VanEck’s spot Bitcoin exchange-traded fund (ETF) witnessed a sudden and significant increase in trading volume, prompting market commentators to investigate the cause. According to data shared by senior Bloomberg ETF analyst Eric Balchunas via X, VanEck’s fund, coded HODL, saw a trading volume of $258 million on February 20th, which is roughly 15 times higher than the previous day.

Intense Interest in VanEck ETF Fund

Balchunas pointed out that the sudden increase in volume at VanEck was not due to a single large investor, but rather from approximately 32,000 individual transactions, which is about 60 times the average. In a subsequent X post, Balchunas stated that he still couldn’t understand what was happening and added the following remarks:

“Nobody knows. Considering how sudden and explosive the increase in the number of transactions was (500 transactions on February 16th, 50,000 transactions on February 20th), I wonder if a Reddit or TikTok influencer recommended them to their followers. It feels like an army of individual investors.”

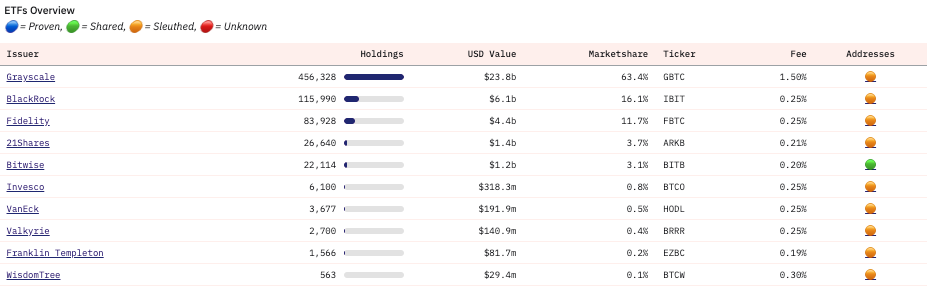

VanEck announced to the United States Securities and Exchange Commission on February 15th that it would reduce ETF fees from 0.25% to 0.20% starting from February 21st; this rate is 5 basis points below the fees applied by market leaders BlackRock and Fidelity.

The largest fund issuer, BlackRock, has committed to not charging fees for its iShares fund until it reaches $5 billion AUM. Since reaching this milestone on February 15th, BlackRock will charge a 0.25% fee on all new investments to its fund.

Noteworthy Developments on the ETF Front

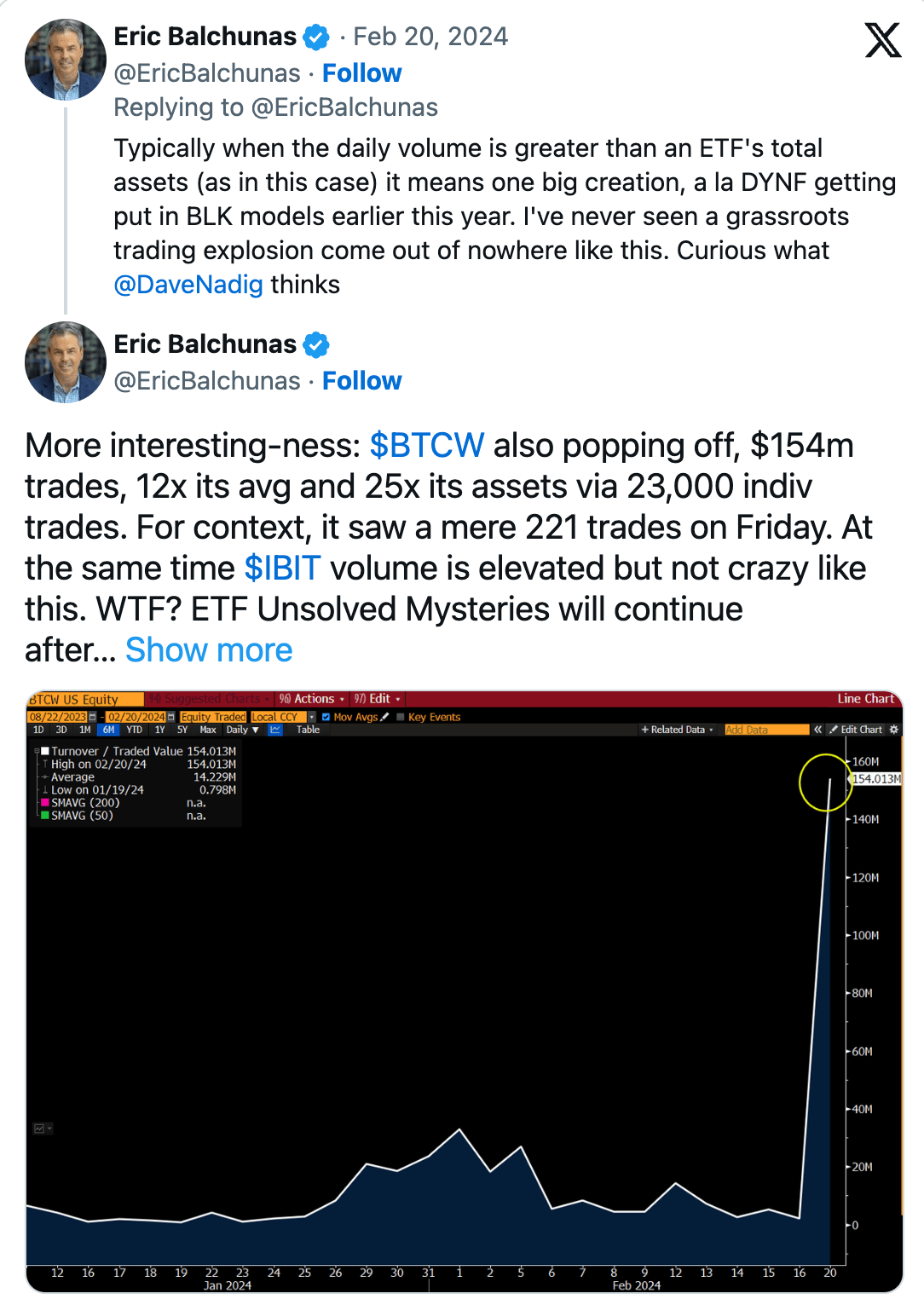

According to Bloomberg data reported by Balchunas, WisdomTree’s Bitcoin Fund (WBTC) also gained momentum in trading volumes, with a nearly 1,200% increase to $154 million on February 20th compared to the total daily volume average.

Balchunas added that WBTC executed 23,000 transactions on February 20th, a significant increase from just 221 transactions on February 16th. The spike in trading volume for HODL and WBTC funds coincided with a period of high but not “insane” volume in the market’s leading funds, including BlackRock’s iShares Bitcoin ETF fund.

According to data from blockchain data analytics platform Dune Analytics, VanEck’s Bitcoin Trust is currently the seventh-largest spot Bitcoin ETF fund with $191.9 million in assets under management (AUM), while WisdomTree’s fund is the smallest with only $29.4 million in AUM.

Türkçe

Türkçe Español

Español