As Bitcoin prepares for its monthly close in February, a critical juncture for price movement, the question remains whether it can maintain its highest levels. The largest cryptocurrency, still above $50,000, has lost its upward momentum over the past two weeks. While some still hope for higher levels, the lack of buying pressure leaves a significant question mark as it fails to overcome some parties’ eagerness to sell.

Excitement Peaks on the Bitcoin Front

The coming days are almost guaranteed to disrupt the status quo, with United States macroeconomic data poised to merge with the classic volatility source of a monthly candle close. The macro landscape itself is unstable, with recent inflation exceeding forecasts, leaving questions about the Federal Reserve’s future actions and whether risk assets will benefit from a potential interest rate cut soon.

The timing for Bitcoin is particularly significant given its own internal dynamics and the increasingly approaching next halving event. Bitcoin continues to trade within a narrow range throughout the second half of February, following the weekly close.

What’s Expected for BTC?

According to data from TradingView, the recent close at $51,700 provided little inspiration for bulls and came in about $450 lower than the previous one. Trade source Material Indicators shared the following remarks on the matter:

“This is a red W close for Bitcoin with a new Trend Precognition signal. The signal is temporary until the new candle closes. I’m waiting for confirmation, but with the US Economic Data on February 22 coinciding with the Monthly Close, we have some wild cards. As we approach the M Close, we expect more volatility.”

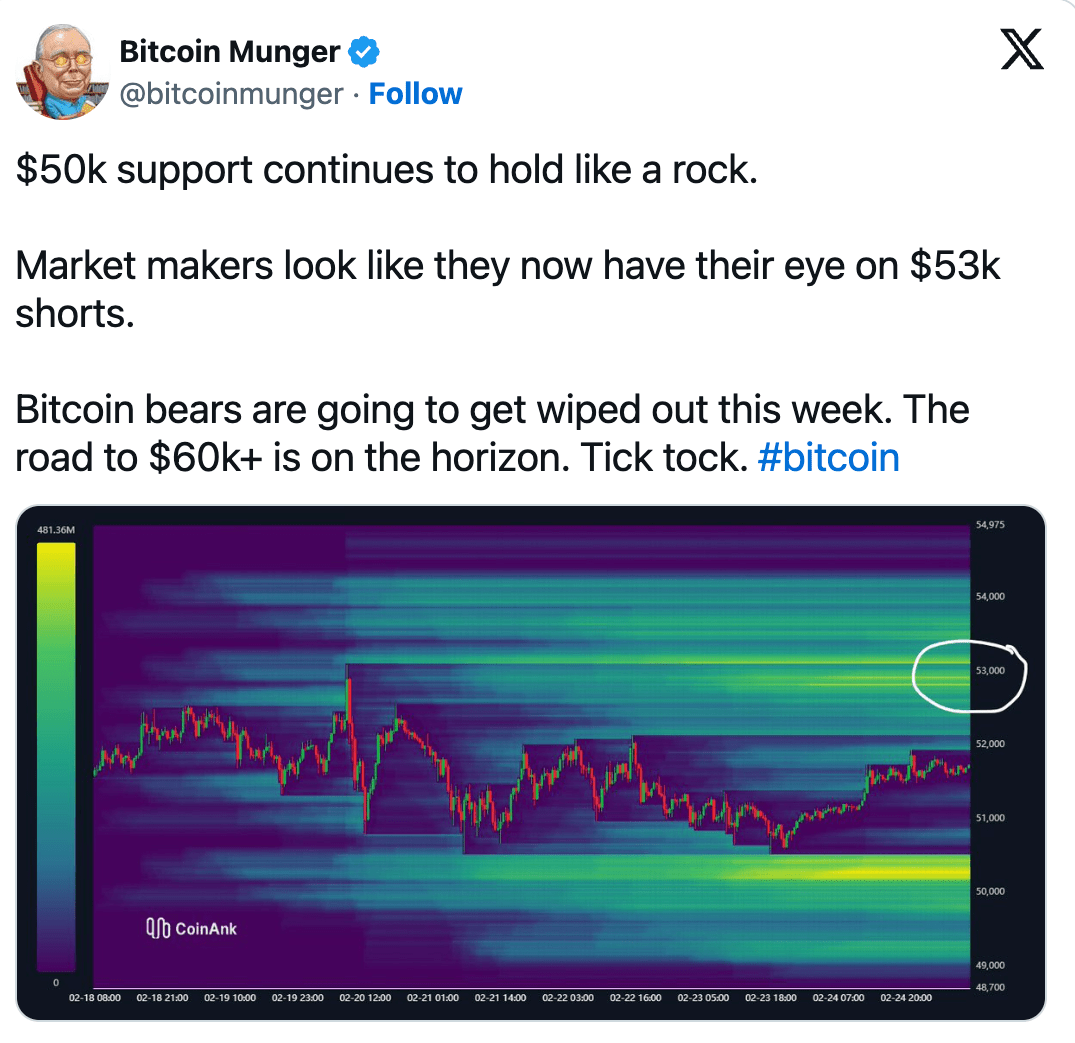

Some popular market observers remain optimistic despite sideways movements. Among them is social media expert Bitcoin Munger. In a recent post, the well-known figure stated:

“Market makers now seem to have their eyes set on short positions that will become liquid at the $53,000 level.”

Data from blockchain analytics platform CoinGlass shows that the BTC/USD pair is still up over 20% for the month of February.

Türkçe

Türkçe Español

Español