stated the following:

“Large whale investors are not taking significant short positions due to the expectation that prices will continue to rise.”

Noteworthy Details in the Bitfinex Report

The Bitfinex Alpha report described the current market conditions as tightening supply and increasing demand. The report showed how the dynamics of current Bitcoin ownership could indicate early bull market conditions. Referring to data from the blockchain data analysis platform Glassnode, analysts mentioned that as the price of the crypto asset increases, the total volume of long-term Bitcoin holder supply approaches zero. The Bitfinex Alpha report included the following statements:

“Currently, less than 6% of the total long-term holder supply by individual institutions is held at a loss. Historically, comparable volumes of Bitcoin held at a loss by the long-term holders group have been an indicator of early bull market conditions.”

According to Tradingview data, the largest crypto asset by market value was trading at $51,511 at the time the article was written. The GM 30 Index, representing the top 30 cryptocurrencies, fell 0.09% in the last 24 hours to 114.14.